Looking for the best affordable car insurance in Florida? You’re not alone.

Finding coverage that protects your vehicle without breaking the bank can feel overwhelming. But what if you could get reliable protection, save money, and enjoy peace of mind all at once? This guide will help you discover top insurance options tailored to your needs, uncover easy ways to lower your premiums, and explain what to look for when choosing a policy.

Keep reading to learn how you can get the best value for your car insurance in Florida today.

Credit: www.nasdaq.com

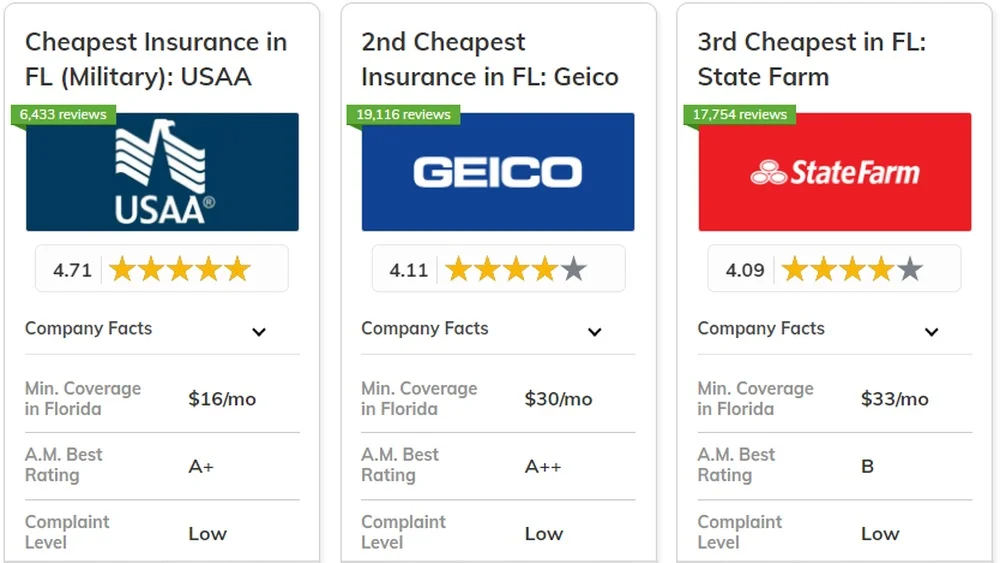

Top Affordable Insurers

Finding affordable car insurance in Florida can save you a lot of money each year. Choosing the right insurer means balancing price with good coverage and service. Several top companies offer competitive rates and reliable policies for Florida drivers.

These insurers have strong reputations for affordability and customer satisfaction. They provide a range of discounts and options to fit different budgets and needs. Here are some of the best affordable car insurance providers in Florida.

State Farm

State Farm is known for low rates and solid customer support. It offers many discounts for safe drivers and bundled policies. The company has a large agent network in Florida for personalized help. Many find State Farm’s full coverage plans affordable and reliable.

Geico

GEICO often provides some of the cheapest rates in Florida. It uses online tools to make quotes fast and easy. Drivers with clean records can save more with GEICO’s safe driver discounts. The company also offers roadside assistance and accident forgiveness.

Progressive

Progressive is a good choice for drivers with unique insurance needs. It offers competitive prices and a wide variety of coverage options. The company features the Name Your Price tool to fit your budget. Discounts for good drivers and bundling are available.

Travelers

Travelers offers affordable policies with flexible coverage choices. It rewards drivers with a clean record through discounts. Travelers is known for good customer service and fast claims processing. This insurer is ideal for those wanting a personalized approach.

Liberty Mutual

Liberty Mutual focuses on customized policies to lower costs. You only pay for the coverage you need. The company offers discounts for safe driving, multiple cars, and more. Liberty Mutual also provides accident forgiveness and new car replacement options.

Allstate

Allstate offers affordable rates with many discount opportunities. Its Safe Driving Bonus helps lower premiums over time. The company’s digital tools make managing policies simple. Allstate also provides accident forgiveness and deductible rewards.

Usaa

USAA serves military members and their families with great rates. It consistently ranks high for customer satisfaction. USAA offers many discounts and flexible coverage options. This insurer is ideal for eligible Florida drivers seeking value and service.

Rates Comparison

Comparing car insurance rates in Florida helps find the best affordable option. Rates vary widely by company, coverage, and driver profile. Understanding how premiums, coverage, and discounts affect rates saves money and ensures proper protection. Here is a clear breakdown of key factors to consider in rate comparison.

