Starting out as a new driver in Florida can feel exciting but also overwhelming—especially when it comes to finding the best car insurance for your needs. You want coverage that protects you without breaking the bank.

But how do you choose from so many options? This guide will help you discover which car insurance companies offer the best rates, reliable service, and smart discounts tailored just for new drivers like you. Keep reading to learn how to save money and gain peace of mind on Florida’s roads.

Your journey to the best car insurance starts here.

Florida Insurance Costs For New Drivers

New drivers in Florida face unique challenges with car insurance costs. The state’s insurance rates tend to be higher for beginners. Understanding these costs helps new drivers budget wisely. Insurance companies consider many factors before setting rates. Knowing what affects premiums can guide new drivers to affordable options.

Average Premiums

Florida’s average car insurance premium for new drivers is higher than the national average. New drivers often pay between $2,000 and $4,000 per year. Teen drivers usually face the highest rates due to lack of experience. Rates may vary depending on the insurance company and coverage level. Full coverage insurance costs more but offers better protection.

Factors Affecting Rates

Age plays a major role in determining insurance costs for new drivers. Younger drivers pay more because they have higher accident risks. Gender also influences rates; young males often pay more than females. Location matters—urban areas in Florida have higher premiums due to more traffic and accidents. Driving record impacts costs; clean records lead to lower rates. Vehicle type affects the price; sports cars and luxury vehicles cost more to insure. Discounts such as good student or safe driver can reduce premiums.

