Choosing the best bank to open a business account in Florida can feel overwhelming. You want a bank that fits your unique needs—whether that means low fees, easy online access, or a strong local presence.

Your business deserves a banking partner that makes managing money simple and helps you grow. You’ll discover the top banks in Florida that offer tailored solutions for startups, freelancers, and established companies alike. Keep reading to find the perfect fit for your business and take control of your financial future today.

Credit: www.navyfederal.org

Top Business Banks In Florida

Choosing the right bank is crucial for business success in Florida. The state offers many banks with services tailored to business needs. Each bank has unique features to support your company’s growth and daily operations.

Some banks focus on online services and low fees. Others provide benefits like interest earnings or easy cash deposits. Traditional banks offer full-service support with many branches and lending options. Here are some top business banks in Florida to consider.

Amex Business Checking

Amex Business Checking suits businesses that prefer online banking. It offers rewards and easy account management. There are no monthly fees, making it cost-effective for startups and small businesses.

Axos Basic Business Checking

Axos Bank provides a strong online banking platform. It charges no monthly fees and offers unlimited free digital transactions. This makes it ideal for businesses wanting simple, affordable banking.

Bluevine Business Checking

Bluevine stands out with a high annual percentage yield (APY) on checking accounts. There are no monthly fees, and it supports easy digital banking. Good for businesses seeking to grow savings.

Mercury

Mercury caters to startups, SaaS, and e-commerce companies. It has a fee-free structure and focuses on online account management. Its tools help businesses handle finances efficiently.

Grasshopper Innovator Checking

This account earns interest on your business checking balance. It suits businesses wanting to make their money work harder. The account combines interest benefits with easy access to funds.

Chase Performance Business Checking

Chase is best for businesses with large or frequent cash deposits. Its wide branch network supports easy cash handling. The bank also offers strong online and mobile banking tools.

Capital One Enhanced Checking

Capital One suits businesses needing frequent ATM cash deposits. It offers a good mix of digital services and physical branch access. The account supports smooth daily banking operations.

Wells Fargo

Wells Fargo serves established small and medium businesses well. It has many branches and offers lending solutions. The bank provides full-service support for growing companies.

Online-focused Banks

Online-focused banks offer flexible, digital-first business account options. These banks suit entrepreneurs who prefer managing finances via apps or web platforms. They usually provide low fees, fast setup, and seamless online tools. Business owners can handle transactions anytime, anywhere without visiting a branch.

These banks often include features like unlimited digital transactions and no minimum balance requirements. Many support integrations with popular accounting software. Such banks fit startups, freelancers, and small businesses aiming to save time and costs on banking.

Amex Business Checking

Amex Business Checking provides a simple, user-friendly online platform. It offers no monthly fees and unlimited transactions. The account is ideal for small businesses that value rewards. Users earn points on daily spending, which adds extra value. Its mobile app is easy to navigate and secure.

Axos Basic Business Checking

Axos Bank offers a basic business checking account with no monthly fees. It supports unlimited domestic ATM fee reimbursements. The account includes unlimited electronic transactions, perfect for online operations. Axos also provides strong fraud protection tools. It suits companies needing straightforward online banking.

Bluevine Business Checking

Bluevine Business Checking pays interest on balances, a rare benefit for checking accounts. It has no monthly fees and no minimum balance. The online dashboard is clear and easy to use. Bluevine supports unlimited transactions and free ACH payments. It is well-suited for growing businesses wanting to earn on idle cash.

Mercury For Startups

Mercury targets startups and tech companies with a fully digital experience. The platform is fee-free and includes useful integrations with payment platforms. Mercury offers virtual cards and multiple user access. It helps startups manage money efficiently without branch visits. The account setup is fast and paperless.

Interest-earning And Cash Deposit Banks

Interest-earning and cash deposit banks serve important roles for Florida businesses. These banks help companies grow money through interest. They also support businesses that handle many cash deposits daily. Choosing the right bank depends on your business needs and cash flow habits.

Some banks focus on paying interest on checking balances. Others offer strong cash deposit services with many branch locations. Here are three top banks in Florida that offer these services.

Grasshopper Innovator Checking

Grasshopper Innovator Checking is ideal for businesses wanting to earn interest. It offers competitive interest rates on checking balances. This helps businesses grow funds without extra effort. The account has low fees and easy online access. It suits small businesses and startups seeking some returns on idle cash.

Chase Performance Business Checking

Chase Performance Business Checking works well for companies with frequent cash deposits. It has a large branch network across Florida. The account allows high volume cash deposits without high fees. Online banking tools help manage accounts easily. Chase’s strong customer support is a bonus for busy business owners.

Capital One Enhanced Checking

Capital One Enhanced Checking supports businesses that need frequent ATM cash deposits. It offers no-fee access to many ATMs nationwide. The account includes interest earnings on balances. Capital One’s mobile app makes banking simple and fast. This account fits businesses needing both cash access and interest benefits.

