Finding the best and cheapest auto insurance in Florida can feel overwhelming. You want solid coverage without paying too much, but with so many options, where do you start?

What if you could discover smart tips to lower your premiums and find a policy that fits your budget perfectly? You’ll learn how to cut costs without sacrificing protection. From insider tricks to trusted insurers, we’ll guide you step-by-step to secure the best deal for your car insurance in Florida.

Keep reading to save money and drive with confidence!

)

Credit: insurify.com

Florida Auto Insurance Market

The Florida auto insurance market is diverse and competitive. Drivers can find many options for coverage and prices. Understanding this market helps in choosing the best and cheapest insurance. Florida’s unique laws and weather conditions influence insurance costs. Also, the state has a high rate of car accidents. These factors affect how providers set their rates and coverage plans.

Insurance companies in Florida offer a range of policies. Some focus on low-cost options, while others provide extensive coverage. Consumers must balance price and protection. Knowing the key players and common coverage types can guide better decisions.

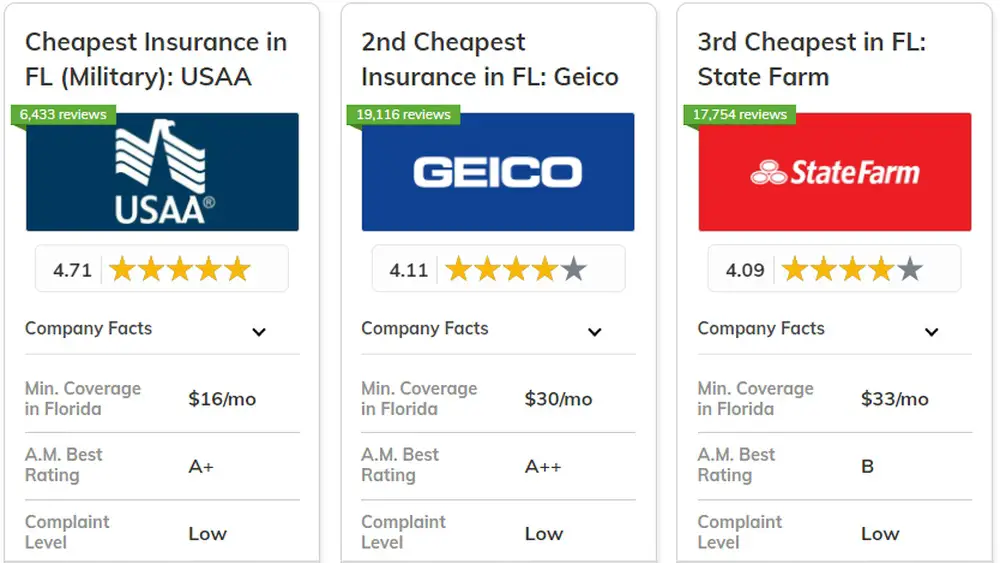

Top Providers In Florida

Several major insurance companies serve Florida drivers. GEICO, Progressive, State Farm, and Allstate are among the most popular. These companies have strong reputations and wide networks. They offer various discounts and flexible plans. Local insurers also compete by providing tailored services and competitive rates.

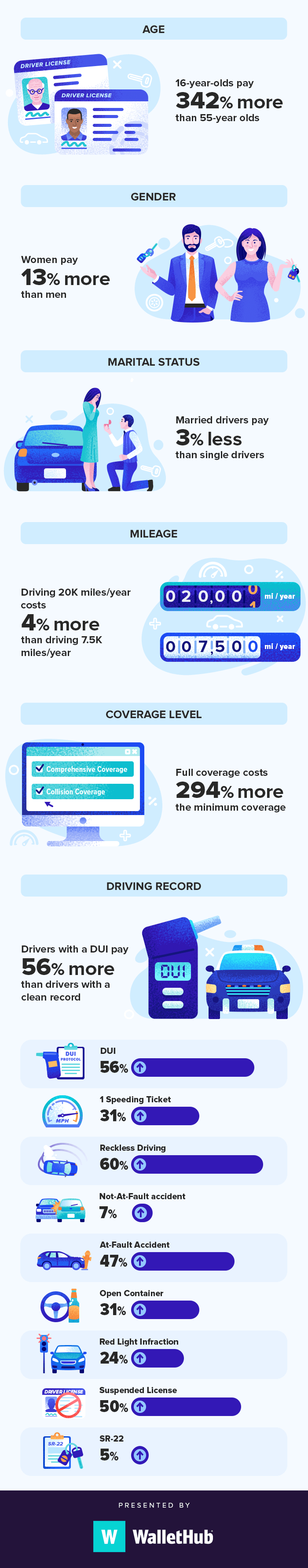

Average Rates And Factors

Florida’s average auto insurance rates are higher than the national average. The cost depends on factors like age, driving history, and location. Vehicle type and coverage level also impact prices. Insurance rates can vary widely even within the state. Shopping around and comparing quotes is essential to find the best deal.

