Are you curious about how sales tax in Gardena, CA, could affect your wallet? Whether you’re a local resident, a business owner, or someone planning a visit, understanding the nuances of Gardena’s sales tax is crucial.

By knowing how it impacts your daily purchases and financial decisions, you can make more informed choices and even find opportunities to save money. Imagine feeling confident every time you shop or make a business transaction, knowing exactly how much extra you’ll pay or collect in taxes.

This article will guide you through the essentials of Gardena’s sales tax, offering insights that are not only practical but also empower you to take control of your spending. Dive in to discover how you can benefit from this knowledge!

Credit: spectrumlocalnews.com

JUMP TO TOPIC

Basics Of Sales Tax

The basics of sales tax can be confusing. Gardena, CA has specific rules. Understanding these is important for shoppers and businesses. Sales tax affects what you pay at checkout. It impacts how businesses price their products.

Understanding Sales Tax In Gardena, Ca

Sales tax in Gardena is a percentage of the purchase price. It is added to the cost of goods and services. Businesses collect this tax for the state. This tax helps fund public services and infrastructure.

Current Rate Of Sales Tax

The sales tax rate in Gardena is set by the state and local government. As of the latest update, it stands at a combined rate of 10.25%. This includes the state, county, and city taxes. The rate can change, so staying informed is essential.

Who Pays Sales Tax?

Consumers are responsible for paying sales tax. When you buy a product, the tax is added to your bill. Businesses collect this tax and send it to the state. Both online and physical stores are required to charge sales tax.

Exemptions From Sales Tax

Some items are exempt from sales tax in Gardena. Essentials like groceries and prescription medications are typically exempt. This helps reduce costs for necessary items. Always check if your purchase qualifies for exemption.

Businesses must comply with sales tax laws. They need to calculate, collect, and remit taxes accurately. Failure to do so can result in penalties. Understanding tax obligations is crucial for business success.

Credit: taxcloud.com

Current Sales Tax Rate In Gardena

Understanding sales tax is crucial for consumers and business owners. Gardena, a vibrant city in California, has its own set sales tax rate. Staying informed about the current rate helps in budgeting and financial planning.

The current sales tax rate in Gardena, CA, is 10.25%. This rate includes the state, county, and city sales tax. Knowing this rate helps shoppers calculate their total purchase cost.

Breakdown Of Sales Tax Components

The total sales tax of 10.25% includes several components. The state of California imposes a base tax rate. Los Angeles County adds its own percentage. Lastly, Gardena contributes a small portion. Each part adds up to the total.

Impact On Consumer Purchases

High sales tax can affect buying decisions. Consumers may choose to buy less. Businesses might see a change in sales volume. Understanding the rate helps in making informed decisions.

Why Sales Tax Rates Change

Sales tax rates can change over time. Local government decisions can cause these changes. Community development projects may need additional funds. This can lead to an increase in the tax rate.

How To Stay Updated

Staying informed about sales tax changes is important. Check local government websites for updates. They provide accurate and timely information. Keeping updated helps in financial planning.

Components Of Gardena’s Sales Tax

Understanding the components of Gardena’s sales tax can be quite enlightening. You might wonder what exactly makes up the total sales tax you pay on your purchases in Gardena, CA. The answer lies in the combination of state tax, local tax, and special district taxes.

State Tax Contribution

State tax is the backbone of sales tax in California, including Gardena. It is a fixed percentage set by the state government. This tax helps fund essential services such as education and transportation. Whether you’re buying a coffee or a new gadget, a portion of what you pay goes to the state.

Think about it next time you’re at a store. That small percentage is part of a larger pool contributing to statewide infrastructure. It’s a reminder that each purchase you make indirectly supports the community’s growth.

Local Tax Contribution

Local tax adds another layer to Gardena’s sales tax. This is determined by the city’s government and can vary from one city to another. Local taxes support city-specific needs like parks, public safety, and street repairs.

Have you ever driven through Gardena and noticed well-maintained roads? That’s your local tax contribution at work. Your everyday purchases play a role in keeping the city vibrant and efficient.

Special District Taxes

Special district taxes are unique to certain areas and fund specific projects. In Gardena, these might cover public transportation or environmental initiatives. They are designed to address local issues and improve quality of life.

Imagine riding a bus that’s part of a well-funded transit system. Your sales tax contribution helps make that possible. It’s fascinating how your spending choices can impact specialized local projects.

Have you ever considered how your daily purchases shape Gardena? Every dollar spent is a vote for the community’s priorities. It’s a concept worth pondering next time you shop. How do you feel knowing your money supports local development?

Credit: www.redfin.com

Impact On Consumers

Gardena, CA sales tax affects local consumers in various ways. Understanding this impact can help residents make informed decisions. The sales tax influences both the cost of goods and consumer spending habits. By exploring these aspects, we can gain better insight into its effects.

Effects On Pricing

Sales tax directly increases the final price of products. This means shoppers pay more at checkout. Higher prices can lead to tighter budgets for many families. Shoppers often need to adjust their purchasing priorities. Some might seek cheaper alternatives or wait for sales. Others could buy in bulk to save on frequent purchases.

