Finding the best auto insurance in Florida can feel overwhelming. You want reliable coverage that fits your budget and protects you on the road.

But with so many options, how do you choose the right one? This guide will help you cut through the noise and find the perfect policy tailored to your needs. By the end, you’ll know exactly what to look for, so you can drive with confidence and peace of mind.

Keep reading to discover how to get the most value and protection for your car insurance in Florida.

Credit: ccicins.wordpress.com

Florida Auto Insurance Market

Florida has a unique auto insurance market shaped by its climate and population. The state faces many claims due to weather events like hurricanes. High traffic in cities adds to the risk of accidents. These factors affect insurance prices and coverage options.

Insurance companies compete to offer the best rates and plans. Understanding the market helps drivers choose the right policy for their needs. The laws in Florida also set specific rules for car insurance.

Key Factors Influencing Rates

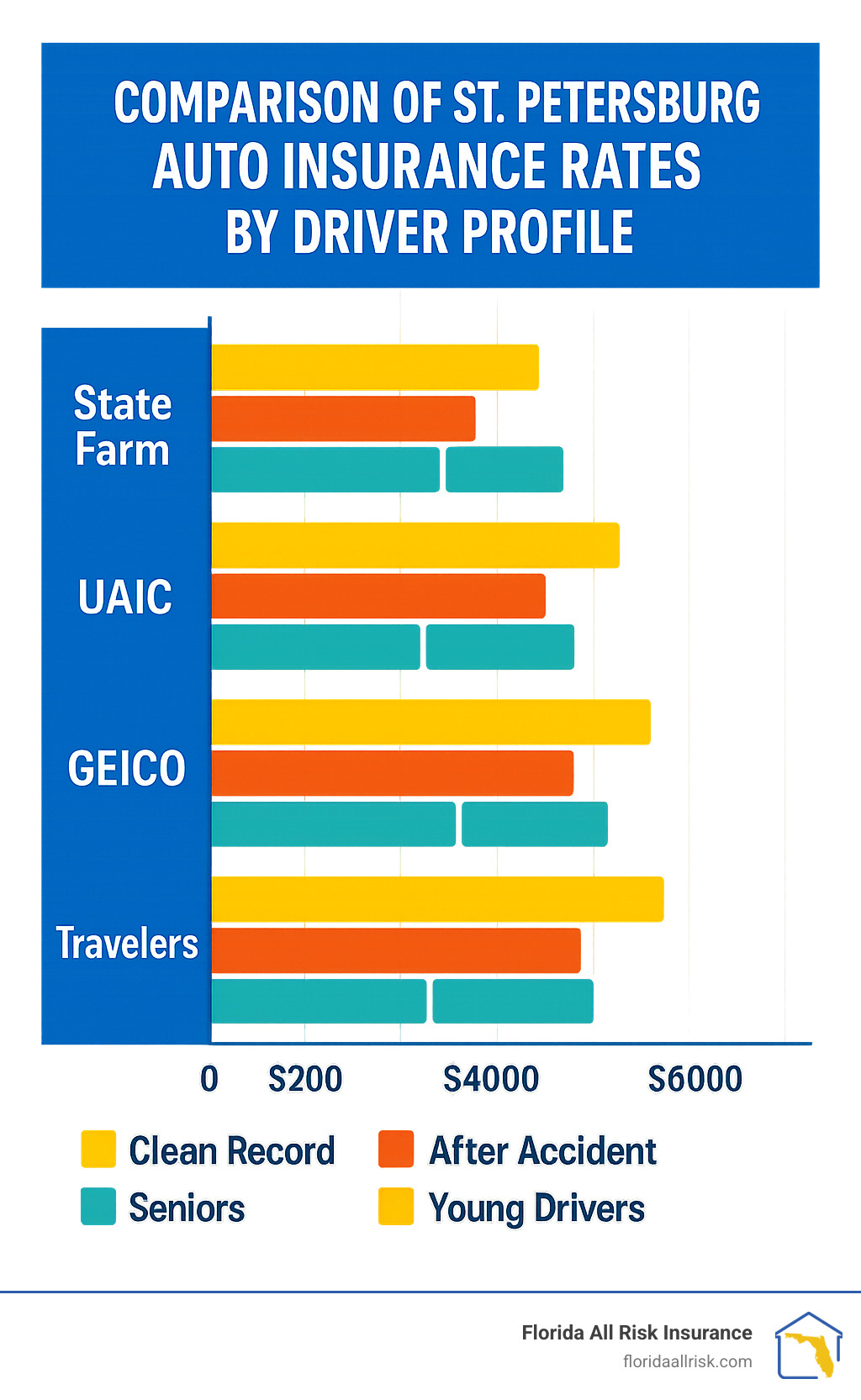

Several factors affect auto insurance rates in Florida. Age plays a big role; younger drivers pay more. Driving history matters too. More accidents or tickets mean higher costs. The car type also impacts the price. Expensive or fast cars cost more to insure.

