Finding the best car insurance in Florida as a student can feel overwhelming. You want coverage that protects you without draining your budget.

But with so many options and discounts out there, how do you choose what fits your unique needs? This guide is made just for you. We’ll break down top insurers, reveal how to unlock student discounts, and share smart tips to keep your rates low.

By the end, you’ll know exactly where to turn for reliable, affordable car insurance—so you can focus on your studies and enjoy the road ahead with confidence. Keep reading to discover how to get the best deal tailored just for you.

Credit: clearsurance.com

Student Car Insurance Basics

Understanding student car insurance basics helps students find the best coverage. Insurance costs can be confusing for young drivers. Knowing why rates change and what coverage to choose saves money and stress.

Why Rates Are Higher For Students

Insurance companies see students as higher risk drivers. Young drivers have less experience on the road. This raises the chance of accidents and claims. Insurance providers charge more to cover this risk. Students often drive older cars, which may lack safety features. Also, students may drive in busy areas, increasing accident risk.

Types Of Coverage Students Need

Liability coverage is essential for all drivers. It pays for damage to others if the student causes an accident. Collision coverage helps repair the student’s car after crashes. Comprehensive coverage protects against theft, fire, or natural disasters. Medical payments coverage pays for medical bills after accidents. Uninsured motorist coverage protects if the other driver lacks insurance. Students should choose coverage based on their car’s value and budget.

