Finding the best car insurance as a young driver in Florida can feel overwhelming. You want coverage that protects you without emptying your wallet.

But how do you choose the right insurer when rates and options vary so much? This guide is here to help you cut through the noise. You’ll discover which companies offer the best rates, smart discounts, and policies tailored just for young drivers like you.

By the end, you’ll feel confident knowing you picked the best car insurance to keep you safe and save you money on Florida’s roads. Keep reading—your perfect insurance plan is closer than you think.

Car Insurance Challenges For Young Drivers

Young drivers in Florida face unique challenges when buying car insurance. Insurers see them as higher risk. This leads to difficulties in finding affordable coverage. Understanding these challenges helps young drivers prepare better.

Insurance companies consider several factors before offering policies. These factors often increase the cost and complexity for young drivers. Learning about these helps reduce surprises and find better options.

High Premiums In Florida

Florida has some of the highest car insurance premiums in the U.S. Young drivers pay even more due to their age and experience. Insurers charge more because young drivers have higher accident rates. This makes insurance a significant expense for teens and young adults.

Premiums can be several times higher than those for older drivers. This often discourages young people from driving or leads to minimal coverage. Finding discounts and safe driving programs can help lower these costs.

Risk Factors For Young Drivers

Young drivers face many risk factors in Florida. Inexperience is the main concern for insurers. Teens are more likely to make mistakes on the road. Risky behaviors like speeding and distracted driving also increase chances of accidents.

Florida’s busy roads and weather add to these risks. Insurance companies use these factors to set higher rates. Understanding these risks helps young drivers stay safer and reduce their premiums.

Impact Of Driving History

Driving history plays a big role in insurance costs for young drivers. Any accidents or traffic violations raise premiums sharply. Clean records, on the other hand, can lead to discounts.

Young drivers should focus on safe driving to build a positive history. Many insurers offer rewards for good behavior over time. Maintaining a clean driving record is the best way to lower insurance costs in Florida.

Credit: www.allstate.com

Top Affordable Car Insurance Providers

Finding affordable car insurance is crucial for young drivers in Florida. Insurance costs can be high due to inexperience and risk factors. Choosing the right provider helps save money and get the needed coverage. Some companies offer special benefits and discounts for young drivers. These can lower premiums without sacrificing protection. Below are top affordable car insurance providers that serve young drivers well.

Geico Benefits For Young Drivers

GEICO offers low rates for young drivers in Florida. Discounts apply for good students and safe driving. Young drivers can use the mobile app to manage policies easily. GEICO’s customer service is quick and helpful. The company also provides useful resources to improve driving skills.

State Farm Discounts And Coverage

State Farm has many discounts for young drivers. Good student and driver training discounts reduce costs. Coverage options include liability, collision, and comprehensive. State Farm agents help customize policies to fit needs. The company is known for strong customer support and claims handling.

Travelers’ Affordability And Features

Travelers offers competitive rates for young drivers in Florida. The company provides accident forgiveness to avoid rate hikes after a first accident. Discounts are available for bundling auto with other insurance. Travelers’ online tools help young drivers track and manage their policies.

Progressive’s Accident Forgiveness

Progressive is popular for its accident forgiveness feature. This helps young drivers avoid premium increases after minor accidents. Discounts for good students and safe driving are available. Progressive’s Name Your Price tool helps find affordable coverage. The company also offers roadside assistance and other add-ons.

Auto-owners For Independent Young Drivers

Auto-Owners provides flexible policies for young drivers who want independence. The company offers personalized service through local agents. Discounts reward safe driving and bundling policies. Auto-Owners focuses on clear communication and fast claims processing. This helps young drivers feel confident and protected.

Usaa For Military Families

USAA serves military families and offers low rates for young drivers. Membership requires military affiliation or family ties. USAA provides excellent customer service and financial strength. Discounts for safe driving and good students are included. Young military drivers gain access to many extra benefits and coverage options.

