Finding the best home insurance for Florida can feel overwhelming. You want to protect your home from hurricanes, floods, and other risks unique to the Sunshine State.

But how do you choose the right policy that fits your needs and budget? This guide will help you cut through the confusion. By the end, you’ll know exactly what to look for and how to get the coverage that keeps your home—and your peace of mind—safe.

Keep reading to discover the top options tailored just for you.

JUMP TO TOPIC

Florida Home Insurance Basics

Understanding Florida home insurance is essential for every homeowner. This insurance protects your home and belongings from damage and loss. Florida has unique risks that affect insurance choices. Knowing the basics helps you pick the right coverage. Let’s explore the key points about Florida home insurance.

Key Coverage Types

Home insurance covers different types of damage and loss. Dwelling coverage pays for damage to your house. Personal property coverage protects your belongings inside the home. Liability coverage covers injuries or damage you cause to others. Additional living expenses coverage helps if you cannot live in your home after damage. Each type plays a vital role in your protection.

State-specific Risks

Florida faces unique risks that affect home insurance. Hurricanes and tropical storms can cause major damage. Flooding is common and often not covered by standard policies. Termites and mold may require extra protection. The risk of sinkholes is higher in some areas. These risks make choosing the right insurance essential.

Mandatory Requirements

Florida does not require home insurance by law. However, mortgage lenders often demand insurance to protect their investment. Insurance must meet lender requirements. Certain areas may require flood insurance separately. Knowing these requirements helps you avoid surprises and stay protected.

