Finding the best affordable home insurance in Florida can feel overwhelming. You want solid protection for your home without breaking the bank.

But with so many options and hidden costs, how do you choose the right policy? This guide will help you cut through the noise and discover reliable, budget-friendly insurance plans tailored to Florida’s unique risks. Keep reading to learn how to safeguard your home and your wallet with confidence.

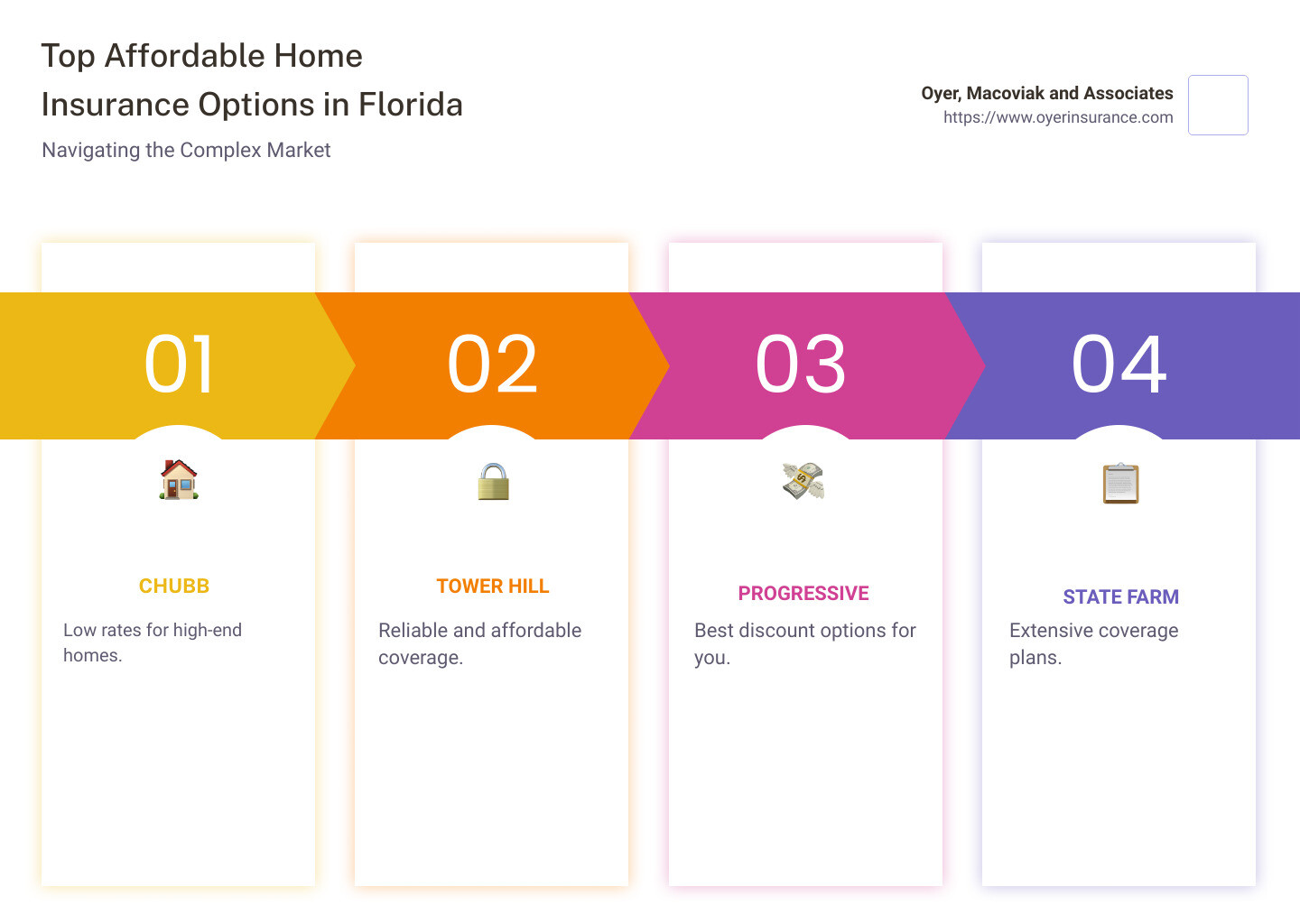

Affordable Home Insurance Options

Finding affordable home insurance in Florida can be a smart way to protect your property without stretching your budget. Many insurers offer options that balance coverage and cost. These options help homeowners stay safe financially while saving money.

