Finding the best cheap insurance in Florida doesn’t have to be overwhelming. Whether you need car, homeowners, or renters insurance, you want solid coverage without breaking the bank.

The good news is, there are trusted companies offering affordable rates tailored to your needs. But how do you choose the right one for you? You’ll discover which insurers provide the lowest prices, how to compare quotes effectively, and smart tips to save even more.

Keep reading to make sure your insurance protects both you and your wallet.

Credit: ccicins.wordpress.com

Top Cheap Car Insurance

Finding top cheap car insurance in Florida is easier with clear options. Drivers want good coverage without high costs. This guide highlights affordable plans for different needs. Choose the best fit for your budget and protection.

Cheapest Full Coverage Plans

Full coverage protects you and others in accidents. State Farm offers some of the lowest full coverage rates in Florida. Their plans include collision and comprehensive coverage. These protect against vehicle damage and theft. Getting multiple quotes helps find the best deal. Full coverage is smart for newer or financed cars.

Affordable Liability Coverage

Liability coverage pays for damage to others if you cause an accident. GEICO provides some of the cheapest liability insurance in Florida. It meets state minimums but can be increased for more protection. Liability insurance is essential and often the most affordable option. Choose a limit that fits your risk and budget.

Minimum Coverage Options

Florida requires minimum car insurance coverage by law. American National Insurance offers low-cost plans that meet these requirements. Minimum coverage includes bodily injury and property damage. These plans keep you legal and protect against basic risks. Ideal for older cars or drivers wanting the lowest rates.

Leading Insurance Providers

State Farm, GEICO, and American National Insurance lead Florida’s cheap car insurance market. Each company has strengths for different coverage types. Compare quotes from these providers to find the best price. Their large networks and customer service make claims easier. Pick a provider with solid reviews and affordable rates.

Affordable Homeowners Insurance

Affordable homeowners insurance in Florida protects your home without draining your wallet. It offers peace of mind at a reasonable cost. Understanding which providers offer low rates helps you save money. Knowing what affects your rates guides you to better choices. Finding discount opportunities can reduce your premium further.

Best Low-cost Providers

Several insurance companies offer affordable homeowners insurance in Florida. Companies like State Farm, Allstate, and Liberty Mutual often provide competitive rates. Local insurers may also have budget-friendly options. Comparing quotes from different providers ensures you find the best price. Check customer reviews to confirm good service with low cost.

Factors Affecting Rates

Your insurance rate depends on many factors. The age and condition of your home matter. Location plays a big role, especially in hurricane-prone areas. Your credit score can influence the premium. Coverage amount and deductible size also change your costs. Understanding these helps you control your insurance expenses.

Discount Opportunities

Insurance companies offer various discounts to lower your premium. Bundling home and auto policies often saves money. Installing security systems or smoke detectors can qualify for discounts. Being a claims-free homeowner may reduce your rate. Ask your insurer about all available discounts to maximize savings.

Budget-friendly Renters Insurance

Renters insurance offers protection for your personal belongings and liability without costing much. It helps cover losses from theft, fire, or accidents in your rental home. In Florida, budget-friendly renters insurance plans provide essential coverage at prices anyone can afford.

Top Affordable Plans

Several companies offer low-cost renters insurance in Florida. Companies like State Farm and Allstate provide plans under $20 per month. These plans include basic personal property and liability coverage. Choosing a plan with a lower deductible can also reduce monthly costs. Compare quotes from different providers to find the best deal.

Coverage Essentials

Basic renters insurance covers personal belongings against fire, theft, and water damage. Liability protection covers injuries to guests and property damage you cause. Some plans also include additional living expenses if your home becomes uninhabitable. Make sure your policy covers the full value of your possessions. Add riders for expensive items like jewelry or electronics if needed.

How To Save On Premiums

Increasing your deductible lowers your premium. Bundling renters insurance with auto insurance can earn discounts. Maintain a good credit score, as insurers often use it to set rates. Installing security devices like smoke detectors or alarms may reduce costs. Ask insurers about all available discounts before buying a policy.

Credit: www.nasdaq.com

Health Insurance Options

Choosing the right health insurance in Florida can save money and provide good care. Many affordable options exist for residents. Understanding these choices helps you pick the best plan.

Health insurance covers doctor visits, hospital stays, and prescriptions. It protects against high medical costs. Florida offers several ways to get health insurance, fitting different budgets.

Marketplace Plans Overview

The Health Insurance Marketplace offers many plans for Florida residents. These plans meet state and federal rules. They include essential health benefits and prevent denial for pre-existing conditions.

Marketplace plans come in categories: Bronze, Silver, Gold, and Platinum. Bronze plans have lower monthly premiums but higher costs when you get care. Platinum plans have higher premiums but lower costs at the doctor’s office.

Open enrollment is the time to sign up for these plans. Special enrollment periods happen after life changes like marriage or job loss.

Low-cost Coverage Choices

Florida offers several low-cost health insurance options. Medicaid covers people with low income and certain disabilities. Florida expanded Medicaid for some, but eligibility rules apply.

There are also short-term health plans for temporary coverage. They cost less but cover fewer services. These plans work well for gaps in coverage.

Some employers provide health insurance with low premiums. Check if your job offers this benefit to save money.

Eligibility And Subsidies

Eligibility for health insurance depends on income, age, and family size. The Marketplace uses these details to show plans and prices. Many people qualify for subsidies that lower monthly payments.

Subsidies come as tax credits to reduce costs. They make health insurance affordable for many Floridians. Low-income families may also get help with out-of-pocket expenses.

Applying through the Marketplace is the easiest way to see if you qualify. Keep income information ready to get accurate results.