Top Home Insurance Providers In Florida

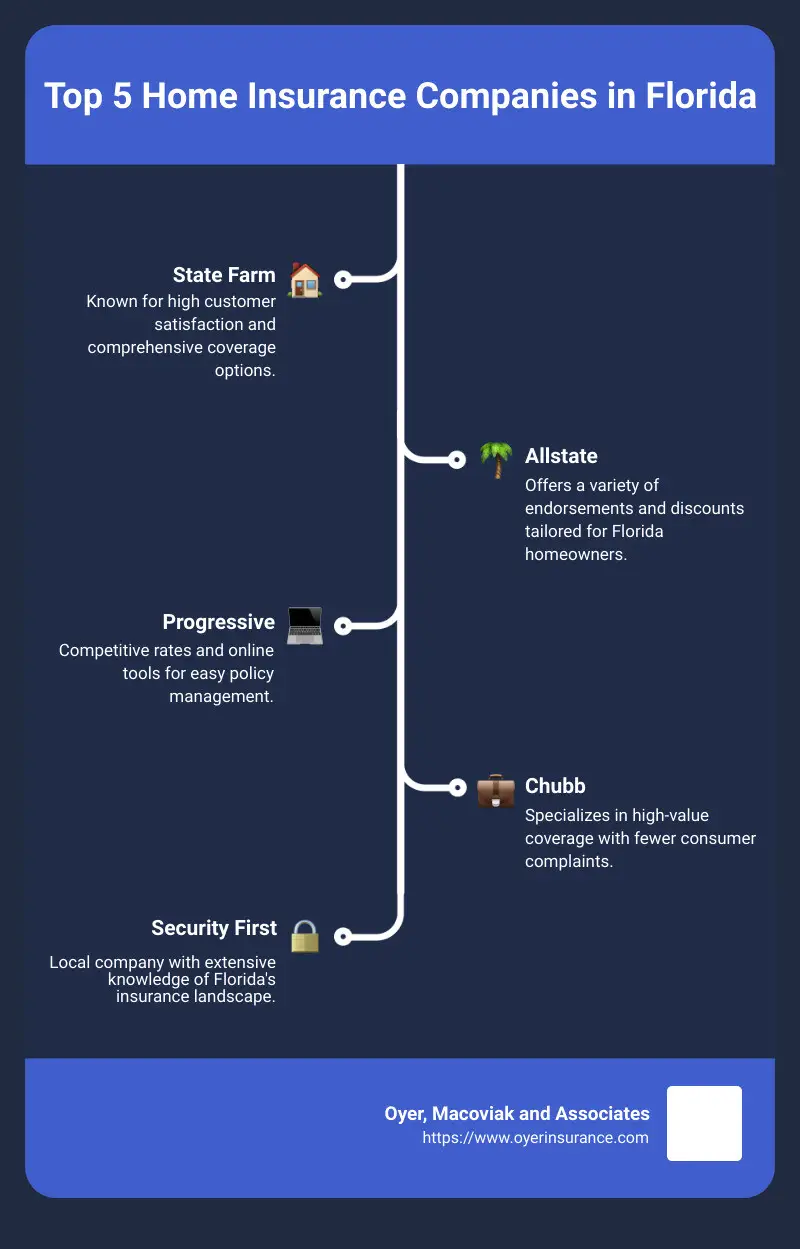

Choosing the right home insurance in Florida is crucial. The state faces unique risks like hurricanes and flooding. Picking a reliable insurer helps protect your home and peace of mind. Here, we review top home insurance providers in Florida to guide your choice.

Leading Companies Overview

Several companies stand out in Florida’s home insurance market. State Farm offers wide coverage and many local agents. Allstate provides customizable plans with useful online tools. Universal Property & Casualty focuses on Florida homes and storm coverage. These insurers have strong reputations and cover common risks well.

Customer Satisfaction Ratings

Customer feedback shows which companies perform best. State Farm often scores high for claims handling and service. Allstate customers appreciate clear policies and helpful support. Universal Property & Casualty receives praise for quick claim responses. Satisfaction ratings help identify insurers that treat customers fairly.

Financial Strength Comparison

Financial strength matters to ensure insurers pay claims. A.M. Best rates State Farm as A++ (Superior). Allstate holds an A+ (Superior) rating. Universal Property & Casualty is rated A (Excellent). These ratings indicate strong ability to handle large claims and stay stable.

Coverage Options For Florida Homes

Choosing the right home insurance in Florida means understanding the coverage options. Florida homes face unique risks like hurricanes and floods. Insurance should protect your home and belongings from these dangers.

Each coverage type offers specific protection. Knowing these can help you pick a plan that fits your needs. Here are the main coverage options for Florida homes.

Dwelling Protection

Dwelling protection covers the physical structure of your home. It pays to repair or rebuild after damage from storms, fire, or other covered events. This coverage is vital in Florida due to frequent hurricanes and strong winds. Make sure the policy limits match your home’s rebuilding cost.

Personal Property Coverage

This covers your belongings inside the home. Furniture, electronics, clothes, and other items are protected. Personal property coverage helps replace items lost or damaged in theft, fire, or weather damage. Keep an inventory of valuables to claim easily.

Liability Protection

Liability protection covers injuries or damage you cause to others. It pays medical bills and legal costs if someone sues you. This protection is important for accidents on your property or caused by your pets. Liability coverage keeps you financially safe from unexpected claims.

Additional Living Expenses

This coverage pays for extra costs if your home is unlivable. It covers hotel stays, meals, and other living expenses during repairs. Florida homes can be damaged by storms, making this coverage crucial. It ensures you have a safe place to stay without extra stress.

Credit: floridaallrisk.com

Cost Factors For Florida Home Insurance

Understanding the cost factors of Florida home insurance helps homeowners make smart choices. Insurance prices can change a lot based on several key points. Knowing these can save money and avoid surprises.

Impact Of Location

Location plays a big role in home insurance costs. Coastal areas face higher risks from hurricanes and floods. Homes near the ocean often have more expensive premiums. Urban areas might have higher theft risks, raising insurance prices. Insurers use local data to set rates that reflect these dangers.

Home Age And Condition

Older homes usually cost more to insure. They might have outdated wiring or plumbing, which raises risk. Newer homes often meet current safety codes and have lower premiums. The condition of the house also matters. Well-maintained homes face fewer claims and cheaper insurance.

Deductibles And Premiums

The deductible is what you pay before insurance helps. Choosing a higher deductible lowers your monthly premium. A lower deductible means paying more each month but less during a claim. Balancing these helps control overall insurance costs. Premiums vary based on coverage levels and risk factors.

