Owning a boat in Florida is a dream for many, but protecting your investment is just as important as enjoying the sunshine and waves. You want boat insurance that fits your needs without breaking the bank.

Finding the best boat insurance company in Florida can be overwhelming with so many options out there. But don’t worry—this guide will help you cut through the noise and discover top insurers that offer great coverage, reliable service, and competitive prices.

Keep reading to learn how to safeguard your boat and enjoy peace of mind every time you hit the water.

Credit: florida1stinsurance.com

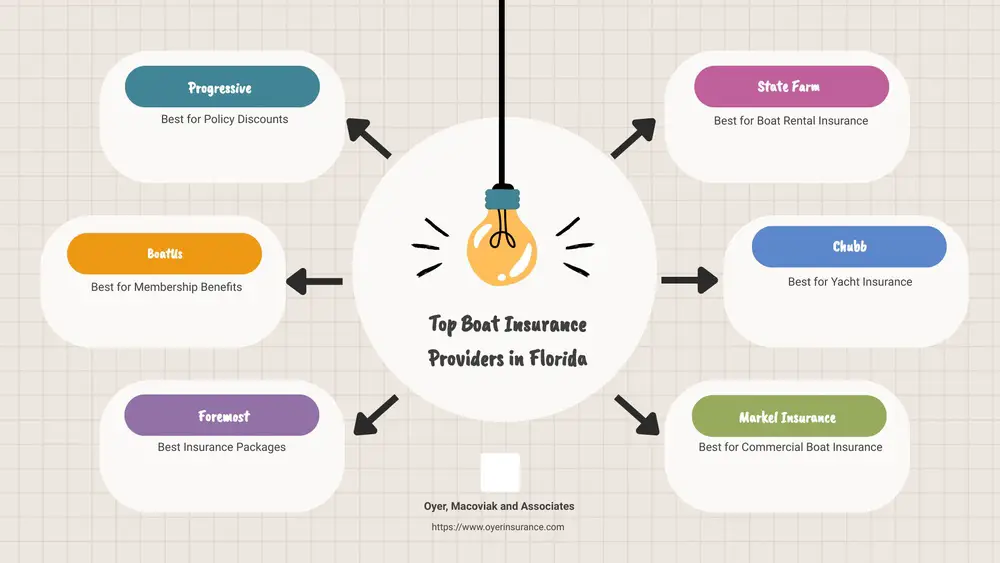

Top Boat Insurers In Florida

Florida has many boat insurance companies. Finding one that fits your needs is important. The right insurer can protect your boat from damage and theft. They also cover liability if you cause harm to others. Here are some of the top boat insurers in Florida to consider.

Progressive

Progressive offers flexible boat insurance plans. Their coverage includes liability, collision, and comprehensive protection. They provide discounts for safety courses and bundling policies. Progressive is known for easy online quotes and quick claims service. Many boat owners trust them for affordable rates and strong coverage.

Boatus

BoatUS specializes in boat insurance and services for boaters. Their policies cover many types of boats and watercraft. They offer towing and assistance services as part of their plans. BoatUS also provides expert advice for boat owners. Their focus on boating makes them a top choice in Florida.

Foremost

Foremost has a long history of insuring boats. They cover personal watercraft, fishing boats, and yachts. Foremost offers customizable coverage options to fit your budget. Their policies include protection for trailers and equipment. They also provide fast claims handling and good customer support.

Wallace Welch & Willingham

This Florida-based insurer is known for marine coverage. They offer comprehensive boat insurance tailored to local needs. Their plans cover liability, physical damage, and more. Wallace Welch & Willingham works closely with local agents. This helps boat owners get personalized service and advice.

Geico

GEICO provides affordable boat insurance with easy online access. They cover many types of boats and offer discounts. GEICO’s policies include liability, collision, and comprehensive coverage. Their strong financial backing ensures reliable claims payment. GEICO is popular for competitive rates and simple service.

Cost Factors For Boat Insurance

Boat insurance costs depend on several key factors. Understanding these factors helps you find the best coverage at the right price. Insurers evaluate your boat and your boating habits to set your premium. Each element plays a role in determining how much you will pay. Below are the main cost factors for boat insurance in Florida.

Boat Value And Age

Newer and more valuable boats usually cost more to insure. The higher the boat’s price, the higher the insurance premium. Older boats may have lower premiums but could lack coverage for certain damages. Insurers also consider the boat’s condition and any upgrades.

Boating Experience And History

Insurance companies check your boating experience before setting rates. A clean record with no accidents lowers the cost. Experienced boaters tend to get better rates than beginners. Having completed safety courses may also reduce premiums.

Type And Use Of Boat

The type of boat affects insurance costs. Sailboats, motorboats, and personal watercraft have different rates. How you use your boat matters too. Recreational use usually costs less than commercial or racing activities. More use means higher risk and higher premiums.

Navigational Area

Where you plan to boat impacts your insurance cost. Boating in calm, inland waters costs less than ocean or rough waters. Areas with more theft or accidents may increase your premium. Insurers want to know the risks based on location.

Claims History

Your past insurance claims influence your premium. A history of frequent claims raises the cost. No claims or few claims show lower risk to insurers. The boat’s claims history also matters. A clean record helps keep rates down.

Ways To Lower Your Premium

Lowering your boat insurance premium in Florida is easier than you think. Small steps can make a big difference in your costs. Understanding these ways helps you save money while keeping your boat protected.