Choosing the right provider and understanding available discounts can lower your premium. Bundling policies might also bring extra savings. Exploring these options ensures you get the best value for your insurance needs.

Top Low-cost Providers

Several companies provide affordable home insurance in Florida. Tower Hill is known for rates below the state average. GEICO offers competitive prices and solid coverage. State Farm and Progressive also stand out with budget-friendly plans. USAA is a good choice for military families seeking low costs. These providers focus on clear policies and reliable service.

Discounts And Savings

Many insurers offer discounts that reduce your premium. Installing security systems or smoke detectors can lower costs. Some companies reward good credit scores with better rates. Seniors may qualify for special discounts. Paying your policy annually instead of monthly can save money. Always ask about available discounts to maximize savings.

Multi-policy Benefits

Combining home insurance with auto or other policies often leads to savings. Many insurers provide multi-policy discounts to loyal customers. This bundling reduces overall insurance expenses. It also simplifies payments and management. Check with your provider about multi-policy offers. This strategy helps protect more while spending less.

Credit: www.oyerinsurance.com

Cost Factors In Florida

Understanding the cost factors in Florida helps find affordable home insurance. Several elements shape insurance premiums. These factors reflect risks insurers consider when setting prices. Knowing them guides homeowners toward better coverage choices.

Impact Of Location And County

Location greatly affects home insurance costs in Florida. Coastal counties face higher risks from hurricanes and flooding. These threats increase premiums compared to inland areas. Urban counties with higher crime rates also see raised insurance costs. Choosing a home in a safer, less risky county lowers insurance expenses.

Effect Of Home Characteristics

Home features influence insurance prices significantly. Older homes usually cost more to insure due to wear and outdated materials. Larger homes require higher coverage amounts, raising premiums. Building materials matter; homes with hurricane-resistant roofs pay less. Regular updates and safety installations can reduce insurance costs.

Role Of Credit And Claims History

Insurers use credit scores to assess risk. Better credit often leads to lower insurance rates. A history of frequent claims signals higher risk and raises premiums. Keeping a clean claims record helps maintain affordable insurance. Responsible financial habits support lower home insurance costs.

Coverage Features To Consider

Choosing the right home insurance in Florida means understanding key coverage features. These features protect your home and belongings from common risks in the state. Knowing what each coverage offers helps you pick the best plan for your needs and budget.

Hurricane And Flood Protection

Florida homes face high risk from hurricanes and floods. Standard policies may not cover flood damage. Check if the plan includes flood insurance or if you need a separate policy. Hurricane coverage usually protects against wind damage but read the details carefully. Having both protections ensures you avoid costly repairs after storms.

Personal Property Coverage

This covers your belongings inside the home. Items like furniture, electronics, and clothes are protected. Confirm if the policy covers the full value or has limits on certain items. Some policies offer replacement cost coverage, which pays to replace items at today’s prices. This feature helps you recover quickly after theft or damage.

Liability And Additional Living Expenses

Liability coverage protects you if someone is injured on your property. It can pay for legal fees and medical bills. Additional living expenses cover temporary housing if your home becomes unlivable. This coverage is vital during repairs after disasters. Make sure the policy limits are enough for your situation.

Comparison Of Leading Companies

Choosing affordable home insurance in Florida requires careful comparison. Top companies offer varied coverage and pricing. Understanding their strengths helps find the best fit for your needs. Below is a detailed look at leading insurers in the state.

State Farm And Tower Hill

State Farm provides strong customer service and extensive coverage options. Their policies include protection against wind damage, common in Florida.