Coverage Options For Young Drivers

Choosing the right coverage options is essential for young drivers in Florida. Insurance plans vary in protection level and cost. Understanding these options helps young drivers get suitable and affordable coverage. This section explains key coverage types and benefits available.

Full Coverage Vs. Liability-only

Full coverage protects both your car and others’ property. It includes collision and comprehensive insurance. Liability-only covers damage or injury to others if you cause an accident. It is cheaper but offers less protection. Young drivers should consider their budget and car value before choosing.

Accident Forgiveness And Its Value

Accident forgiveness means your rates do not increase after a first accident. Many insurers offer this to young drivers. It helps keep insurance affordable after minor mistakes. This feature can save money and reduce stress. Check if the insurance company includes accident forgiveness in their plan.

Multi-car And Family Plans

Multi-car plans cover more than one vehicle under the same policy. Family plans include several drivers, often lowering costs. These plans benefit families with multiple young drivers. Discounts are common with such plans. They offer savings and simplify managing car insurance for the whole family.

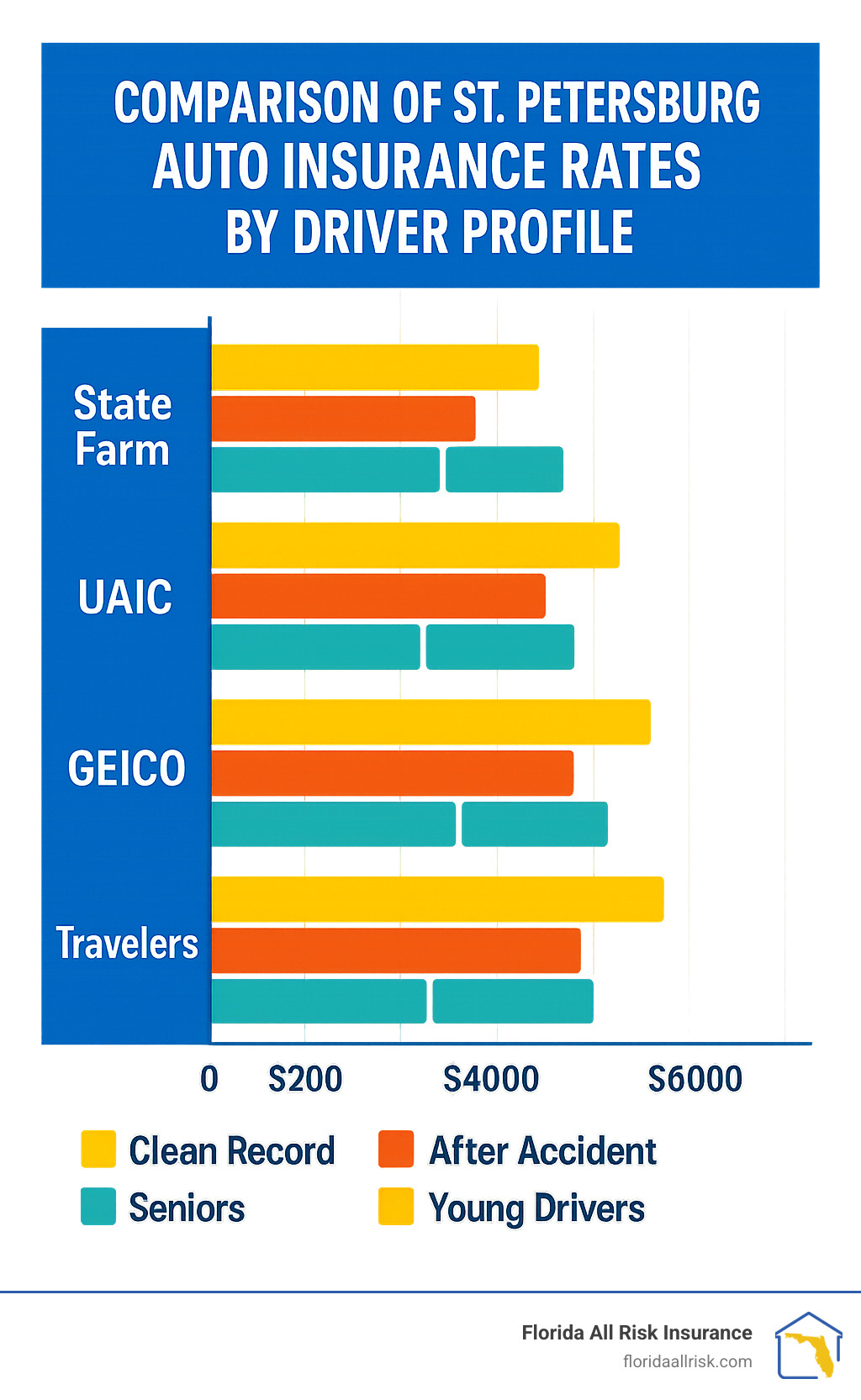

Credit: floridaallrisk.com

Cost-saving Tips For Young Drivers

Young drivers in Florida face high car insurance costs. Finding ways to save money helps manage these expenses. Simple actions can lower premiums and keep coverage affordable.

Understanding discounts and smart choices makes insurance less costly. Here are some key tips for young drivers to save on car insurance.

Safe Driving Discounts

Insurance companies reward drivers who avoid accidents. Staying accident-free for a period can qualify for discounts. Completing defensive driving courses also helps reduce rates. Safe driving lowers risk, so insurers offer better prices.

Good Student Discounts

Maintaining good grades often leads to insurance savings. Many providers give discounts to students with a B average or higher. This reward encourages young drivers to focus on school and safe driving. Keeping up grades benefits both education and insurance costs.

Bundling Insurance Policies