Taking Boating Safety Classes

Completing a boating safety class shows you know the rules and how to handle your boat safely. Many insurers offer discounts for certified boaters. These classes also reduce the risk of accidents, which can lower your insurance rates over time.

Marine Surveys

A marine survey inspects your boat’s condition and equipment. It helps identify any problems before they cause damage. Insurance companies may give discounts if your boat passes a survey, proving it is well-maintained and safe to operate.

Adding Safety Features

Installing safety devices like alarms, GPS, or fire extinguishers makes your boat safer. These features reduce the chance of theft or damage. Insurance companies often lower premiums for boats equipped with extra safety measures.

Comparing Quotes

Rates vary widely between insurance providers. Getting quotes from multiple companies helps find the best price. Compare coverage options, discounts, and customer reviews. This simple step can save you a significant amount on your premium.

Credit: www.moranfinancialsolutions.com

Coverage Options To Consider

Choosing the right boat insurance starts with understanding key coverage options. These options protect your boat, yourself, and others on the water. They also help you avoid costly expenses after accidents or damage. Knowing what each coverage covers makes it easier to find a policy that fits your needs and budget.

Liability Coverage

Liability coverage protects you if you cause injury or damage to others. It pays for medical bills, property damage, and legal fees. This coverage is essential for all boat owners in Florida. It helps you avoid paying large sums out of pocket after accidents.

Comprehensive And Collision

Comprehensive insurance covers damage to your boat not caused by a collision. This includes theft, fire, vandalism, and natural disasters. Collision coverage pays for damage from hitting another object or boat. Together, these coverages protect your boat from many risks on the water.

Uninsured Boater Protection

This coverage helps if you are hit by a boater without insurance or with too little coverage. It covers your medical costs and damages to your boat. Many Florida boaters carry limited insurance, so this protection is important. It gives you peace of mind during unpredictable situations.

Emergency Assistance

Emergency assistance offers help during a breakdown or accident on the water. It can include towing, fuel delivery, and repairs. This coverage saves you from being stranded far from shore. Many boaters find this option valuable for safer boating trips.

Choosing The Right Insurer

Choosing the right boat insurance company in Florida is crucial for every boat owner. The right insurer provides peace of mind and protects your investment. It is important to evaluate several factors before making your choice. These factors help ensure you get the best coverage for your needs and budget.

Discounts And Benefits

Many insurers offer discounts to lower your premium. Discounts may include safe boating courses, multi-policy bundles, and loyalty rewards. Some companies provide benefits like roadside assistance or towing services. Check which discounts apply to your situation. These savings can add up and reduce your overall cost.

Customer Service And Claims Support

Good customer service is vital when you need help. Choose an insurer known for quick and fair claims processing. Friendly and knowledgeable representatives make a difference. You want to feel confident that your claim will be handled smoothly. Read reviews and ask other boaters about their experiences.

Policy Customization

Every boat and boater has different needs. Look for companies that offer flexible policy options. You may want coverage for liability, theft, or damage. Some insurers allow you to add protection for trailers or personal belongings. Customizing your policy ensures you pay only for what you need.

Financial Strength

Financial strength shows an insurer’s ability to pay claims. Choose companies with strong ratings from agencies like A.M. Best or Standard & Poor’s. A financially stable insurer offers long-term security. This means you can trust them to cover losses if an accident occurs. Do not overlook this key factor.

Florida-specific Insurance Tips

Boat insurance in Florida needs special attention. The state’s unique weather, laws, and waterways influence coverage. Understanding these factors helps boat owners choose the right policy. This section covers key Florida-specific insurance tips. It focuses on hurricane risks, local rules, and boating zones.

Hurricane And Weather Coverage

Florida faces hurricanes every year. Many policies exclude hurricane damage or charge extra. Check if your insurance covers storm surge and wind damage. Consider adding flood insurance for extra protection. Secure your boat with proper hurricane preparation steps. This lowers the risk of damage and insurance claims.

Local Regulations

Florida has strict boating laws. Insurance must meet state minimum requirements. Some counties or cities may require additional coverage. Verify your policy aligns with local rules before purchasing. Keep proof of insurance on board at all times. This helps avoid fines and legal trouble while boating.

Navigational Restrictions

Florida waters have specific navigational limits. Some areas restrict boat size or speed. Insurance companies often consider these zones in policies. Make sure your coverage applies to your usual boating locations. This ensures claims are valid if an accident occurs in restricted waters.

Credit: www.trustedchoice.com

Frequently Asked Questions

What Is The Average Cost Of Boat Insurance In Florida?

The average cost of boat insurance in Florida ranges from $300 to $700 annually. Premiums vary by boat type, usage, and insurer.

Which Insurance Company Has The Best Rates In Florida?

Progressive offers some of the best boat insurance rates in Florida, thanks to low costs and multiple discounts.

Which Is The Best Company For Marine Insurance?

Progressive, USAA, and GEICO rank among the best marine insurance providers for affordable rates and solid coverage.

How Much Is Insurance On A $30,000 Boat?

Boat insurance on a $30,000 boat typically costs between $300 and $600 annually. Rates depend on boat type, usage, location, and insurer.

Conclusion

Choosing the right boat insurance in Florida protects your investment well. Consider your boat’s type, age, and use to find the best fit. Comparing multiple companies helps you get fair rates and coverage. Safe boating habits and added safety features may lower premiums.

Review options carefully to match your needs and budget. Stay informed, and enjoy your time on the water with peace of mind.