Tips To Lower Insurance Costs

Lowering insurance costs in Florida is possible with a few smart strategies. Saving money on your policy helps protect your budget. You do not have to sacrifice coverage for affordability. Understanding how to reduce premiums makes a big difference. These tips can guide you toward cheaper insurance without losing essential protection.

Comparing Multiple Quotes

Getting quotes from several insurers helps find the best price. Each company uses different rules to set rates. Comparing helps spot who offers the lowest cost. Use online tools or call companies directly to request quotes. Look beyond price and check what coverage each plan offers. This step saves you money and ensures proper coverage.

Checking For Discounts

Many insurers offer discounts that lower your premium. Safe driving, bundling home and auto policies, or good grades can reduce costs. Ask the insurance agent about all available discounts. Some companies also give discounts for low mileage or vehicle safety features. Applying these discounts cuts your insurance bill significantly.

Adjusting Coverage Levels

Review your coverage and remove unneeded extras. Higher deductibles usually mean lower monthly payments. Choose coverage limits that meet your needs but avoid overpaying. Dropping unnecessary add-ons saves money too. Make sure you still have enough protection for your situation. Small changes here can lead to big savings.

Credit: www.nasdaq.com

Top Insurance Companies In Florida

Florida hosts many insurance companies offering affordable rates and solid coverage. Choosing the right insurer can save money and provide peace of mind. This section highlights some of the top insurance providers in Florida known for their value and reliability.

State Farm Benefits

State Farm is popular for its wide coverage options. It offers competitive rates for full coverage insurance. The company provides strong customer service and local agents in Florida. Many drivers find discounts for safe driving and multiple policies. State Farm’s claims process is straightforward and fast. It is a trusted choice for affordable insurance in Florida.

Geico Savings

GEICO is well-known for low liability coverage rates in Florida. Its online tools make getting a quote simple and quick. GEICO offers many discounts, including for good drivers and military members. The company has a large network of approved repair shops. Customers often praise GEICO for its easy claims handling. It is a great option for budget-conscious drivers.

Other Notable Insurers

American National Insurance stands out for cheap minimum coverage plans. Progressive offers flexible policies with useful add-ons. Allstate provides solid coverage with various discount opportunities. Local insurers can also offer competitive prices and personalized service. Comparing several companies helps find the best deal. Many insurers provide online quotes to simplify comparison.

Frequently Asked Questions

What Car Insurance Is The Cheapest In Florida?

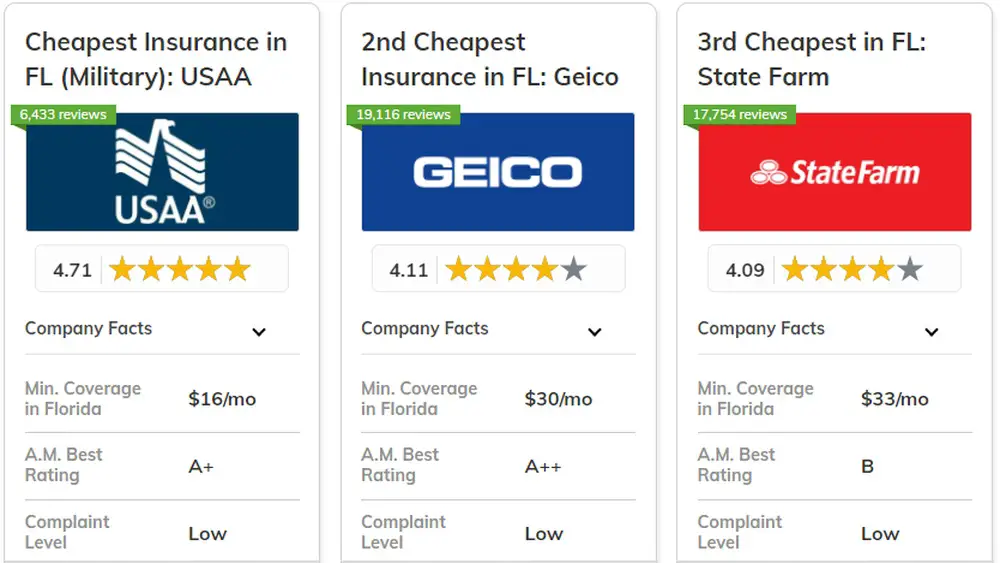

State Farm offers the cheapest full coverage in Florida. GEICO has the lowest liability rates. American National provides affordable minimum coverage. Compare quotes from these insurers to find the best deal for your needs.

Which Car Insurance Company Is The Best In Florida?

State Farm ranks as the best car insurance company in Florida for coverage and affordability. Geico and USAA also offer strong options. Compare quotes to find the best fit for your needs.

Who Has The Most Affordable Homeowners Insurance In Florida?

Several companies offer affordable homeowners insurance in Florida. Compare quotes from Citizens Property Insurance, State Farm, and Universal Property to find the best rates. Prices vary by location and coverage, so getting multiple quotes ensures the most affordable option for your needs.

Who Truly Has The Cheapest Car Insurance?

State Farm offers the cheapest full coverage, GEICO provides the lowest liability rates, and American National leads in minimum coverage. Compare quotes from these top insurers to find the best deal for your needs.

Conclusion

Finding cheap insurance in Florida takes some effort and smart comparison. Check rates from different companies to see who offers the best deal. Remember to consider your coverage needs carefully before choosing. Discounts can lower your costs, so ask about them.

Staying informed helps you save money and get good protection. Stay patient and keep comparing until you find a plan that fits your budget and needs. Your wallet will thank you.