Popular Coverage Options

Florida drivers often choose liability, collision, and comprehensive coverage. Personal Injury Protection (PIP) is mandatory in Florida. Uninsured motorist coverage is also common due to many uninsured drivers. Optional add-ons like roadside assistance and rental car coverage provide extra security. Selecting the right coverage depends on individual needs and budget.

Credit: wallethub.com

Tips To Lower Premiums

Lowering auto insurance premiums in Florida can save you significant money each year. Small changes in your policy or shopping habits often reduce costs. Understanding the best ways to cut premiums helps you keep quality coverage without overspending. Below are practical tips to lower your auto insurance premiums effectively.

Compare Multiple Quotes

Always get quotes from several insurers before choosing. Prices vary widely between companies for the same coverage. Comparing quotes helps you spot the best deal and avoid overpaying. Use online tools or contact agents directly for quick estimates. Regularly reviewing quotes ensures you keep the lowest possible rate.

Bundle Policies For Discounts

Combining your auto insurance with other policies like home or renters insurance lowers premiums. Insurers reward customers who buy multiple policies through one company. Bundling simplifies payments and often qualifies you for special discounts. Check with your insurer about available bundle options to save more.

Increase Your Deductible

Raising your deductible reduces your monthly premium cost. The deductible is the amount you pay before insurance covers a claim. Choose a higher deductible only if you can afford the out-of-pocket cost in an accident. This strategy works best for drivers with fewer claims or good driving records.

Adjust Coverage Based On Vehicle

Review your car’s value and needs to adjust coverage accordingly. Older cars might not need full comprehensive or collision coverage. Dropping unnecessary coverage lowers your premium without risking too much. Tailor your policy to fit your vehicle’s age, condition, and usage for smart savings.

Discount Opportunities

Finding the best and cheapest auto insurance in Florida often depends on the discounts available. Insurance companies offer various discount opportunities to help drivers save money. These discounts reward safe behavior, low usage, and other factors that lower risk. Understanding these can lead to significant savings on your policy.

Safe Driving Discounts

Many insurers give discounts for a clean driving record. Avoiding accidents and traffic violations shows you are a low-risk driver. This can reduce your premium by a good margin. Maintaining a safe driving history over time increases your chances of earning these discounts.

Defensive Driving Course Benefits

Completing a defensive driving course often lowers insurance costs. These courses teach safe driving techniques and accident avoidance. Insurance companies reward drivers who take extra steps to improve safety. The discount may also improve your skills and confidence on the road.

Low Mileage And Usage Discounts

Driving fewer miles can qualify you for special discounts. Many insurers offer lower rates for low mileage drivers. If you use your car mainly for short trips or occasional drives, you may save money. Tracking your annual mileage helps you prove eligibility for these discounts.

Special Discounts For Students And Devices

Students often get discounts for good grades or limited driving experience. Maintaining a certain GPA can lead to lower insurance premiums. Some insurers also offer discounts for using safety devices. Features like anti-theft systems or driving apps may reduce your risk and cost.

Choosing The Right Insurer

Choosing the right auto insurance company in Florida affects your budget and peace of mind. It is important to pick a provider that offers affordable rates and reliable service. Compare options carefully to find the best fit for your needs.

Check the coverage options and discounts each insurer offers. Make sure the policy matches your driving habits and vehicle type. Consider customer reviews and claim handling to avoid future hassles.

Geico Vs Progressive Comparison

GEICO and Progressive are two top insurers in Florida. GEICO often has lower average premiums. Progressive may offer better deals for drivers with special cases like DUIs.

Progressive also provides more optional coverages. GEICO is known for easy online tools and fast quotes. Both companies have solid financial strength and wide service networks.

Compare quotes from both to see which fits your budget. Look at discounts like good driver, multi-policy, or vehicle safety features. Choose the insurer that offers the best overall value for you.

Evaluating Customer Service And Claims

Good customer service makes a big difference during claims. Check how fast and fair the insurer handles claims. Read reviews on customer satisfaction and claim experiences.