Traditional Full-service Banks

Traditional full-service banks offer a wide range of services for businesses. They provide physical branches, personal support, and many financial products. Many business owners prefer these banks for their reliability and convenience. These banks often have tailored options for small and medium businesses. They also offer loans, credit lines, and merchant services. In Florida, two top traditional banks stand out for business accounts.

Wells Fargo Services

Wells Fargo has a strong presence in Florida. It offers many business banking services. These include checking and savings accounts designed for businesses. The bank provides loans to help businesses grow. Wells Fargo supports cash management and payment processing. It also offers online and mobile banking for easy access. Business owners can visit local branches for help. The bank is known for personalized customer service. It suits established businesses that need many banking options.

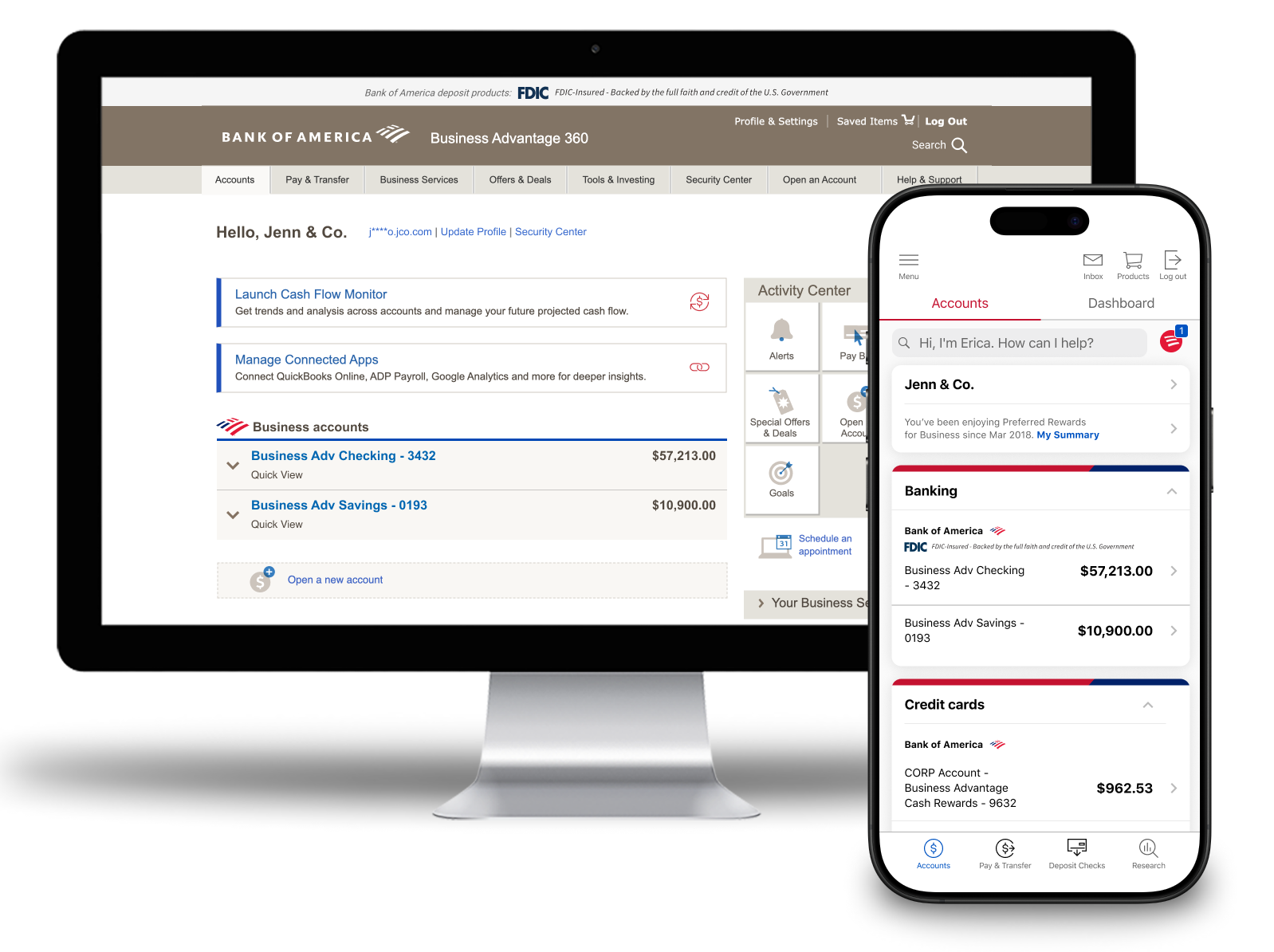

Bank Of America Benefits

Bank of America serves many small and medium businesses in Florida. It offers business checking accounts with no monthly fees under certain conditions. The bank provides tools to help manage cash flow. It also has merchant services for accepting payments. Online and mobile banking features are easy to use. Bank of America offers business credit cards with rewards. Its local branches make in-person support simple. The bank’s services help businesses save time and money.