Discounts And Savings

Many insurers offer discounts that reduce costs. Bundling home and auto insurance is one common way. Installing security systems or storm shutters may also lower rates. Some companies reward long-term customers with better prices. Checking for available discounts can lead to meaningful savings.

Natural Disaster Coverage

Natural disasters pose a real threat to homes in Florida. Insurance that covers these events is essential. It protects your home and belongings from costly damage. Understanding the key types of natural disaster coverage helps you make smart decisions.

Hurricane Insurance

Hurricanes cause heavy damage in Florida. Hurricane insurance covers wind and rain damage from storms. It helps repair or rebuild your home. Many policies require a separate hurricane deductible. Check your coverage limits carefully. This coverage reduces financial risk during hurricane season.

Flood Protection

Floods can ruin homes fast. Standard home insurance often excludes flood damage. Flood protection is a separate policy or add-on. It covers water damage from heavy rain and storms. Flood insurance pays for repairs and replacement of damaged items. This coverage is vital in flood-prone areas.

Windstorm Coverage

Strong winds cause broken windows and roof damage. Windstorm coverage helps fix these problems. It covers damage from wind, hail, and flying debris. This coverage is sometimes bundled with hurricane insurance. It offers extra protection during stormy weather. Windstorm coverage keeps your home safe.

Tips To Lower Home Insurance Costs

Home insurance in Florida can be expensive due to weather risks. There are ways to reduce these costs without losing coverage. Simple steps can lower your premiums and protect your home better.

Home Safety Improvements

Install smoke detectors and fire alarms. They reduce fire damage risk and lower insurance rates. Strengthen doors and windows to resist storms. Add storm shutters or impact-resistant glass. These upgrades show insurers your home is safer.

Bundling Policies

Combine home and auto insurance with the same company. Bundling policies often leads to discounts. It saves money and makes managing insurance easier. Ask your agent about bundling deals for Florida homes.

Shopping Around

Compare quotes from different insurance companies. Prices vary a lot between providers. Check reviews and coverage details carefully. Switching companies can save hundreds annually. Update your information to get accurate quotes.

Claims Process In Florida

Understanding the claims process in Florida is key for home insurance holders. Natural events like hurricanes and floods often cause damage here. Knowing the steps can reduce stress and speed up your claim. This guide breaks down the process clearly.

Filing A Claim

Start by contacting your insurance company quickly. Provide your policy number and details of the damage. Take photos or videos as proof. Keep records of any repairs or expenses. The company assigns an adjuster to assess the damage. Stay available for questions and inspections.

Common Challenges

Delays often happen due to heavy claim volumes after storms. Disagreements about damage value may occur. Some claims get denied for missing coverage. Paperwork errors can slow the process. Communication problems between you and the insurer are common.

Tips For Quick Resolution

Report damage immediately. Keep detailed records and receipts. Be honest and clear in all communications. Review your policy to understand coverage. Follow up regularly with your adjuster. Consider professional help if disputes arise.

Credit: www.marketwatch.com

Credit: www.oyerinsurance.com

Frequently Asked Questions

What Is The Best Home Insurance For Florida Residents?

The best home insurance in Florida offers comprehensive coverage for hurricanes, floods, and theft. Look for insurers with strong financial ratings and local expertise.

How Much Does Home Insurance Cost In Florida?

Home insurance in Florida typically costs between $1,500 and $3,000 annually. Prices vary based on location, home value, and coverage limits.

Does Florida Home Insurance Cover Hurricane Damage?

Yes, most Florida home insurance policies cover hurricane damage but may exclude flooding. Flood insurance often requires a separate policy.

Can I Get Discounts On Florida Home Insurance?

Yes, discounts are available for security systems, multiple policies, and hurricane-resistant upgrades. Ask your insurer about all possible savings.

Conclusion

Choosing the best home insurance in Florida protects your home and peace of mind. Consider coverage options that fit your needs and budget. Compare quotes from trusted companies carefully. Check customer reviews for real experiences. Don’t forget to review policy details clearly.

Preparing now helps avoid stress during emergencies. A good policy offers safety against storms and damages. Protect your home with smart choices today. Stay informed and updated on insurance changes. Your home deserves the right protection always.