Combining car insurance with other policies cuts overall costs. Bundling home, renters, or life insurance can lower premiums. Insurance companies offer discounts for multiple policies. This method simplifies payments and saves money.

Choosing The Right Car To Insure

Some cars cost less to insure than others. Older models or cars with high safety ratings often have lower premiums. Avoiding sports cars or luxury vehicles reduces insurance costs. Picking a practical car helps young drivers save money on insurance.

Comparing Geico And Progressive

Choosing the right car insurance for young drivers in Florida can be challenging. Two top contenders are GEICO and Progressive. Both offer competitive rates and solid coverage options. Understanding their differences helps parents and teens make informed decisions. This section compares GEICO and Progressive on premium costs, customer satisfaction, and teen-focused policy features.

Premium Costs And Discounts

GEICO generally offers lower premiums for young drivers in Florida. Their rates are competitive due to many available discounts. These include good student discounts and multi-policy savings. Progressive’s rates tend to be slightly higher but competitive for drivers with clean records.

Progressive provides unique discounts like the Snapshot program. This program rewards safe driving habits with potential savings. GEICO also offers discounts for drivers who complete defensive driving courses. Both insurers tailor discounts to help young drivers save money.

Customer Satisfaction Ratings

Customer reviews show GEICO scores well in claims handling and customer service. Many policyholders praise their quick response times. Progressive also receives positive feedback for claims support and user-friendly mobile apps.

J.D. Power surveys often rank GEICO slightly higher in overall satisfaction. Both companies work hard to maintain good reputations. Young drivers and their families benefit from reliable customer service with either choice.

Policy Features For Teens

GEICO provides policies designed for teen drivers with flexible coverage options. They offer tools to help parents monitor teen driving habits. GEICO’s online resources educate young drivers on safe driving practices.

Progressive emphasizes accident forgiveness and usage-based insurance. These features help reduce premium increases after minor accidents. Progressive also offers a Name Your Price tool to fit coverage within budgets. Both insurers support teen drivers with helpful policy features.

