Looking for the best cheap car insurance in Florida? You want coverage that protects you without emptying your wallet.

But finding affordable insurance that fits your needs can feel overwhelming. Rates vary depending on where you live, your driving record, and the kind of coverage you choose. The good news? You don’t have to settle for high prices or skimpy protection.

You’ll discover practical tips to compare rates, uncover hidden discounts, and choose the right insurer for your unique situation. Keep reading to learn how to save money and get the car insurance you deserve in Florida.

Top Cheap Insurers In Florida

Finding affordable car insurance in Florida is easier with the right insurer. Many companies offer competitive rates tailored to local drivers. This section highlights top cheap insurers in Florida. Learn about their offerings and how they can save you money.

State Farm Rates

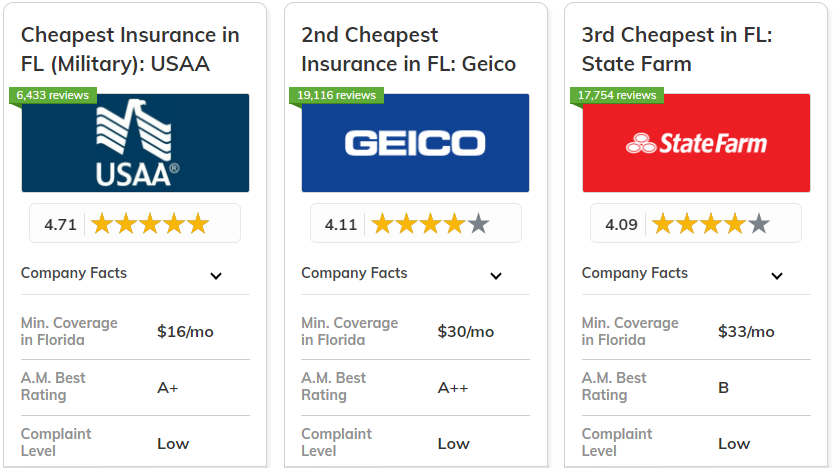

State Farm provides some of the lowest full coverage rates in Florida. They have strong customer service and a wide agent network. Discounts are available for safe driving and multiple policies. State Farm’s rates suit drivers seeking reliable coverage at a fair price.

Geico Deals

GEICO is known for low prices and easy online quotes. They offer discounts for good drivers, military members, and federal employees. GEICO’s quick digital tools make managing your policy simple. Many Florida drivers find GEICO’s deals budget-friendly and flexible.

Progressive Offers

Progressive offers competitive rates with useful tools like Name Your Price. Drivers can compare coverage options to match their budget. Discounts include safe driver, multi-car, and homeowner bundles. Progressive serves Florida drivers looking for customizable insurance plans.

Acceptance Insurance

Acceptance Insurance focuses on providing low-cost coverage for Florida drivers. They often approve drivers with challenging records. Their policies meet state minimum requirements and include optional add-ons. Acceptance Insurance helps drivers find affordable protection fast.

Local Agencies Overview

Local Florida insurance agencies provide personalized service and local knowledge. They can offer tailored quotes that fit your needs. Many local agents work with multiple companies to find cheap rates. Consider visiting a local agency for hands-on help and advice.

Credit: www.moneylion.com

Coverage Types And Costs

Understanding coverage types and their costs helps you choose the best cheap car insurance in Florida. Insurance plans vary by protection level and price. Knowing these options aids in balancing cost and security.

Full Coverage Options

Full coverage includes liability, collision, and comprehensive insurance. It protects against damages to others and your vehicle. Costs are higher than basic plans but provide better security. Ideal for newer or expensive cars.

Liability Only Plans

Liability plans cover damages you cause to others. They meet Florida’s minimum legal requirements. These plans are cheaper but do not cover your car’s repairs. Good choice for older vehicles or tight budgets.

High-risk Driver Policies

High-risk drivers pay more due to past accidents or violations. These policies often have higher premiums and stricter terms. Some companies specialize in affordable plans for high-risk drivers. Checking multiple insurers helps find better prices.