Consumer Behavior

The sales tax can change how people shop. Many consumers might reduce spending due to increased costs. Some may choose to buy less or delay non-essential purchases. Others could explore online shopping to find tax-free options. Consumer loyalty might shift towards stores with better deals or lower taxes. These changes in behavior reflect efforts to manage personal finances effectively.

Impact On Businesses

Understanding the impact of Gardena CA sales tax on businesses is crucial. Businesses must navigate compliance requirements and maintain accurate records. These responsibilities ensure smooth operations and avoid legal issues. The sales tax affects profit margins, pricing strategies, and customer satisfaction. Business owners must stay informed about tax rates and regulations. This knowledge helps them make strategic decisions for their businesses.

Compliance Requirements

Businesses in Gardena must comply with specific sales tax regulations. They need to collect the correct sales tax from customers. Accurate calculations are essential to avoid penalties. Business owners should familiarize themselves with local tax laws. Being informed helps in maintaining compliance. Regular updates from tax authorities are important for staying compliant. Non-compliance can lead to fines and damage reputation.

Record-keeping Best Practices

Effective record-keeping is vital for businesses managing sales tax. Businesses should maintain detailed records of all transactions. This includes sales, tax collected, and exemptions. Organized records simplify tax filing and audits. Using digital tools can enhance accuracy and efficiency. Regular audits of records help identify discrepancies. Proper record-keeping supports compliance and financial planning.

Exemptions And Reductions

Gardena, CA, offers sales tax exemptions and reductions to lessen the tax burden. These exemptions aim to support local businesses and residents. Understanding these can save money on eligible purchases.

Qualifying Products And Services

Some items in Gardena are exempt from sales tax. These often include essential goods. Groceries, prescription medications, and certain medical devices are usually tax-free. Children’s clothing and educational materials may also qualify. Each category has specific guidelines. Review these to ensure eligibility.

Application Process

To claim an exemption, follow the application process closely. First, identify if your purchase qualifies. Then, gather necessary documentation. This may include receipts or proof of purchase. Submit these to the relevant tax authority. They will review your application and determine eligibility.

Some exemptions are automatic at the point of sale. Others require a formal application. Always check the latest guidelines. They can change over time. Staying informed ensures you maximize savings.

Future Changes To Sales Tax

Understanding potential changes in Gardena, CA sales tax is crucial. Both businesses and residents should stay informed about future tax developments. The city’s economy depends on sales tax, which funds essential services. Knowing possible adjustments helps everyone plan effectively. This section explores potential rate changes and legislative proposals.

Potential Rate Adjustments

Gardena’s sales tax rate may change in the future. Local authorities often review tax rates to meet budget needs. Inflation and economic conditions influence these decisions. Rate adjustments aim to balance public services and economic growth. Residents should monitor announcements from city officials. Information about rate changes impacts budgeting and spending habits.

Legislative Proposals

Lawmakers propose new tax laws to address fiscal challenges. These proposals affect local sales tax rates. Some seek to increase funds for infrastructure and services. Others aim to reduce the tax burden on consumers. Understanding these proposals helps residents engage in the legislative process. Public feedback influences decision-makers, shaping the city’s financial future.

Frequently Asked Questions

What Is The Sales Tax Rate In Gardena, Ca?

The sales tax rate in Gardena, CA is 10. 25%. This includes state, county, and city taxes. Rates can change, so it’s wise to check the latest information from official sources or local authorities.

How Does Gardena’s Sales Tax Compare To Nearby Areas?

Gardena’s sales tax is slightly higher than the California state average of 7. 25%. Nearby areas might have similar or slightly different rates. Always verify with local guidelines for the most accurate figures.

Are There Exemptions To Gardena Sales Tax?

Certain items, like groceries and prescription medications, are exempt from Gardena sales tax. This aligns with California’s general tax exemption policies. For a comprehensive list of exemptions, consult the California Department of Tax and Fee Administration.

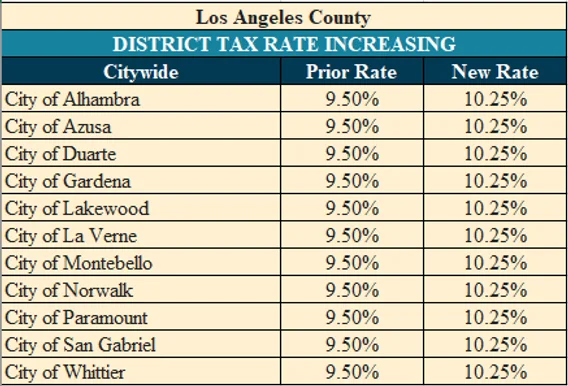

Does Gardena Have Additional District Taxes?

Yes, Gardena includes additional district taxes, contributing to the total 10. 25% rate. These district taxes fund local services and infrastructure improvements. Staying informed about these taxes can help in understanding overall costs.

Conclusion

Understanding sales tax in Gardena, CA is important for residents. It affects daily expenses and budgeting. Paying attention to tax rates can help manage finances better. Changes in tax can impact what you pay at stores. Local businesses also feel the effects of sales tax.

Keeping up with current rates ensures no surprises at checkout. This knowledge aids in smart shopping choices. Stay informed to make the best financial decisions. By knowing Gardena’s tax rates, you gain control over spending. Always check for updates to stay ahead.

Your wallet will thank you.