How To Shop For Car Insurance In Florida

Shopping for car insurance in Florida can feel confusing for young drivers. The right policy balances cost, coverage, and customer service. Young drivers should learn how to compare options carefully. This helps find the best deal and avoid surprises later.

Taking time to understand how to shop makes a big difference. Start by knowing where to look and what to ask. Use available tools to simplify the process. This approach saves money and ensures proper protection on the road.

Getting Multiple Quotes

Request quotes from several insurance companies. Each company uses different methods to calculate rates. Comparing multiple quotes shows the range of prices available. It also reveals which insurers offer discounts for young drivers. Avoid choosing the first quote you receive. More quotes mean better chances to find savings.

Understanding Policy Terms

Read the policy details carefully. Look for coverage limits, deductibles, and exclusions. Know what events the insurance will pay for. Some policies cover damage to your car, others only cover injuries. Pay attention to Florida’s minimum insurance requirements. Clear understanding helps avoid unexpected costs after an accident.

Using Online Tools And Resources

Use online comparison websites to gather quotes quickly. Many sites let you enter information once and get multiple offers. Check for customer reviews and ratings on insurer websites. Look for tips on choosing coverage suitable for young drivers. Online tools save time and provide useful insights during shopping.

Common Mistakes Young Drivers Make

Young drivers in Florida often face high car insurance costs. Many make avoidable errors that increase their premiums. Understanding these common mistakes helps save money and get better coverage.

These errors include not checking enough insurance quotes, missing out on discounts, and picking weak coverage. Avoiding these pitfalls leads to smarter insurance choices.

Not Comparing Enough Quotes

Young drivers often accept the first insurance quote they get. This limits their chances to find cheaper options. Prices vary widely between companies. Comparing multiple quotes uncovers the best rates and coverage.

Using online tools to compare quotes saves time. It helps spot differences in price and benefits. This step is key to affordable insurance in Florida.

Ignoring Discounts

Many young drivers miss discounts that lower insurance costs. Companies offer savings for good grades, safe driving, and driver education courses. Some discounts apply for having multiple policies or cars.

Asking about all available discounts can reduce premiums significantly. Ignoring these options means paying more than necessary.

Choosing Inadequate Coverage

Young drivers sometimes pick coverage that is too low or too basic. This can lead to high out-of-pocket expenses after an accident. Florida laws require minimum coverage, but more protection is often needed.

Choosing proper coverage balances cost and security. It protects young drivers from financial losses and legal trouble.

Credit: www.libertymutual.com

Frequently Asked Questions

What Is The Best Insurance For Young Drivers In Florida?

The best insurance for young drivers in Florida includes GEICO, State Farm, Progressive, and Travelers. They offer affordable rates and discounts. USAA is ideal for military families. Comparing quotes helps find the best coverage and price.

Which Car Insurance Company Is Best For Young Drivers?

GEICO, State Farm, Progressive, and Travelers rank best for young drivers. They offer affordable rates, discounts, and accident forgiveness benefits.

Is Geico Or Progressive Better For Young Drivers?

GEICO offers affordable rates and solid discounts for young drivers. Progressive provides accident forgiveness and usage-based programs. Choose GEICO for lower premiums; pick Progressive for accident benefits and flexible plans. Both suit young drivers but differ in pricing and coverage options.

Who Has The Lowest Car Insurance Rates In Florida?

GEICO often offers the lowest car insurance rates in Florida. State Farm and Nationwide also provide affordable options. Rates vary by individual factors. Compare quotes to find the best deal for your situation.

Conclusion

Choosing the right car insurance helps young drivers stay safe and save money. Affordable options like GEICO and State Farm offer reliable coverage in Florida. Compare quotes to find the best fit for your budget and needs. Remember, good insurance protects you and others on the road.

Start with trusted companies and check for discounts. Young drivers can drive confidently knowing they have the right coverage. Keep policies updated and review them regularly. Smart choices lead to better rates and peace of mind. Safe driving and proper insurance go hand in hand.