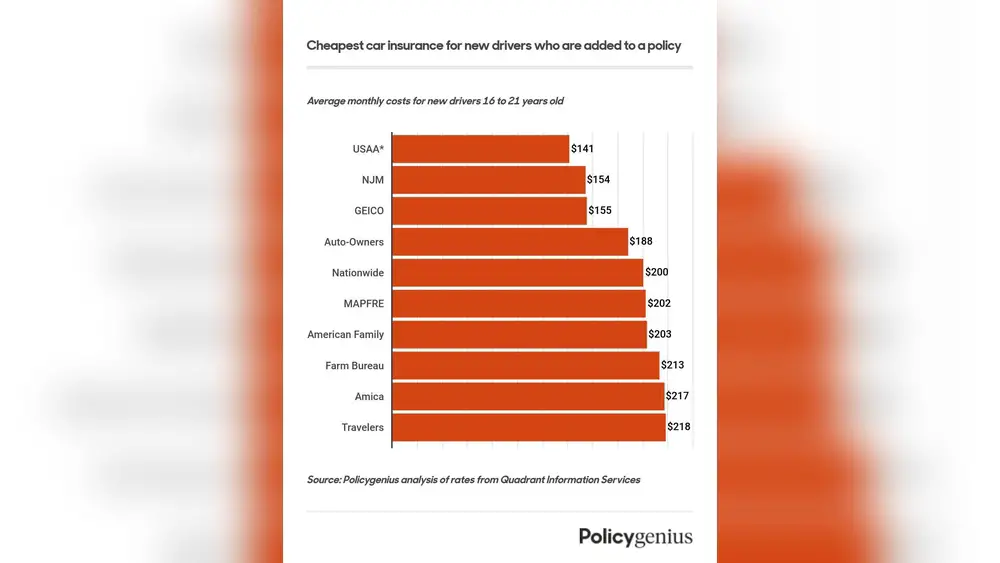

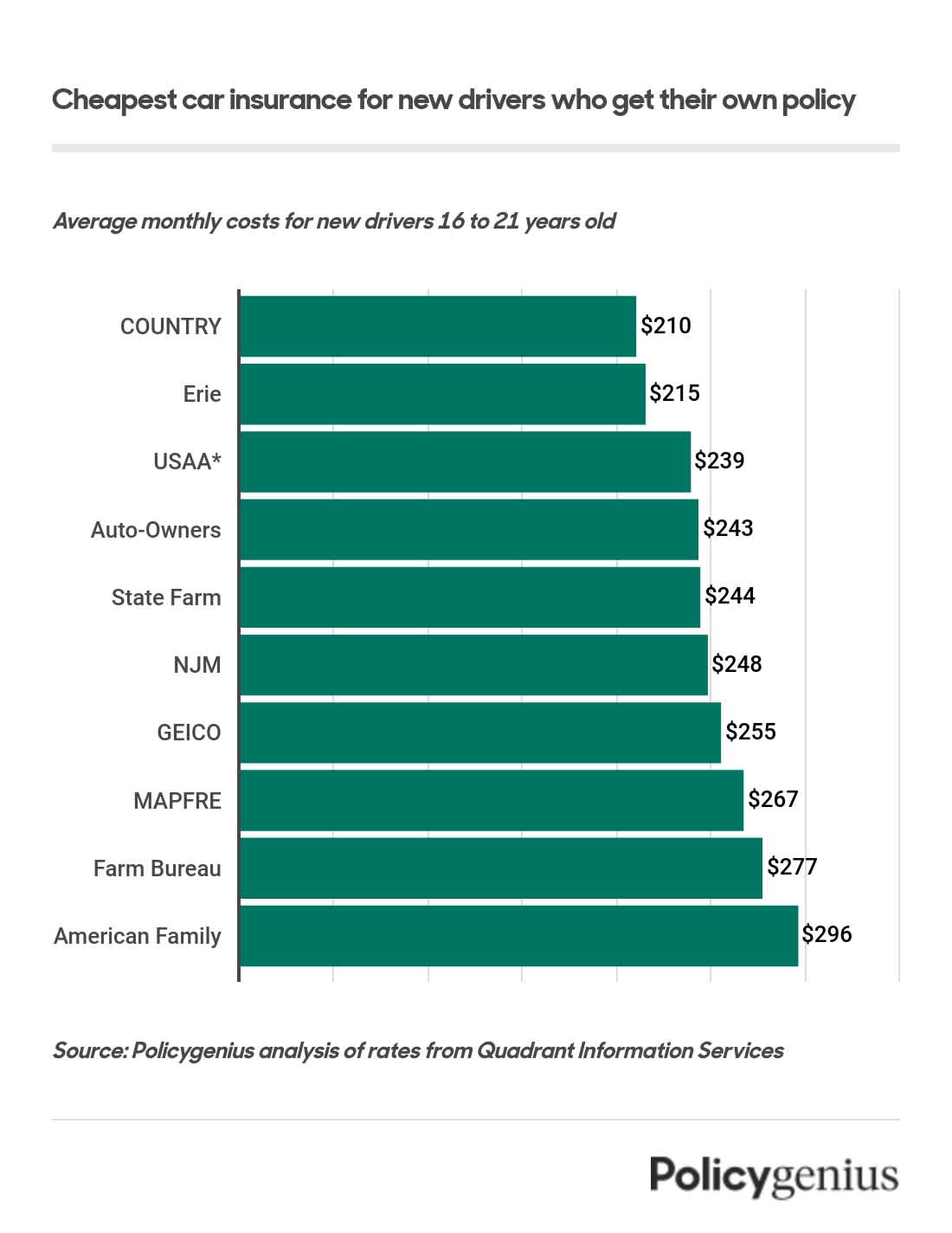

Top Affordable Insurers For Beginners

Finding affordable car insurance as a new driver in Florida can feel tough. Many insurers offer special rates designed just for beginners. These companies balance cost with good coverage. They help new drivers build a strong insurance record. Here are top affordable insurers that new drivers often choose.

Usaa

USAA serves military families and offers great rates for new drivers. Their policies include discounts for good students and safe driving. USAA provides excellent customer service and reliable coverage. Many new drivers find their prices competitive and fair.

Geico

Geico is known for low rates and easy online services. It offers discounts for new drivers with good grades. Geico’s mobile app helps track claims quickly. New drivers appreciate its affordable premiums and simple sign-up process.

Travelers

Travelers offers flexible coverage options that fit beginner drivers. They provide discounts for defensive driving courses. Travelers focuses on helping drivers save money while staying protected. Its customer support is helpful and easy to reach.

State Farm

State Farm is popular for its local agents and personalized service. They offer discounts for new drivers who take driver education classes. State Farm’s accident forgiveness program helps protect your rates. Many beginners trust State Farm for steady, affordable coverage.

Auto-owners

Auto-Owners delivers competitive rates and strong financial stability. They reward new drivers with discounts for safety features and clean driving records. Auto-Owners works with local agents to tailor policies. Their coverage helps new drivers feel secure on the road.

Discounts For New And Teen Drivers

New and teen drivers in Florida often face higher car insurance costs. Insurance companies offer various discounts to help reduce these expenses. These discounts reward safe driving habits and good academic performance. Bundling different insurance policies can also lower premiums significantly. Understanding these discounts helps new drivers save money and stay protected on the road.

Good Student Discounts

Many insurers offer discounts for students with good grades. Maintaining a certain GPA, usually 3.0 or higher, can qualify a driver for savings. This reward encourages responsible behavior both in school and on the road. Parents should ask insurance agents about eligibility requirements. Good student discounts can lower premiums by 10% to 25%.

Safe Driving Rewards

Safe driving is key to reducing insurance costs. Companies track driving records to offer rewards for no accidents or tickets. Some insurers use apps or devices to monitor safe driving habits. These programs reward cautious driving with lower rates or cash back. New drivers benefit from staying accident-free and following traffic rules.

Bundling Policies

Combining car insurance with other policies saves money. Bundling home, renters, or life insurance with car coverage often reduces total costs. Insurance companies give discounts for multiple policies under one provider. This option simplifies payments and boosts savings. New drivers should check with providers for bundling offers to maximize discounts.

Coverage Options For New Drivers

New drivers in Florida face unique challenges when choosing car insurance. Coverage options differ in price and protection. Understanding these options helps new drivers pick suitable plans. Good coverage provides peace of mind and financial safety on the road.

Liability Coverage

Liability coverage is required by Florida law. It pays for injuries or property damage caused to others. This coverage includes bodily injury and property damage limits. New drivers should select limits that protect their finances. Liability coverage does not pay for your own injuries or car damage.

