Looking for the best cheap car insurance in Florida? You want reliable coverage without breaking the bank, and that’s exactly what you’ll find here.

Whether you’re a teen driver, have a clean record, or need full coverage after a mishap, knowing where to look can save you hundreds each year. You’ll discover which companies offer the lowest rates for your unique situation and learn simple tips to lower your premiums.

Keep reading to find the perfect affordable car insurance that fits your budget and keeps you protected on Florida’s roads.

Credit: clearsurance.com

Top Cheap Insurers In Florida

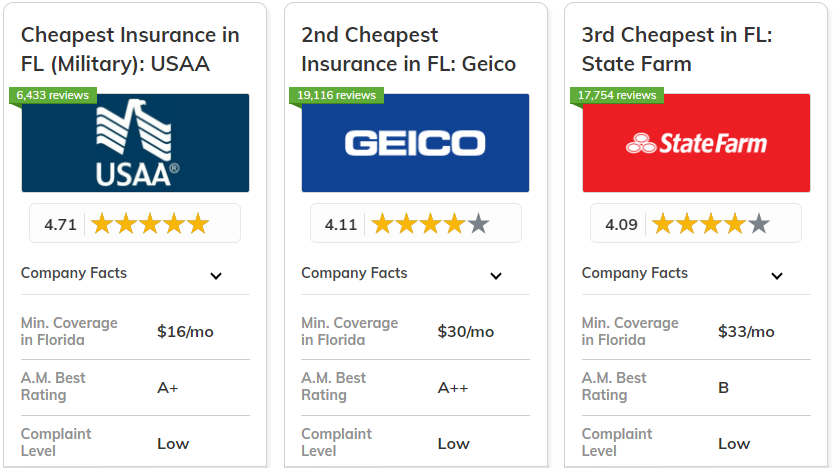

Finding affordable car insurance in Florida means knowing which companies offer the best deals. Several insurers stand out for providing cheap rates without sacrificing service quality. Choosing the right insurer depends on your coverage needs and personal situation.

This section highlights top cheap insurers in Florida for various types of coverage. Each insurer offers unique benefits tailored to different drivers.

Geico For Minimum Coverage

GEICO often provides the lowest prices for minimum coverage in Florida. Their easy online quotes save time. Drivers who want basic liability insurance find GEICO affordable and reliable. Discounts for safe driving and multiple policies help reduce costs.

State Farm For Full Coverage

State Farm is a solid choice for full coverage car insurance. They offer competitive rates with comprehensive protection. Policyholders benefit from personalized service and local agents. State Farm’s discounts for good drivers and bundling make full coverage more affordable.

Best Options For Teens

Teen drivers face higher insurance costs, but GEICO offers some of the cheapest rates for young drivers. Their programs reward safe driving habits. Parents can save by adding teens to existing policies. Look for insurers with teen-specific discounts and driving courses.

Affordable Choices After Dui

After a DUI, insurance costs rise sharply. State Farm provides some of the best affordable options for drivers with DUI records. They offer payment plans and risk-based pricing to keep coverage accessible. Getting quotes from several companies helps find the lowest rate.

Credit: www.nasdaq.com

Key Factors Influencing Rates

Several key factors influence car insurance rates in Florida. Understanding these elements helps you find the best cheap car insurance. Each factor plays a role in determining your monthly premium. Knowing how they affect rates allows smarter insurance choices.

Impact Of Driving Record

Your driving record greatly affects insurance costs. A clean record shows you are a low-risk driver. Accidents or tickets increase your risk and raise rates. Insurers reward safe driving with discounts. Keep your record clean to save money.

Age And Insurance Costs

Age is a major factor in insurance pricing. Young drivers usually pay higher rates due to inexperience. Older drivers often get lower rates if they have a good record. Middle-aged drivers benefit from stability and low risk. Age brackets determine your premium range.

Location-based Rate Differences

Your location in Florida impacts insurance prices. Urban areas with high traffic cause higher premiums. Rural areas tend to have lower rates. Crime rates and accident statistics in your neighborhood also matter. Insurers use location data to assess risk.

Coverage Type Effects

The type of coverage you choose affects your costs. Liability-only coverage is cheaper but offers less protection. Full coverage includes collision and comprehensive protection, costing more. Higher coverage limits raise premiums. Choose coverage based on your needs and budget.