Specialized Banking Options

Specialized banking options cater to unique business needs in Florida. These banks offer tailored features beyond standard accounts. They help manage finances efficiently for specific business types. Choosing the right specialized bank can save time and reduce costs.

Relay Multiple Accounts

Relay allows businesses to open multiple accounts under one profile. This helps separate expenses and income easily. You can track spending by project or department. Relay offers free transfers between accounts, which improves cash flow control. Its dashboard is user-friendly and ideal for growing businesses. The bank supports integrations with popular accounting software. Relay’s focus on organization suits startups and small businesses well.

Lili For Freelancers

Lili is designed specifically for freelancers and solo entrepreneurs. It combines a business account with tax tools to simplify money management. Users get automatic tax savings and expense categorization. Lili offers no monthly fees or minimum balance requirements. The app provides instant notifications for every transaction. Freelancers benefit from features like invoicing and cashback offers. Lili’s simple approach makes banking less stressful for independent workers.

Choosing The Right Bank For Your Business

Choosing the right bank for your business is a crucial step toward financial success. A good bank supports your daily operations and helps your business grow. The right account can save you money, time, and effort. It also provides tools tailored to your needs. Consider your business goals and how a bank fits into them.

Factors To Consider

Look at fees, minimum balance requirements, and transaction limits. Check if the bank offers online banking and mobile apps. Customer service quality matters a lot. Fast, helpful support can solve issues quickly. Also, consider branch locations if you prefer in-person banking. Some banks provide business loans or credit lines. These options can be useful as your business expands.

Business Type And Banking Needs

Your business type affects which bank suits you best. For example, a startup might need low fees and easy online access. A retail store may require many cash deposit options. Service businesses might value invoicing and payment integration. Think about the volume of transactions and payment methods. Match these needs with the bank’s features. Choosing a bank that fits your business style simplifies money management.

Account Features To Compare

Choosing the best bank for your business account in Florida means looking closely at key account features. These features influence your banking experience and costs. Comparing them helps find a bank that fits your business needs perfectly.

Focus on fees, branch access, customer support, and digital tools. Each factor plays a role in daily banking and long-term growth.

Fees And Charges

Start by checking monthly fees and minimum balance requirements. Some banks offer free accounts with no minimum balance. Others may charge for transactions, wire transfers, or cash deposits. Hidden fees can add up fast. Look for banks with clear, low-cost fee structures. Consider how often you will make deposits and withdrawals. Choose a bank that saves you money based on your business habits.

Branch Access And Customer Support

Branch locations matter for businesses needing frequent in-person services. More branches mean easier access to deposits and meetings. Customer support is equally important. Find a bank with responsive and helpful staff. Good support solves problems quickly and reduces stress. Check if support is available by phone, chat, or in person. Fast help keeps your business running smoothly.

Digital Tools And Integrations

Modern business banking relies on strong digital tools. Look for online banking platforms that are easy to use and reliable. Mobile apps should let you deposit checks, transfer money, and track spending. Integrations with accounting software save time and reduce errors. Banks offering invoicing, payment processing, or payroll services add extra value. Choose a bank that supports your business technology needs.

Credit: www.upflip.com

Credit: business.bankofamerica.com

Frequently Asked Questions

What Bank Is Best For A Business Account?

The best business bank depends on your needs. Amex suits online and rewards users. Chase and Capital One handle cash well. Wells Fargo serves established firms with branches. Mercury, Bluevine, and Axos offer fee-free, digital-focused accounts for startups. Choose based on services and fees.

What Is The Best Bank To Go With For A Business Account?

The best business bank depends on your needs. Amex suits online rewards; Chase handles cash deposits; Wells Fargo offers branches and loans. Mercury, Bluevine, and Axos are great for startups with no fees and digital focus. Choose based on your business size and banking preferences.

What Is The Best Bank To Open An Llc Business Account?

Top banks for LLC business accounts include Chase and Capital One for cash deposits, Amex and Mercury for online banking, and Wells Fargo for full-service needs. Choose based on your business size, cash handling, and digital preferences.

What Is The Best Bank For Business Accounts In Florida?

The best bank depends on your business needs. Popular choices include Chase for branch access, Mercury for startups, and Wells Fargo for lending and services. Online-focused banks like Bluevine and Axos offer low fees and digital convenience.

Conclusion

Choosing the right bank in Florida depends on your business needs. Online banks suit startups and digital businesses well. Traditional banks offer more branch access and lending options. Consider fees, services, and ease of use before deciding. A good business account supports growth and daily operations.

Take time to compare each bank’s features carefully. Your business deserves a bank that fits its unique goals.