Finding the best car insurance rates as a senior in Florida can feel overwhelming. You want coverage that fits your budget without sacrificing quality or benefits.

But how do you navigate through so many options to find the perfect plan for your unique needs? This guide will help you uncover the top insurance providers offering affordable rates and valuable discounts specifically for seniors like you. By the end, you’ll know exactly where to look and what to ask for, so you can confidently secure the best deal on car insurance in Florida.

Keep reading to protect both your wallet and peace of mind on the road.

Top Insurers For Seniors In Florida

Finding the best car insurance as a senior in Florida can save money and stress. Several insurers offer special rates and benefits tailored to seniors. These companies understand the unique needs of older drivers and provide discounts or plans to fit their lifestyle. Below are some top insurers known for their senior-friendly policies in Florida.

Geico’s Senior Discounts

GEICO offers discounts specifically for senior drivers. These savings help reduce premiums for those aged 50 and older. GEICO also rewards safe driving habits. Seniors who complete defensive driving courses may earn extra discounts. The process to apply is simple and can lower yearly costs.

Usaa’s Military Benefits

USAA provides car insurance mainly for military members and their families. Seniors with military backgrounds can access exclusive rates. USAA focuses on excellent customer service and coverage options. Their discounts often beat those of other insurers. This company is a strong choice for veterans and active military seniors.

State Farm’s Defensive Driving Offers

State Farm encourages seniors to improve driving skills. They offer discounts for completing approved defensive driving courses. These courses can refresh driving knowledge and boost safety. The savings from this discount can be substantial. State Farm also provides personalized support through local agents.

The Hartford And Aarp Partnership

The Hartford partners with AARP to offer car insurance to seniors. This collaboration provides benefits tailored to older drivers. AARP members enjoy competitive rates and added perks. Coverage includes options designed to meet seniors’ specific needs. The Hartford’s service is highly rated among senior customers.

Nationwide’s Low-mileage Plans

Nationwide offers special plans for seniors who drive less. Low-mileage drivers can save money with pay-per-mile insurance. This option fits retirees who spend more time at home. Nationwide’s plans help seniors pay only for the miles they drive. It’s a cost-effective choice for careful drivers.

Credit: floridaallrisk.com

Key Discounts For Senior Drivers

Seniors in Florida can benefit from several car insurance discounts tailored to their driving habits and lifestyle. These discounts help lower premiums and make insurance more affordable. Understanding these key discounts helps senior drivers save money and maintain good coverage.

Defensive Driving Course Savings

Completing a defensive driving course often leads to lower insurance rates. These courses teach safe driving techniques and accident prevention. Insurers reward seniors who take these courses because they pose less risk on the road. Many Florida insurance companies offer discounts after course completion.

Low-mileage Discounts

Seniors usually drive fewer miles than younger drivers. Insurance companies recognize this lower risk and offer low-mileage discounts. Reporting fewer miles driven annually can reduce your premium. This discount suits seniors who mainly drive locally or only occasionally.

Bundling Auto And Home Policies

Combining auto and home insurance policies with the same company often results in discounts. Bundling simplifies payments and provides savings on both policies. Many Florida insurers encourage bundling by offering significant rate reductions for seniors. This is a smart way to cut overall insurance costs.

Loyalty And Safe Driving Rewards

Insurance companies reward seniors who stay with them for many years. Loyalty discounts lower premiums as a thank-you for staying. Safe driving records also qualify for rewards. Seniors with no recent accidents or tickets often get better rates. These rewards encourage continued safe driving habits.

Factors Influencing Senior Car Insurance Rates

Senior drivers in Florida face unique factors that impact their car insurance rates. Insurers assess several elements to set fair prices. Understanding these helps seniors find the best coverage at affordable costs.

Age And Driving History

Age affects risk levels in insurance calculations. Older drivers may face higher rates due to increased accident risk. However, a clean driving record can lower premiums. Insurers reward safe driving habits over time.

Vehicle Type And Usage

The kind of car influences insurance costs. Sports cars or luxury vehicles usually cost more to insure. Seniors driving older or safer cars often get better rates. How often the vehicle is used also matters. Less driving can reduce premiums.

Location And Traffic Conditions

Where seniors live impacts their insurance rates. Urban areas with heavy traffic and higher accident rates mean higher costs. Rural locations tend to have lower rates due to less congestion. Local crime rates also affect insurance prices.

Health And Vision Considerations

Health issues may influence insurance eligibility and rates. Conditions affecting reaction time or vision raise concerns for insurers. Regular medical check-ups and clear vision tests help maintain good insurance status. Some companies offer discounts for seniors with good health.