Factors Impacting Rates

Car insurance rates in Florida vary widely due to many key factors. Understanding these can help you find the best cheap car insurance. Rates depend on who you are, what you drive, where you live, and the insurance company’s rules.

Each factor plays a role in shaping your premium. Paying attention to these details can save you money and offer better coverage.

Personal Driving History

Your driving record is one of the biggest factors in your insurance cost. A clean history with no accidents or tickets lowers your rates. Past claims or violations make you appear risky, raising your premium. Insurance companies reward safe drivers with better prices.

Vehicle And Location

The type of car you own affects your insurance cost. New or expensive cars cost more to insure. Some models are safer and cheaper to fix, lowering rates. Where you live in Florida also matters. Urban areas with more traffic and theft risk lead to higher premiums. Rural areas usually have lower costs.

Company Pricing Models

Each insurance company sets prices differently. Some focus on low rates for safe drivers. Others may charge more but offer better customer service or perks. Companies use data and risk analysis to decide premiums. Comparing multiple insurers helps find the best deal for your profile.

Coverage Level Effects

The amount and type of coverage impact your cost directly. Minimum liability coverage is cheaper but offers limited protection. Full coverage with collision and comprehensive costs more but covers more risks. Choosing the right balance between price and protection is key. Higher coverage means higher premiums, but better peace of mind.

Credit: clearsurance.com

Ways To Save On Insurance

Saving money on car insurance in Florida is possible with smart choices. Many drivers pay more than needed. Small steps can reduce your premium without losing coverage. Focus on comparing offers, finding discounts, and using expert help. These strategies make insurance affordable and reliable.

Comparing Multiple Quotes

Getting quotes from different companies shows price differences. Each insurer uses unique methods to set rates. Comparing many quotes helps find the lowest price. Use online tools or call companies directly. Check the coverage details to avoid surprises. A lower price with the same coverage is a real saving.

Discount Opportunities

Insurance companies offer discounts for various reasons. Safe drivers often receive lower rates. Bundling car insurance with home or renters insurance can save money. Some insurers give discounts for good student grades. Installing anti-theft devices may reduce premiums. Always ask about discounts before buying a policy.

Using Insurance Brokers

Brokers work with several insurance companies. They understand the market and find the best deals. A broker saves time by doing the research for you. They can explain complex terms in simple words. Brokers help match your needs with affordable options. Their service often costs nothing extra to the buyer.

Regional Rate Differences

Car insurance rates in Florida vary widely by region. Where you live affects your premiums significantly. Insurance companies assess risks differently in urban and rural areas. These regional rate differences impact how much drivers pay for coverage.

Understanding these differences helps you find cheap car insurance in Florida. Knowing which areas have higher or lower rates guides better choices. The location influences factors like traffic, accident rates, and theft, all affecting premiums.

Urban Vs Rural Premiums

Urban areas in Florida usually have higher car insurance premiums. More cars, traffic, and accidents raise risks for insurers. Cities like Miami and Orlando report more claims. Insurance companies charge more to cover these risks.

Rural areas tend to have lower premiums. Less traffic and fewer accidents reduce risk. Small towns and countryside locations often enjoy cheaper rates. However, some rural regions might see higher costs if emergency services are far away.

Insurance costs reflect local conditions, including road types and crime rates. Urban drivers pay more but may find extra coverage options. Rural drivers pay less but should check if coverage fits their needs.

Popular Florida Cities Costs

Miami ranks among the most expensive cities for car insurance. High population density and theft rates push prices up. Orlando and Tampa also have above-average premiums. These cities face heavy traffic and many claims.

Jacksonville and Tallahassee offer more moderate rates. These cities have fewer accidents and lower crime rates. Drivers here often find more affordable insurance options.

Smaller cities like Pensacola and Cape Coral usually have lower premiums. Less congestion and safer roads reduce costs. Choosing insurance in these areas can save money without sacrificing coverage.

Tools For Rate Comparison

Finding the best cheap car insurance in Florida requires comparing rates carefully. Various tools help drivers check prices quickly. These tools provide easy access to multiple insurance quotes.

Using these tools saves time and shows the best options available. They help you understand different coverage levels and prices. Here are some popular tools for rate comparison.