Location is important. Urban areas usually have higher rates due to more accidents and theft. Credit scores influence rates as well. Insurance companies use them to predict risk. Finally, coverage level and deductibles change the premium.

Mandatory Coverage Requirements

Florida requires drivers to have specific minimum coverage. Personal Injury Protection (PIP) is mandatory. It covers medical costs after an accident. Property Damage Liability (PDL) is also required. It pays for damage to others’ property.

The state does not require Bodily Injury Liability coverage but recommends it. Drivers must carry proof of insurance at all times. Failure to have proper coverage can lead to fines and penalties.

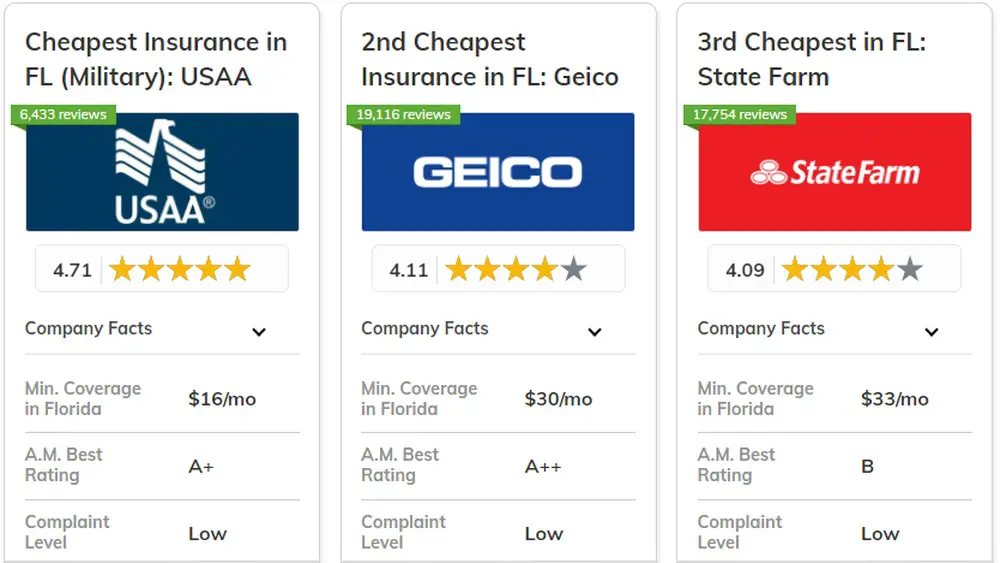

Popular Insurers In Florida

Many insurance companies operate in Florida. Some of the most popular include State Farm, GEICO, and Progressive. These companies offer competitive rates and good customer service. Local insurers also provide tailored policies for Florida drivers.

Choosing a well-known insurer helps ensure reliable claims support. Comparing quotes from several providers can save money. Look for companies that understand Florida’s unique risks and laws.

Credit: www.nasdaq.com

Affordable Auto Insurance Plans

Affordable auto insurance plans help many drivers in Florida protect their vehicles without spending too much. These plans offer good coverage options at prices that fit most budgets. Finding the right balance between cost and protection is key for smart car owners.

Top Budget-friendly Options

Several insurance companies in Florida offer low-cost plans. These plans cover basic needs like liability and property damage. Some providers focus on offering minimal coverage for drivers who want to save money. Others bundle services to reduce overall costs. Picking the right plan depends on your driving habits and how much coverage you need.

Comparison Of Coverage And Costs

Comparing plans side by side can save money. Look at the premiums, deductibles, and coverage limits. Some plans have lower monthly payments but higher deductibles. Others charge more monthly but cover more risks. Knowing what each plan includes helps avoid surprise expenses later. Use online tools to check multiple options quickly.

Discounts And Savings Opportunities

Many insurers offer discounts that lower your premium. Common discounts include safe driver, multi-car, and good student deals. Some companies reduce rates for paying annually or using automatic payments. Bundling home and auto insurance also cuts costs. Ask your provider about all available discounts to maximize savings.