How To Compare Senior Auto Insurance Quotes

Comparing senior auto insurance quotes takes careful thought. You must look beyond price. Check what each policy covers. Understand the benefits and limits. This process helps find the best value for your needs. Start with clear goals on coverage and budget. Then use the right tools and research to guide your choice.

Using Online Comparison Tools

Online tools make it easy to compare quotes fast. Enter your information once. See multiple offers side-by-side. These tools show prices from many companies. They also highlight discounts for seniors. Use filters to narrow results by coverage or price. This saves time and reveals competitive rates in Florida.

Evaluating Coverage Options

Check what each policy covers in detail. Look for liability, collision, and comprehensive protections. See if roadside assistance or rental car coverage is included. Consider your driving habits and health needs. Some plans offer special benefits for seniors. Choose coverage that fits your lifestyle and risks.

Checking Company Financial Strength

Pick insurers with strong financial ratings. This means they can pay claims reliably. Look for ratings from agencies like A.M. Best or Moody’s. A financially stable company offers peace of mind. Avoid insurers with poor or unstable ratings. Your claims are safer with a trusted company.

Reading Customer Reviews

Customer reviews reveal real experiences with insurers. Read feedback on claim service and customer support. See if seniors feel valued and helped. Watch for complaints about delays or denials. Positive reviews show a company cares for its clients. Use reviews to gauge trust and satisfaction.

Additional Insurance Options For Seniors

Seniors in Florida may benefit from more than just car insurance. Exploring additional insurance options can provide extra security and peace of mind. These coverages protect important assets and support different life needs.

Understanding available choices helps seniors make informed decisions. Below are key insurance options tailored to seniors’ needs.

Homeowners Insurance Deals

Homeowners insurance protects your house and belongings from damage or theft. Many insurers offer special discounts for seniors. These deals often include lower premiums or bundled options with car insurance. Check for coverage on natural disasters common in Florida, like hurricanes. A good policy saves money and reduces stress during emergencies.

Life Insurance Choices

Life insurance provides financial support to loved ones after you pass. Seniors can find policies that do not require a medical exam. Permanent life insurance offers lifelong coverage and cash value benefits. Term life insurance covers a specific period and is usually less expensive. Choose a plan that fits your budget and family needs to ensure protection.

Travel Insurance For Seniors

Travel insurance covers trip cancellations, medical emergencies, and lost luggage. Seniors often face higher risks when traveling. Policies designed for seniors may cover pre-existing conditions. These plans offer reassurance during vacations or visits to family. Compare options and costs to find the best travel insurance for your trips.

Credit: www.waybetterinsurance.com

Tips To Lower Your Car Insurance Costs

Lowering car insurance costs is essential for seniors in Florida. Smart steps can reduce premiums significantly. Understanding how to save helps maintain financial security. Simple actions lead to noticeable savings on your insurance bill.

Increasing Deductibles

Raising your deductible lowers your monthly premium. Choose a higher deductible only if you can pay it easily after a claim. This method reduces costs but requires readiness to cover more expenses in case of accidents. It is a practical way to cut insurance fees.

Maintaining A Clean Driving Record

Safe driving keeps your record clean and premiums low. Avoid tickets, accidents, and claims. Insurance companies reward drivers with fewer risks by offering better rates. Staying cautious on the road directly benefits your wallet.

Taking Advantage Of Senior Programs

Many insurers offer discounts for senior drivers. These programs recognize experienced drivers and promote safety. Check for age-related discounts or special courses to reduce your premium. Participating in these programs often results in notable savings.

Reviewing And Updating Policies Annually

Insurance needs change over time. Reviewing your policy each year helps find better deals. Update your information and compare options regularly. This practice prevents overpaying and ensures your coverage matches your current situation.

Credit: ccicins.wordpress.com

Frequently Asked Questions

Who Has The Cheapest Car Insurance Rates In Florida For Seniors?