Average Premium Costs

Florida’s average car insurance premium is higher than the national average. Rates depend on age, driving record, and location within the state. Some companies offer rates as low as $800 per year. Others may charge over $1,500 for similar coverage. Comparing quotes from multiple insurers reveals the best prices.

Coverage Options

Basic coverage in Florida includes liability insurance, required by law. Full coverage adds collision and comprehensive protection. Optional coverages like uninsured motorist and medical payments improve safety. Each coverage type affects the premium differently. Choosing the right mix balances cost and protection.

Discount Availability

Many Florida insurers offer discounts that lower premiums. Common discounts include safe driver, multi-policy, and good student deals. Some companies provide discounts for low mileage or vehicle safety features. Asking about all available discounts can reduce the overall cost significantly.

Discounts To Save

Saving money on car insurance in Florida is easier with discounts. Insurance companies offer many ways to reduce your premium. These discounts reward good habits and smart choices. Understanding these options helps you pay less for coverage.

Check which discounts apply to you. They can add up to big savings over time. Here are some common discounts that can lower your insurance cost.

Safe Driver Discounts

Insurance providers value drivers with clean records. Avoiding accidents and tickets can earn you a safe driver discount. This shows you drive responsibly and lowers your risk. Insurers often require no claims for a set period to qualify.

Multi-policy Savings

Bundling your car insurance with other policies saves money. Combine auto with home or renters insurance for discounts. This makes managing your policies easier and cheaper. Many companies reward customers who buy multiple types of coverage.

Good Student Discounts

Young drivers can save by keeping good grades. Schools usually need to report your academic performance. Maintaining a B average or higher may qualify you for discounts. This encourages safe driving and responsible behavior among students.

Low Mileage Discounts

Driving less can reduce your insurance costs. Low mileage discounts apply if you drive fewer miles annually. This lowers the chance of accidents and claims. Some insurers offer this option for those with short commutes or limited use.

Choosing Coverage

Choosing the right car insurance coverage in Florida is crucial for protecting yourself and your vehicle. The right coverage keeps you safe from unexpected costs. It also fits your budget and driving needs. Understanding different coverage types helps you make smart decisions. Consider what protection you need and what you can afford.

Florida drivers have many options. Each type of coverage offers different benefits. Knowing these can guide you to the best affordable car insurance plan.

Liability Vs Full Coverage

Liability insurance covers damage to others if you cause an accident. It is the minimum required by Florida law. It pays for injuries and property damage to others. It does not cover your own car or injuries.

Full coverage combines liability with collision and comprehensive insurance. Collision covers damage to your car after a crash. Comprehensive protects against theft, weather, or vandalism. Full coverage costs more but offers wider protection.

Optional Coverages

Optional coverages add extra layers of protection. They include uninsured motorist coverage, which helps if the other driver lacks insurance. Rental car reimbursement pays for a rental while your car is fixed. Roadside assistance covers towing and emergency help.

These extras can be affordable and useful. Choose optional coverages based on your needs and risks.

Coverage For High-risk Drivers

High-risk drivers face higher rates due to past accidents or tickets. Insurance companies may limit coverage or charge more. Some insurers specialize in high-risk policies. They offer affordable options tailored to these drivers.

Check for discounts and safe driving programs. These can lower premiums over time. High-risk drivers should compare multiple quotes to find the best deal.

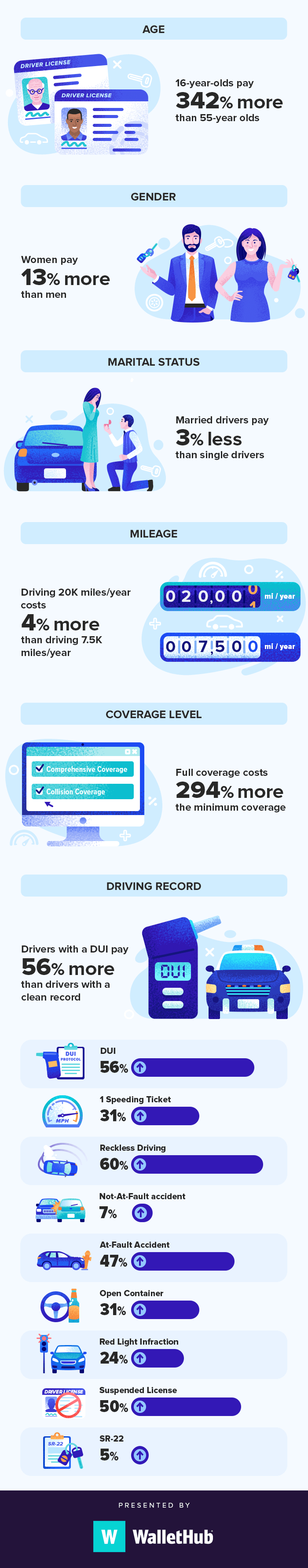

Factors Affecting Rates

Understanding the factors affecting car insurance rates helps you find affordable options in Florida. Insurance companies use different criteria to set your premium. Knowing these can guide you to better choices and savings.