Collision And Comprehensive

Collision coverage pays for damage to your car after a crash. It helps repair or replace your vehicle. Comprehensive coverage protects against non-collision events like theft or weather damage. These coverages are optional but valuable for new drivers. They reduce out-of-pocket costs after accidents or other incidents.

Optional Add-ons

Optional add-ons enhance basic car insurance policies. Examples include roadside assistance, rental car reimbursement, and uninsured motorist coverage. Roadside assistance helps with breakdowns or flat tires. Rental car reimbursement covers costs while your car is repaired. Uninsured motorist coverage protects you from drivers without insurance. New drivers benefit from these extras to stay safer and save money.

Comparing Geico And Progressive

Choosing the best car insurance is important for new drivers in Florida. Geico and Progressive stand out as popular options. Both offer affordable plans and useful features. Comparing these two can help new drivers decide which fits their needs best. Let’s explore their differences in cost, coverage, and special considerations.

Cost Differences

Geico often provides lower average rates than Progressive in Florida. New drivers may find Geico’s premiums more affordable. Progressive’s prices can be higher, depending on the driver’s profile. Discounts, like good student or safe driver, affect final costs. Shopping around for quotes is key to getting the best price.

Coverage Benefits

Geico offers solid coverage options, including liability and collision. It also has helpful add-ons like roadside assistance. Progressive stands out with its name-your-price tool. This lets drivers customize coverage based on budget. Progressive also offers accident forgiveness, which can be useful for new drivers.

Special Considerations

Progressive may be better for drivers with past violations or DUIs. It provides flexible coverage for those with unique needs. Geico’s mobile app is highly rated for easy claims and policy management. Both companies offer discounts for new drivers and students. Checking customer reviews can give insight into service quality.

Credit: www.libertymutual.com

Tips To Lower Insurance Costs

Lowering car insurance costs benefits new drivers in Florida. Insurance can be expensive for beginners. Some simple actions can reduce premiums significantly. This section shares practical tips to save money on insurance.

Choosing The Right Vehicle

Pick a car with good safety ratings. Insurance companies favor cars that protect drivers well. Smaller engines often cost less to insure. Avoid luxury or sports cars; they usually raise premiums. Check if the vehicle has anti-theft devices. These features help lower insurance costs.

Maintaining A Clean Driving Record

Drive carefully and avoid accidents or tickets. Insurance companies reward safe drivers with lower rates. Even minor violations can increase premiums. New drivers should follow traffic laws strictly. Keep good habits to build a positive record. Over time, this will reduce insurance expenses.

Using Telematics Programs

Enroll in telematics or usage-based insurance programs. These track driving habits using a mobile app or device. Safe driving leads to discounts and savings. Avoid hard braking, speeding, and rapid acceleration. Programs help insurers see your real risk. This can lower your insurance cost over time.

Finding The Best Policy In Florida

Finding the best car insurance policy in Florida requires careful thought. New drivers face many options, making the process confusing. A good policy offers the right coverage at a fair price. It also fits your specific needs as a new driver. Use several methods to gather information and compare offers. This helps you make a smart choice.

Using Online Quotes

Start by getting quotes from different insurers online. Many websites let you enter your details and get prices fast. This saves time and helps you see many options at once. Make sure to enter accurate information for the best results. Compare coverage limits, deductibles, and prices side by side. Online tools also show discounts for new drivers.

Consulting Local Agents

Local insurance agents know Florida’s rules and market well. They can explain policies in simple language. Visit or call agents near you to ask questions. Agents may offer personalized advice based on your needs. They help you understand coverage types and add-ons. Sometimes, they find deals not listed online.

Reading Customer Reviews

Customer reviews reveal real experiences with insurers. Look for feedback on claim handling and customer service. Reviews show how quickly companies respond and pay claims. Check multiple sites to get a clear picture. Positive reviews build trust in an insurer’s reputation. Avoid companies with many complaints from new drivers.

Credit: www.policygenius.com

Credit: www.allstate.com

Frequently Asked Questions

How Much Is Insurance In Florida For A New Driver?

Car insurance for new drivers in Florida averages $477 to $504 monthly. Rates vary by provider, coverage, and driving history.

What’s The Best Car Insurance For Beginner Drivers?

The best car insurance for beginner drivers offers low rates, good coverage, and discounts. Top choices include GEICO, State Farm, USAA, and Progressive. Compare quotes to find affordable, reliable coverage tailored to new drivers’ needs. Look for good student and safe driver discounts to save more.

Is Geico Or Progressive Better In Florida?

GEICO usually offers lower rates in Florida, while Progressive suits drivers needing DUI coverage or extra options. Choose based on your needs.

Who Has The Best Car Insurance Rates In Florida?

Travelers, GEICO, USAA, and State Farm offer some of the best car insurance rates in Florida. Rates vary by driver profile.

Conclusion

Choosing the best car insurance in Florida helps new drivers stay safe and save money. Compare different companies and coverage options carefully. Consider discounts for young or good student drivers. Check reviews to find reliable, affordable insurance. Start with basic coverage, then adjust as needed.

Drive responsibly to keep your rates low. Protect yourself and others on the road. The right insurance gives peace of mind for every trip. Take your time to pick the best fit for you.