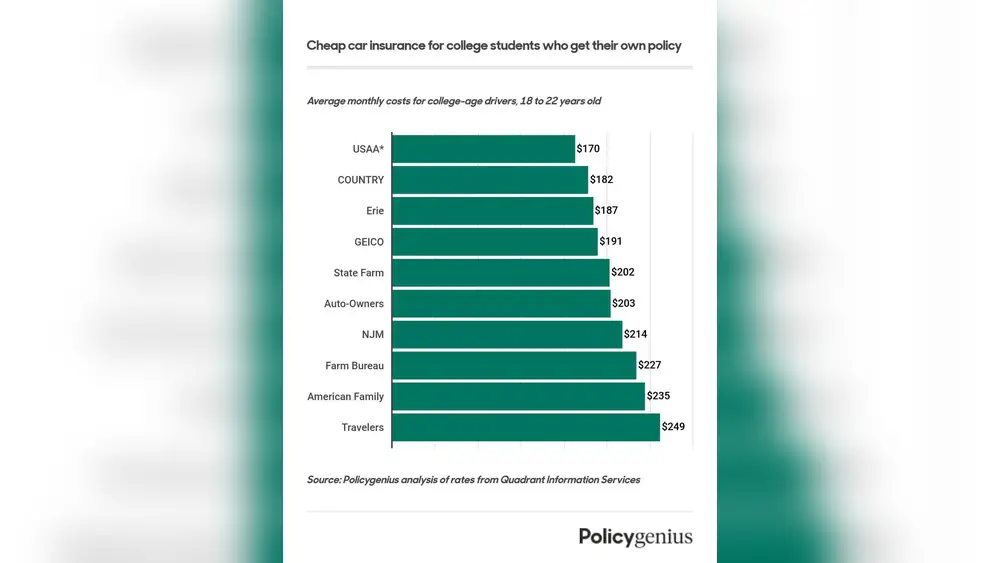

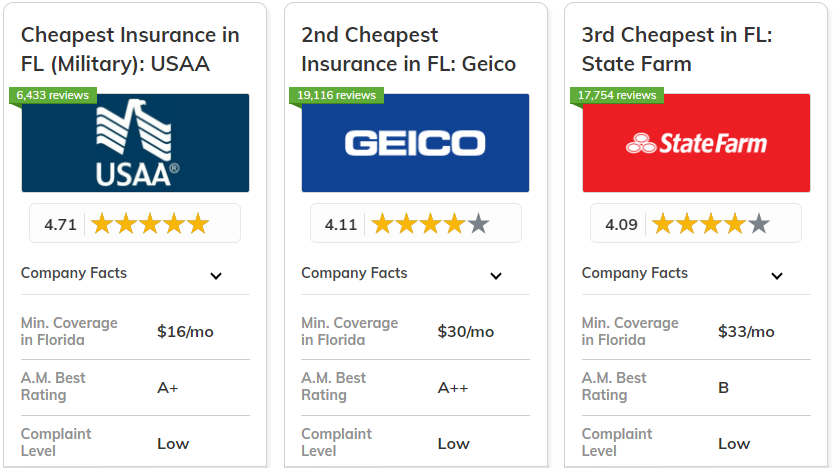

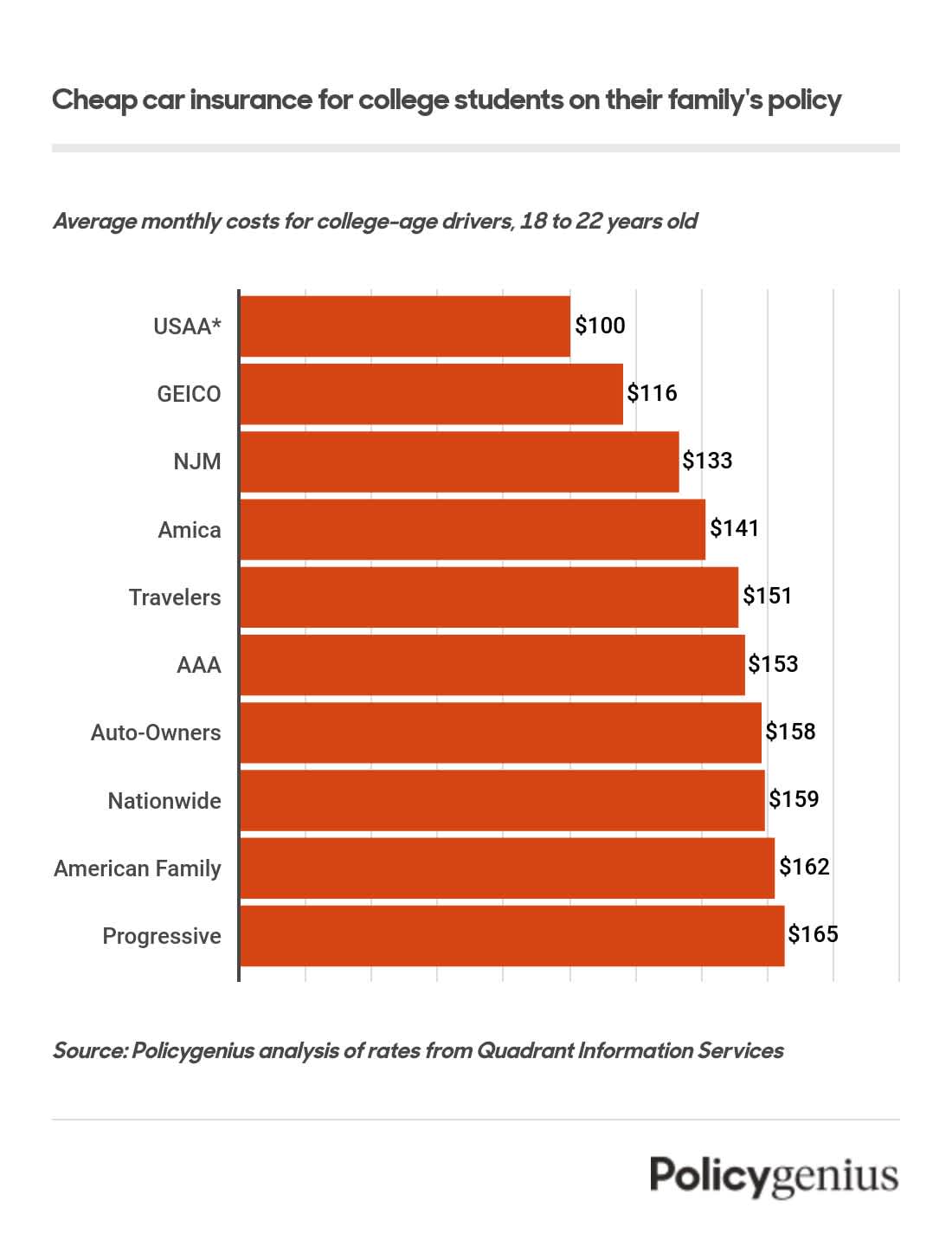

Top Affordable Insurers In Florida

Finding affordable car insurance in Florida can be tough for students. Many insurers offer discounts and special plans to help students save money. Choosing the right company means balancing cost with coverage. Below are some top insurers known for affordable rates and student-friendly benefits.

Geico Student Discounts

GEICO is popular among students for its low rates. They offer discounts for good grades and driver education courses. GEICO also provides multi-vehicle and safe driver discounts. Their online tools make it easy to get a quick quote. Many students find GEICO’s prices very competitive.

Usaa Benefits For Students

USAA serves military families but also offers great rates for student members. Their policies include accident forgiveness and roadside assistance. USAA has discounts for good students and safe driving habits. The company’s customer service is highly rated. USAA’s coverage options fit many student budgets well.

State Farm Coverage Options

State Farm has flexible coverage plans for young drivers. Students can save with good student discounts and driver training programs. State Farm offers reliable roadside help and accident coverage. Their agents often provide personalized advice for students. State Farm balances cost and protection effectively.

Nationwide And Travelers Deals

Nationwide and Travelers offer competitive rates for student drivers. Both provide discounts for good grades and safe driving courses. Their coverage includes options like rental car reimbursement and accident forgiveness. Nationwide and Travelers also have easy online claims processes. Students benefit from their affordable and reliable plans.

Ways To Lower Student Insurance Costs

Students in Florida can reduce their car insurance costs with smart choices. Insurance companies offer discounts that reward safe driving and good grades. Combining policies can also lead to big savings. Technology helps track driving habits to adjust rates fairly.

Driver Education And Safety Discounts

Completing a driver education course often lowers insurance premiums. These courses teach safe driving skills to reduce accidents. Insurers see educated drivers as less risky. Safety programs, like defensive driving, can also earn discounts.