Find out if the company offers 24/7 claims support. Easy access to local agents can also help. Make sure you feel confident they will assist you quickly after an accident.

Ask about the claims process. Some insurers use mobile apps to speed up filing. Others provide direct repair services to simplify repairs. Choose a company with clear, simple claim handling.

Switching Providers To Save

Switching your auto insurance provider can lower your costs. Get new quotes before your current policy ends. Compare prices and coverage to find better deals.

Notify your old insurer before canceling the policy. Avoid coverage gaps by timing the switch carefully. Use savings to improve coverage or reduce deductibles.

Check for cancellation fees or penalties. Some companies offer sign-up bonuses or discounts for new customers. Stay informed to maximize your savings and coverage quality.

Alternative Insurance Options

Alternative insurance options in Florida offer flexible and budget-friendly ways to protect your vehicle. These choices suit drivers who want to save money and pay for insurance based on their actual driving. Understanding these options helps find coverage that fits your lifestyle and wallet.

Pay-per-mile Insurance Plans

Pay-per-mile insurance charges you for the miles you drive. It works well for drivers who use their car less often. This plan can lower costs significantly if you drive fewer miles each year. You pay a base rate plus a small fee for every mile driven. This method encourages careful driving and reduces unnecessary trips.

Florida drivers who stay home or carpool can benefit from this plan. It offers a fair way to pay only for the coverage you need. The less you drive, the more you save on your premiums.

Usage-based Insurance Programs

Usage-based insurance tracks your driving habits with a device or app. It monitors speed, braking, and time on the road. Good driving skills lead to discounts on your insurance. This program rewards safe and responsible drivers. It can lower your rates if you follow traffic rules and avoid risky behavior.

Florida insurers use this data to offer personalized rates. It helps drivers understand their habits and improve safety. Usage-based insurance is ideal for tech-savvy drivers who want to control their costs. It makes insurance pricing fair and transparent.

Maintaining Affordable Insurance

Keeping auto insurance affordable in Florida requires smart and consistent efforts. Small changes in daily habits and regular policy checks can lower costs. Staying proactive helps avoid surprises and keeps rates competitive. The tips below focus on practical ways to maintain affordable insurance without sacrificing coverage.

Improving Driving Habits

Safe driving reduces the risk of accidents and claims. Insurance companies reward drivers with fewer incidents by lowering premiums. Avoid speeding, follow traffic rules, and stay attentive on the road. Good habits build a clean driving record, which helps keep insurance costs down over time.

Regular Policy Reviews

Insurance needs change with time, so review policies regularly. Check for outdated coverage or unnecessary add-ons. Adjust coverage to fit your current vehicle and driving patterns. Comparing quotes from different insurers during reviews can reveal better deals. Staying updated ensures you only pay for what you really need.

Using Technology To Monitor Driving

Many insurers offer apps or devices that track driving behavior. These tools measure speed, braking, and distance driven. Safe drivers earn discounts based on their monitored habits. Using technology encourages careful driving and helps identify areas to improve. This approach can make insurance more affordable and personalized.

Credit: www.oyerinsurance.com

Frequently Asked Questions

Who Has The Most Affordable Car Insurance In Florida?

GEICO often offers the most affordable car insurance in Florida. Progressive provides competitive rates for drivers with specific needs. Compare quotes to find the best deal.

Who Really Has The Cheapest Car Insurance?

GEICO often offers the cheapest car insurance for many drivers. Rates vary by location, driving history, and coverage needs. Comparing quotes from multiple insurers ensures the best deal. Consider discounts, higher deductibles, and bundling policies to lower costs further.

Is Geico Or Progressive Better In Florida?

GEICO usually offers lower average rates than Progressive in Florida. Progressive suits drivers needing DUI coverage or extra options. Choose based on your specific needs and compare quotes to find the best deal.

How To Get Lower Car Insurance In Fl?

Compare quotes from multiple insurers and bundle policies. Increase your deductible and maintain a clean driving record. Take defensive driving courses and ask for discounts. Adjust coverage based on your car’s value and driving habits. Regularly shop around and consider switching providers to save on Florida car insurance.

Conclusion

Finding the best and cheapest auto insurance in Florida is possible with careful research. Compare multiple insurance providers to see who offers the best rates. Adjust your coverage and deductibles to fit your needs and budget. Remember to check for discounts like safe driver or bundling policies.

Staying informed helps you save money without sacrificing important coverage. Drive safely and review your policy yearly to keep costs low. Smart choices lead to affordable and reliable auto insurance in Florida.