Online Quote Platforms

Online quote platforms allow users to get multiple insurance quotes in minutes. You enter basic information once and receive rates from many companies. These websites show prices side by side for easy comparison. They often include filters for coverage types and discounts. Many platforms update rates daily to ensure accuracy.

Mobile Apps For Insurance

Mobile apps bring insurance quotes to your smartphone. You can compare rates anytime and anywhere. These apps often have user-friendly designs and quick input forms. Some apps provide notifications about new discounts or policy changes. They may also offer digital ID cards and claims tracking, adding convenience beyond just quotes.

Agent And Broker Services

Agents and brokers help find cheap car insurance by comparing multiple companies. They provide personalized advice based on your needs. Agents understand local Florida laws and insurance requirements. Brokers work with many insurers to find competitive rates. Talking to an agent can reveal discounts not shown online. They guide you through coverage options and policy details.

Credit: www.nasdaq.com

Frequently Asked Questions

Who Has The Cheapest Auto Insurance In Florida?

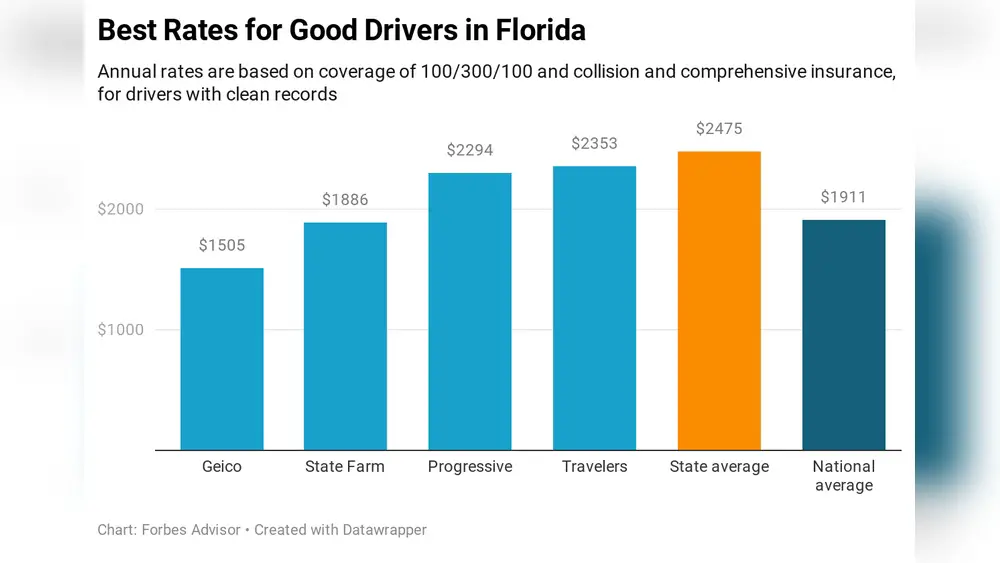

State Farm often offers the cheapest full coverage auto insurance in Florida. Rates vary by driver profile and location. Compare multiple quotes to find the best deal.

Who Has The Most Affordable Car Insurance?

State Farm often offers the most affordable full coverage car insurance in Florida. Rates vary by location, vehicle, and driving history. Compare multiple quotes and ask about discounts to find the best deal tailored to your needs.

How Much Should Car Insurance Cost In Florida?

Car insurance in Florida typically costs between $1,200 and $2,000 annually. Rates vary by coverage, driving record, and location. Compare multiple quotes to find the best price. Choose coverage that fits your needs for affordable and reliable protection.

How To Get Lower Car Insurance In Fl?

Compare quotes from multiple Florida insurers to find the best rate. Ask about discounts like safe driving or bundling. Choose a higher deductible and maintain a clean driving record to lower premiums. Use an independent agent to explore options and save more on car insurance.

Conclusion

Finding cheap car insurance in Florida requires smart choices and careful comparison. Check multiple companies to see who offers the best rates. Ask about discounts to lower your premiums further. Remember, your driving record and coverage needs affect the price.

Choosing the right policy means balancing cost and protection. Take your time to review options before deciding. This way, you get affordable insurance that fits your needs and keeps you safe on the road.