Good Student Discounts Explained

Many insurers reward students with good grades. A high GPA shows responsibility and maturity. This reduces the chance of risky behavior on the road. Students should provide proof of grades to claim these discounts.

Bundling Policies For Savings

Buying multiple insurance policies from one company saves money. Students can bundle car insurance with renters or health insurance. Bundling cuts the overall premium and simplifies payments. It’s an easy way to lower costs without sacrificing coverage.

Using Telematics And Usage-based Insurance

Telematics devices monitor driving habits like speed and braking. Safe driving recorded by these devices can reduce insurance rates. Usage-based insurance charges based on miles driven and behavior. This option benefits students who drive less or carefully.

Credit: www.policygenius.com

Choosing The Right Coverage

Choosing the right car insurance coverage is key for students in Florida. It affects both protection and cost. Students need to balance affordable rates with enough coverage for peace of mind. Understanding different coverage types helps make smart choices. Here are important coverage options to consider.

Full Coverage Vs Liability Only

Full coverage includes both liability and physical damage protection. It covers repairs to your car and damages to others. Liability only covers damage you cause to other people or property. Full coverage costs more but protects your own car. Liability is cheaper but risky if you have a newer or valuable vehicle. Students with older cars might choose liability only to save money.

Adding Roadside Assistance

Roadside assistance helps with emergencies like flat tires, dead batteries, or lockouts. It can save time and money during breakdowns. Some insurance plans include it or offer it as an add-on. Students who drive far from home or in unfamiliar areas benefit from this service. It provides extra safety and peace of mind on the road.

Customizing Deductibles

The deductible is what you pay before insurance covers the rest. Higher deductibles lower your monthly premium but increase out-of-pocket costs after a claim. Lower deductibles raise your premium but reduce your expenses after accidents. Students should choose a deductible that fits their budget and risk level. Balancing premium and deductible keeps insurance affordable and practical.

Shopping Tips For Students

Choosing the right car insurance is important for students in Florida. Smart shopping helps save money and avoid surprises. Focus on key steps to find the best coverage for your needs. Follow these tips to make your search easier and safer.

Comparing Quotes Online

Start by gathering quotes from different insurers. Use online tools to see prices side by side. Enter the same details for each quote to get fair comparisons. Pay attention to discounts for students or good grades. Comparing saves time and helps spot the best deals quickly.

Checking Company Reputation

Research each company’s reputation before buying. Read reviews and ratings from other customers. Look for trustworthiness and good customer service. Choose companies known for fast claims and fair treatment. A strong reputation means better support when you need it most.

Reading Policy Fine Print

Always read the policy details carefully. Check what is covered and what is excluded. Look for limits on coverage and any extra fees. Understand the deductibles you must pay after a claim. Clear knowledge of the policy avoids costly mistakes later on.

Special Considerations In Florida

Florida has unique rules and challenges for student drivers. Understanding these can help students find the best car insurance. Special factors in Florida affect coverage needs and costs. Students must know the state rules, road conditions, and how to handle insurance after moving.

State Minimum Insurance Requirements

Florida requires drivers to carry certain minimum insurance. This includes $10,000 personal injury protection (PIP) and $10,000 property damage liability (PDL). These cover some medical expenses and damage to others’ property. Most experts suggest getting more than the minimum. This helps protect against bigger accidents and costs.

Impact Of Florida Driving Conditions

Florida roads have heavy traffic in cities and tourist spots. Weather can change fast, with sudden rain and storms. These conditions increase accident risks for new drivers. Insurance rates reflect these risks. Choosing coverage with good accident protection is important. Students should consider extra coverage for uninsured drivers too.

Handling Insurance After Moving

Many students move to Florida for college or work. They must update their insurance to meet Florida laws. This means switching or adjusting policies from other states. Not updating insurance can cause legal problems or denied claims. Contact the insurer quickly after moving. This ensures proper coverage and avoids gaps in protection.

Credit: floridaallrisk.com

Frequently Asked Questions

What Is The Best Student Car Insurance?

The best student car insurance offers affordable rates and discounts. USAA, GEICO, and Progressive provide top coverage and student discounts.

Do Students Get A Discount On Car Insurance?

Yes, many insurers offer discounts to students with good grades or those enrolled in driver education. These discounts help lower premiums.

Who Has The Lowest Car Insurance Rates In Florida?

GEICO and State Farm offer some of the lowest car insurance rates in Florida. Nationwide and Travelers also provide affordable options. Rates vary by individual factors and coverage type.

Does Geico Give A Good Student Discount?

Yes, GEICO offers a good student discount that helps lower car insurance rates for eligible students.

Conclusion

Choosing the right car insurance helps students stay protected and save money. Many insurers offer special discounts tailored for students. Comparing rates and coverage options is key to finding the best fit. Students should also check for education and safe-driving discounts.

Affordable insurance makes driving easier and less stressful. Start early and review policies regularly to keep costs low. Smart choices today can lead to better savings tomorrow. Drive safely and enjoy peace of mind on Florida roads.