Savings From Bundling Policies

Bundling multiple insurance policies lowers your overall cost. Combining auto and renters or homeowners insurance brings discounts. Insurers reward customers who buy more than one policy. Bundling simplifies payments and can reduce premiums significantly.

Tips To Lower Your Premium

Lowering your car insurance premium in Florida is possible with simple steps. Small changes can lead to big savings on your monthly bill. Focus on strategies that impact your rate directly. These tips help you pay less without losing coverage quality.

Shop Around And Compare Quotes

Different companies offer different prices for the same coverage. Request quotes from several insurers before choosing one. Use online tools to compare rates quickly. Checking often can catch better deals as prices change.

Increase Deductibles Wisely

Choosing a higher deductible lowers your premium. You pay more out of pocket if you have a claim. Only raise deductibles if you can afford the extra cost. This method works well if you rarely file claims.

Improve Your Credit Score

Insurers use credit scores to set premiums in Florida. A higher score shows you manage money well. Pay bills on time and reduce debts to boost your score. Better credit often means lower insurance costs.

Maintain A Clean Driving Record

Accidents and tickets increase your insurance rates. Drive safely to avoid points on your license. A clean record signals you are a low-risk driver. Over time, this can reduce your premium significantly.

Use Defensive Driving Courses

Taking a defensive driving course can lower your premium. Many Florida insurers offer discounts for completing approved courses. These classes teach safer driving habits and reduce accident risk. Check with your insurer about course options.

Add Safety Features To Your Vehicle

Cars with safety features cost less to insure. Devices like anti-theft alarms and airbags reduce risk. Installing these features can qualify you for discounts. Ask your insurer which features lower your premium.

Credit: www.moneylion.com

Cost Variations By Florida City

Car insurance costs in Florida vary widely by city. Different factors influence rates, including traffic, crime, and local laws. Understanding these cost variations helps drivers find affordable coverage in their area. Each city in Florida has unique premium trends based on risk factors and demand.

Insurance Rates In Miami

Miami shows some of the highest car insurance rates in Florida. High traffic congestion raises accident risks here. Theft and vandalism rates also contribute to higher premiums. Drivers in Miami pay more for full coverage than many other cities.

Costs In Tampa Bay Area

Tampa Bay offers moderately priced insurance compared to Miami. Traffic is busy but less dense, lowering accident claims. Insurance companies often give discounts for safe driving here. Overall, Tampa’s rates are more affordable for most drivers.

Fort Lauderdale Premium Trends

Fort Lauderdale’s insurance costs fall between Miami and Tampa Bay levels. Its coastal location increases weather-related risks. Flood and hurricane damage make premiums slightly higher. Still, Fort Lauderdale remains cheaper than Miami for many drivers.

Rates In Orlando And Surroundings

Orlando has some of the lowest car insurance rates in Florida. Less traffic and fewer accidents reduce insurer risk. Insurance companies often compete aggressively here. Drivers can find affordable policies with good coverage options.

Insurance For High-risk Drivers

High-risk drivers face challenges securing affordable car insurance in Florida. These drivers may have violations like DUIs, accidents, or multiple tickets. Insurance companies see them as higher risk. This leads to higher premiums and fewer coverage options. Still, options exist for drivers with a troubled record. Understanding these options helps reduce costs and find coverage that fits your needs.

Options For Drivers With Violations

Drivers with violations can choose from several insurance types. Assigned risk plans are one option. These state-run programs ensure coverage for drivers who cannot get insurance elsewhere. Another option is non-standard insurance. These policies cover high-risk drivers but cost more. Some companies offer policies with limited coverage to lower premiums. Choosing the right option depends on your budget and driving history.

Companies Catering To High-risk

Certain insurers specialize in high-risk driver coverage. Companies like The General and SafeAuto focus on affordable rates for drivers with violations. They offer flexible payment plans and tailored policies. These insurers understand high-risk driver challenges and work to provide fair coverage. Researching and comparing these companies can help find the best deal. Some national providers also have special programs for high-risk drivers.

Ways To Reduce High-risk Premiums

Reducing premiums is possible even for high-risk drivers. Maintaining a clean driving record lowers rates over time. Taking defensive driving courses can qualify for discounts. Increasing your deductible lowers your monthly premium. Bundling insurance policies, like auto and renters, saves money. Installing safety devices in your car may also reduce costs. Regularly comparing quotes keeps you informed about better deals.