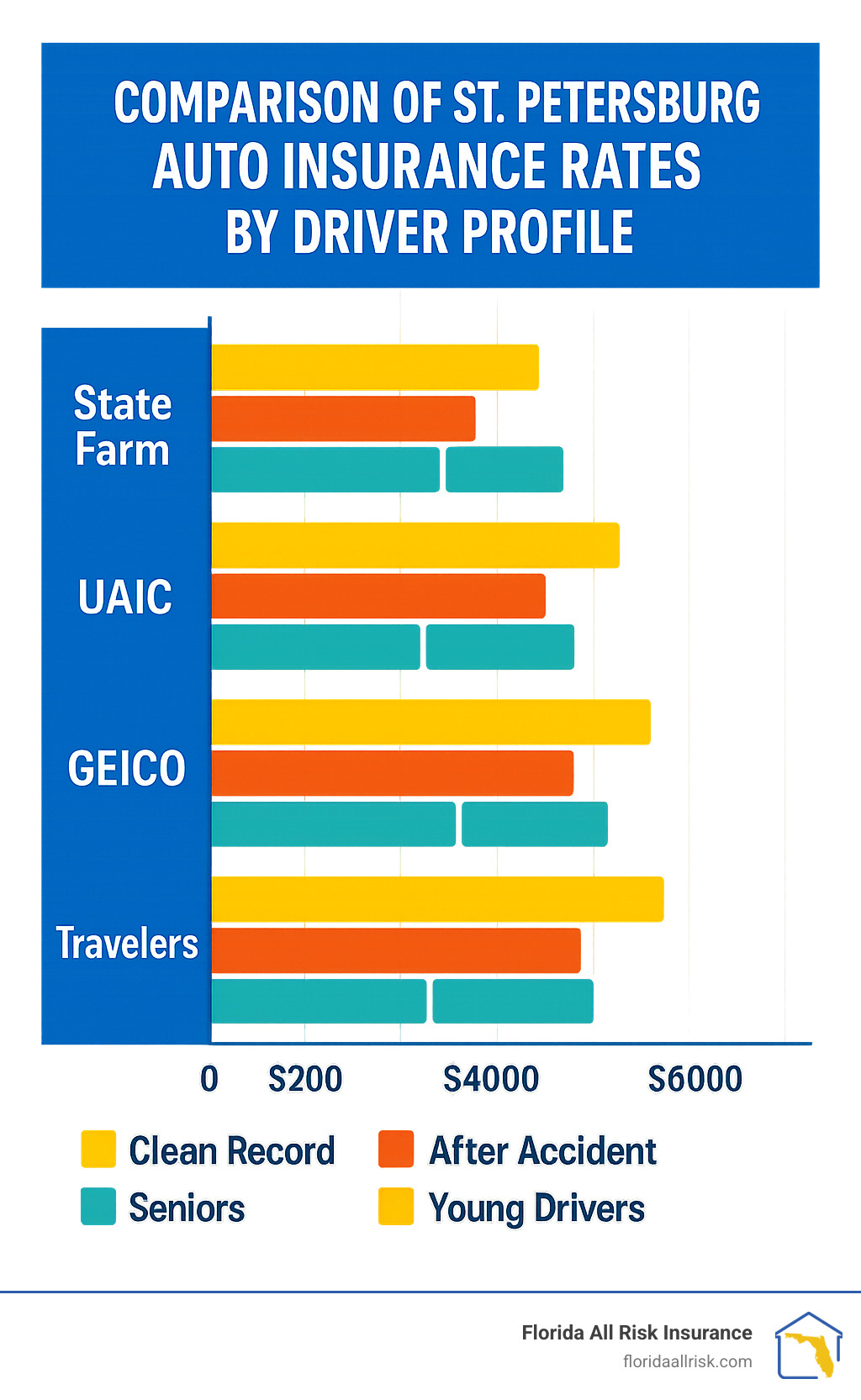

GEICO, The Hartford (AARP members), Nationwide (low-mileage plans), and State Farm offer some of the cheapest car insurance rates for seniors in Florida. Rates vary by individual factors, so comparing quotes from these insurers helps find the best deal.

Who Has The Most Affordable Car Insurance For Seniors?

GEICO, The Hartford (AARP members), Nationwide, and USAA offer some of the most affordable car insurance rates for seniors. Discounts for low mileage and defensive driving help lower costs. Rates vary by location and individual factors, so compare quotes for the best deal.

Does Car Insurance Go Up At Age 70 In Florida?

Car insurance rates in Florida may increase at age 70 due to higher risk factors. Rates vary by insurer and driving history. Seniors can find discounts through companies like The Hartford or Nationwide. Shopping around helps secure affordable coverage tailored for older drivers.

Which Insurance Company Is Best For Senior Citizens?

No single insurer fits all seniors. Fidelity Life suits no-exam life insurance, USAA serves military auto needs, and The Hartford offers AARP benefits. Choose based on your specific insurance type and personal needs.

Conclusion

Finding affordable car insurance rates for seniors in Florida takes some research. Compare quotes from multiple providers to get the best deal. Consider discounts for low mileage and safe driving habits. Choose coverage that fits your needs without overspending. Regularly review your policy to keep rates low as your situation changes.

Smart choices help protect your savings and peace of mind. Drive safely and save more with the right senior car insurance plan.