Coverage Types To Consider

Choosing the right auto insurance means knowing the types of coverage available. Each type protects you in different ways. Some cover damages you cause to others. Others protect your car from damage or theft. Understanding these can help you pick the best policy for your needs.

Liability Coverage Essentials

Liability coverage pays for injuries and damage you cause to others. It is required by Florida law. This coverage helps with medical bills and repair costs for the other party. It does not cover your injuries or car damage.

Comprehensive And Collision

Comprehensive coverage protects against theft, vandalism, and natural disasters. Collision coverage pays for damage to your car after an accident. Both types cover your vehicle but do not pay for injuries. These coverages are optional but highly recommended for full protection.

Uninsured Motorist Protection

Uninsured motorist protection helps if another driver has no insurance. It covers your injuries and damages in such cases. This coverage is important in Florida due to many uninsured drivers. It gives peace of mind during unexpected accidents.

Credit: floridaallrisk.com

Tips For Lowering Premiums

Lowering your auto insurance premiums in Florida helps save money each month. Small changes can make a big difference. Understanding key tips can reduce your costs without losing coverage.

Safe Driving Habits

Drive carefully and follow all traffic rules. Avoid speeding tickets and accidents. Insurers reward drivers with fewer claims. Use seat belts and avoid distractions while driving. Maintain a clean driving record to get better rates.

Bundling Policies

Combine your auto insurance with other policies like home or renters insurance. Many companies offer discounts for bundling. This reduces overall premiums. Bundling also makes managing policies simpler and more convenient.

Credit Score Impact

Keep your credit score healthy. Insurers often use credit scores to set prices. Pay bills on time and reduce debt. A good credit score can lower your insurance costs. Check your credit report regularly for errors.

Claims Process And Customer Service

Understanding the claims process and customer service is key to choosing the best auto insurance in Florida. Clear, fast claims handling helps drivers feel secure. Good customer service supports clients through stressful times. This section explains how Florida insurers manage claims and treat their customers.

Filing A Claim In Florida

Filing a claim in Florida usually starts with a quick phone call or an online form. Insurers often provide 24/7 claim reporting. Many companies offer mobile apps to make this step easier. After the claim is reported, an adjuster reviews the case. They check damages and decide the payout. The goal is to resolve claims quickly, so drivers get help fast.

Customer Satisfaction Ratings

Customer satisfaction ratings show how well insurers serve their clients. Florida drivers often check these scores before buying insurance. Ratings come from surveys and reviews. Top companies score high in communication and claim handling. Low scores may indicate slow service or poor support. These ratings help pick reliable insurers with friendly service teams.

Handling Disputes Efficiently

Disputes can arise over claim amounts or coverage details. Efficient insurers address these issues quickly. They provide clear explanations and listen to customer concerns. Many companies offer mediation or arbitration to solve conflicts. Fast dispute resolution reduces stress and builds trust. Drivers appreciate insurers who respect their needs and act fairly.

Frequently Asked Questions

What Factors Affect Auto Insurance Rates In Florida?

Auto insurance rates in Florida depend on your driving record, vehicle type, location, age, and coverage level. Weather and traffic also influence premiums. Insurers consider these to assess risk and set prices tailored to each driver’s profile.

Which Companies Offer The Best Auto Insurance In Florida?

Top Florida auto insurers include State Farm, GEICO, Progressive, and Allstate. They provide competitive rates, excellent customer service, and diverse coverage options. Comparing quotes helps find the best fit for your needs and budget.

How Can I Lower My Florida Auto Insurance Premiums?

To reduce premiums, maintain a clean driving record, bundle policies, increase deductibles, and ask about discounts. Choosing a safer car and limiting coverage on older vehicles also help save money on insurance.

Is Florida A No-fault Auto Insurance State?

Yes, Florida has a no-fault system requiring Personal Injury Protection (PIP). PIP covers your medical expenses regardless of fault. This system aims to speed up claims and reduce litigation costs.

Conclusion

Choosing the right auto insurance in Florida saves money and stress. Compare plans carefully to find coverage that fits your needs. Consider price, benefits, and customer service before deciding. Good insurance protects you from unexpected costs on the road. Take time to review options and ask questions if unsure.

Protect your car and your peace of mind today. Stay safe and drive confidently with the best coverage available.