Tower Hill stands out for affordability. Their rates often fall below the Florida state average. They focus on local risks and offer discounts for safe homes.

Usaa And Chubb

USAA serves military families with excellent rates and benefits. Their claims process is fast and efficient. Membership is limited but highly valued.

Chubb offers premium coverage with high limits. They cover expensive homes and valuable items well. Their policies come with personalized service and fewer exclusions.

Geico And Progressive

GEICO is known for competitive pricing and easy online quotes. Their multi-policy discounts reduce costs for bundled insurance.

Progressive provides flexible coverage and competitive rates. They offer discounts for homes with protective devices. Their customer support is responsive and helpful.

Tips To Lower Your Premium

Lowering your home insurance premium in Florida is possible with smart choices. Simple steps can reduce your costs without losing coverage. These tips help protect your home and save money at the same time.

Improving Home Security

Adding security devices can lower your insurance rates. Install alarms, smoke detectors, and deadbolt locks. Security cameras also show insurers you care about safety. These upgrades reduce the risk of theft or damage. Insurance companies often reward safer homes with discounts.

Choosing Higher Deductibles

Selecting a higher deductible means paying less monthly. This option shifts some cost to you if a claim happens. It works well if you have savings to cover small repairs. A higher deductible lowers your premium but increases out-of-pocket costs during claims.

Regularly Reviewing Your Policy

Check your insurance policy at least once a year. Make sure it matches your current needs and home value. Remove coverage you no longer need to save money. Comparing quotes from different insurers can reveal better deals. Staying informed helps avoid paying too much.

Credit: www.oyerinsurance.com

Customer Ratings And Reviews

Customer ratings and reviews reveal real experiences with home insurance providers. They show how companies perform on service, pricing, and claims. This feedback helps choose the best affordable home insurance in Florida. Honest opinions highlight strengths and expose common problems. Below, explore top-rated insurers, frequent complaints, and claims handling insights.

Best Rated Insurers In Florida

Chubb, USAA, and Amica stand out with high customer satisfaction. Their policies cover many risks at reasonable prices. State Farm also earns praise for reliable coverage and strong support. Tower Hill offers affordability with positive reviews from Florida homeowners. These insurers maintain trust by delivering consistent service and fair claims processing.

Common Complaints And Issues

Some customers report rising premiums after renewal periods. Others mention difficulty understanding policy terms and coverage limits. Delays in claim approvals frustrate many insured residents. Florida’s weather risks cause some claims to be denied or underpaid. Awareness of these issues helps buyers prepare and ask the right questions.

Claims Handling Experiences

Fast and fair claims handling builds customer loyalty. USAA and Amica often receive praise for quick responses. State Farm’s local agents assist with smooth claim processes. Some insurers face criticism for slow communication and claim denials. Reading multiple reviews gives a balanced view of expected claim service quality.

Credit: www.oyerinsurance.com

Frequently Asked Questions

Who Is The Cheapest Homeowners Insurance In Florida?

Tower Hill Insurance often offers the cheapest homeowners insurance in Florida. USAA, State Farm, and GEICO also provide affordable options. Compare quotes to find the best rate for your needs.

What Is The Average Cost Of Homeowners Insurance In Florida?

The average cost of homeowners insurance in Florida is about $2,000 to $3,000 annually. Rates vary by location, home value, and coverage.

Who Has The Most Reasonably Priced Homeowners Insurance?

Travelers, Progressive, USAA, and Tower Hill offer the most reasonably priced homeowners insurance. Tower Hill is especially affordable in Florida.

What Is The Highest Rated Homeowners Insurance Company In Florida?

Chubb, USAA, and Amica rank as the highest rated homeowners insurance companies in Florida. State Farm and Tower Hill also receive strong reviews.

Conclusion

Finding affordable home insurance in Florida is possible with careful research. Compare quotes from multiple providers to get the best deal. Consider coverage options that fit your needs without overspending. Review customer feedback to ensure good service and claims support.

Protect your home and family without breaking your budget. Smart choices lead to peace of mind and savings. Start your search today and secure your home wisely.