Driving Record Impact

Your driving record is one of the biggest rate factors. Accidents, tickets, and claims increase your insurance cost. A clean record shows you are a low risk. This usually means lower premiums. Safe driving keeps your rates affordable.

Location Influence

Where you live in Florida affects your insurance price. Urban areas often have higher rates due to more traffic and accidents. Rural areas usually have lower premiums. Crime rates and weather risks also play a role. Your ZIP code matters to insurers.

Vehicle Type

The type of car you drive impacts your insurance cost. Expensive or high-performance cars cost more to insure. Cars with high repair costs or theft rates raise premiums. Choosing a reliable, safe vehicle can lower your insurance bills.

Credit Score

Insurance companies in Florida often check your credit score. Better credit usually means lower insurance rates. Poor credit can lead to higher premiums. Maintaining good credit helps you get affordable car insurance.

Credit: wallethub.com

Tips To Lower Premiums

Lowering your car insurance premiums in Florida can save you a lot of money. Small changes in your habits and choices impact your rates. Follow these practical tips to reduce what you pay for insurance. Each step helps build a safer, more affordable insurance profile.

Maintain Clean Driving Record

Insurance companies reward drivers with no accidents or tickets. Avoid speeding, reckless driving, and distractions on the road. A clean record shows you are low risk. This can lead to lower premiums over time.

Bundle Policies

Combine your car insurance with other policies like home or renters insurance. Many insurers offer discounts for bundling. This simple step often cuts your total insurance cost by a noticeable amount.

Increase Deductibles

Choose a higher deductible to lower your monthly payments. Deductible is what you pay before insurance covers damages. A higher deductible means you accept more risk but pay less each month. Only raise it if you can afford the out-of-pocket cost in case of a claim.

Shop And Compare Quotes

Check multiple insurance companies for the best price. Rates differ widely for the same coverage. Use online tools to compare quotes quickly. Regularly reviewing options helps you find affordable policies that fit your needs.

Claims And Customer Service

Claims and customer service are crucial factors when choosing affordable car insurance in Florida. A smooth claims process saves time and stress. Friendly and helpful customer service ensures you get support when needed. Both aspects affect your overall satisfaction with the insurer.

Ease Of Filing Claims

Filing claims should be quick and simple. Top insurers offer multiple ways to report a claim, such as phone, app, or website. Clear instructions guide you through every step. Fast claim approval helps you repair your vehicle sooner. Avoid companies with slow or complicated claim processes.

Customer Satisfaction Ratings

Customer ratings reveal real experiences with insurers. High ratings show reliable service and fair claim handling. Check reviews from Florida drivers before choosing a company. Insurers with consistent positive feedback build trust. Low ratings may indicate poor communication or delays.

Availability Of Online Services

Online services make managing your policy easier. You can file claims, check status, and pay bills anytime. Mobile apps add convenience for busy drivers. Look for insurers with user-friendly digital platforms. Good online tools reduce phone wait times and speed up support.

Credit: www.whitechipinsurance.com

Frequently Asked Questions

Who Has The Most Affordable Auto Insurance In Florida?

State Farm often provides the most affordable auto insurance in Florida. GEICO and Travelers also offer competitive rates. Discounts and clean driving records lower costs. Comparing quotes helps find the best deal.

Is Geico Or Progressive Better In Florida?

GEICO usually offers lower average rates in Florida. Progressive suits drivers needing DUI coverage or extra options. Choose based on your specific needs and discounts.

How To Get Lower Car Insurance In Fl?

Maintain a clean driving record to qualify for safe driver discounts. Bundle policies like auto and home insurance. Choose insurers offering good student or low-mileage discounts. Compare rates from top Florida companies like State Farm, GEICO, and Travelers for the best deals.

What Is The Best Insurance Company To Have In Florida?

State Farm ranks as the best insurance company in Florida for affordability and coverage. USAA, Allstate, and Liberty Mutual also offer great options. Choose based on your specific needs for the best rates and discounts.

Conclusion

Finding affordable car insurance in Florida is possible with careful research. Compare rates from top providers like State Farm, GEICO, and Progressive. Consider discounts for safe driving, bundling policies, or good students. Choose a policy that fits your budget and coverage needs.

Regularly review your insurance to keep costs low. Protect yourself without overspending. Affordable coverage is within reach for every Florida driver.