Using Online Tools To Compare

Online tools simplify comparing car insurance rates in Florida. They save time and effort by gathering multiple quotes quickly. These tools provide a clear view of different policies and prices. Using them helps you find coverage that fits your needs and budget.

Benefits Of Quote Comparison Sites

Quote comparison sites show many insurance options in one place. They let you compare prices side by side. This helps spot the cheapest and best coverage easily. These sites update prices regularly, so you get current offers. No need to visit multiple websites or call many agents. You save hours and reduce confusion.

Top Platforms For Florida Insurance

Several platforms specialize in Florida car insurance quotes. They include well-known names like NerdWallet, The Zebra, and Compare.com. These sites gather data from many insurers for Florida drivers. They cover various coverage types and budgets. Most platforms have user-friendly designs, perfect for quick comparisons.

How To Get Personalized Quotes

Enter your personal details on comparison sites to get accurate quotes. Provide your age, driving history, car model, and zip code. This information tailors the quote to your profile. Avoid guessing or leaving fields blank for best results. Review each quote carefully before deciding. Personalized quotes help find the best price and coverage match.

Frequently Asked Questions

Who Has The Cheapest Car Insurance In Florida?

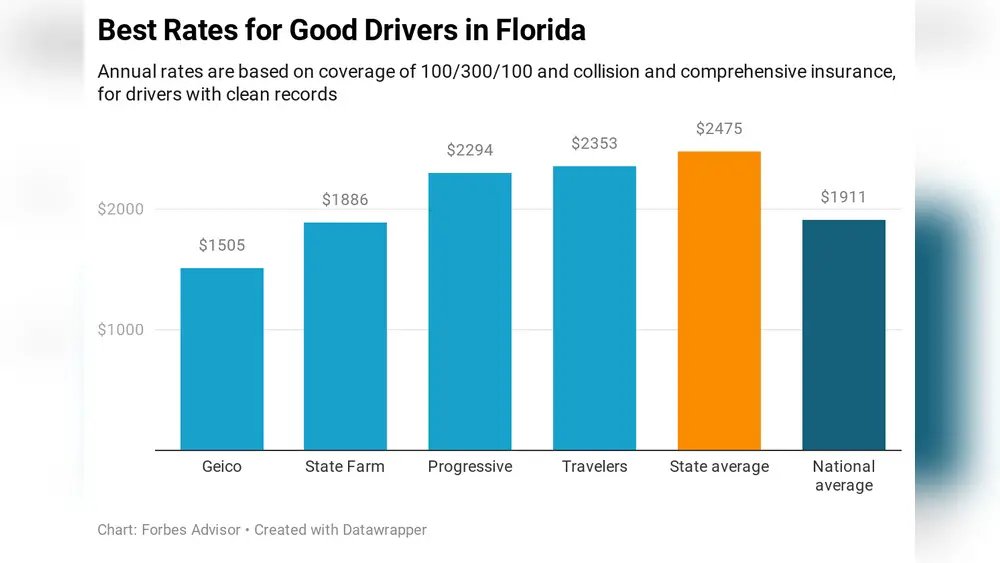

GEICO often offers the cheapest rates for minimum coverage and teen drivers in Florida. State Farm is usually cheapest for full coverage and after a DUI. Compare multiple quotes to find the best price based on your age, driving record, location, and coverage needs.

Who Has The Most Affordable Car Insurance?

GEICO often offers the most affordable car insurance for minimum coverage and teens. State Farm provides cheap full coverage and rates after a DUI. Compare multiple quotes to find the best deal based on your age, location, and driving record.

How To Get Lower Car Insurance In Fl?

Compare quotes from multiple insurers like GEICO and State Farm. Maintain a clean driving record and consider bundling policies. Choose coverage that fits your needs and avoid unnecessary extras to lower car insurance costs in Florida.

How Much Should Car Insurance Cost In Florida?

Car insurance in Florida averages around $1,500 annually but varies by age, driving record, location, and coverage type. Compare quotes from GEICO, State Farm, and others to find the best rate. Full coverage costs more than minimum liability, and bundling policies can reduce premiums.

Conclusion

Finding affordable car insurance in Florida takes time and effort. Compare quotes from different companies carefully. Consider your driving record, age, and coverage needs. Choose a policy that fits both your budget and protection goals. Stay safe on the road and keep your costs low.

Smart choices lead to better savings every year.