Finding the best auto insurance rates in Florida can feel like a maze. You want solid coverage without paying more than you have to.

But how do you know which company offers the best deal for your unique situation? This guide will help you cut through the confusion. You’ll discover key factors that affect your rates and learn simple steps to find affordable coverage tailored just for you.

Stick with us, and you’ll be on your way to saving money while protecting your ride in the Sunshine State.

Credit: www.insure.com

Top Insurers In Florida

Florida drivers have many options for auto insurance providers. Choosing the right insurer can lower your premium and improve your coverage. Some companies stand out for their affordable rates and special discounts. These top insurers offer reliable service and competitive prices that suit many Floridians.

Here are some of the leading auto insurance companies in Florida. They provide various benefits for different types of drivers and needs.

Geico’s Competitive Rates

GEICO is known for its low rates in Florida. Many drivers save money with GEICO’s policies. It offers easy online quotes and a wide range of coverage options. The company frequently ranks among the cheapest in the state. GEICO’s discounts for good drivers and vehicle safety help reduce costs further.

Progressive’s Discounts

Progressive offers many discounts to Florida drivers. They have special rates for safe drivers and multi-policy customers. Progressive’s Snapshot program rewards drivers who practice safe habits. The company also provides competitive rates for drivers with past incidents. Progressive’s flexible coverage options fit many budgets.

Usaa For Military Families

USAA serves military members, veterans, and their families. It offers some of the lowest rates for eligible customers. USAA’s customer service is highly rated, focusing on military needs. Members can access exclusive discounts and benefits. USAA coverage includes comprehensive protection tailored to military lifestyles.

Other Affordable Providers

Several other insurers offer affordable rates in Florida. Companies like State Farm and Allstate provide solid coverage with discounts. Local insurers may also have competitive prices and personalized service. Comparing multiple quotes helps find the best rate for your needs. Always check each provider’s discounts and coverage options before choosing.

Factors Impacting Your Premium

Understanding the factors that impact your auto insurance premium helps you make better choices. Insurance companies use many details to decide how much you pay. Some factors you can control, others you cannot. Knowing these elements guides you to find affordable rates in Florida.

Location Effects

Your address plays a big role in setting your premium. Urban areas usually have higher rates due to more traffic and theft risks. Rural areas often offer lower rates because of less congestion. Even within Florida, rates differ from city to city.

Driving Record Importance

A clean driving record lowers your insurance costs. Accidents, tickets, and claims raise premiums. Insurers see safe drivers as less risky. Keeping a good record saves money over time.

Age And Gender Influence

Younger drivers often pay more because they have less experience. Older drivers usually get discounts for safe driving history. Men under 25 tend to pay higher rates than women the same age. These differences come from statistical risk data.

Coverage Options

Choosing coverage affects your monthly premium. Liability-only coverage costs less but offers limited protection. Full coverage, including collision and comprehensive, costs more. Adjusting coverage levels changes your premium directly.

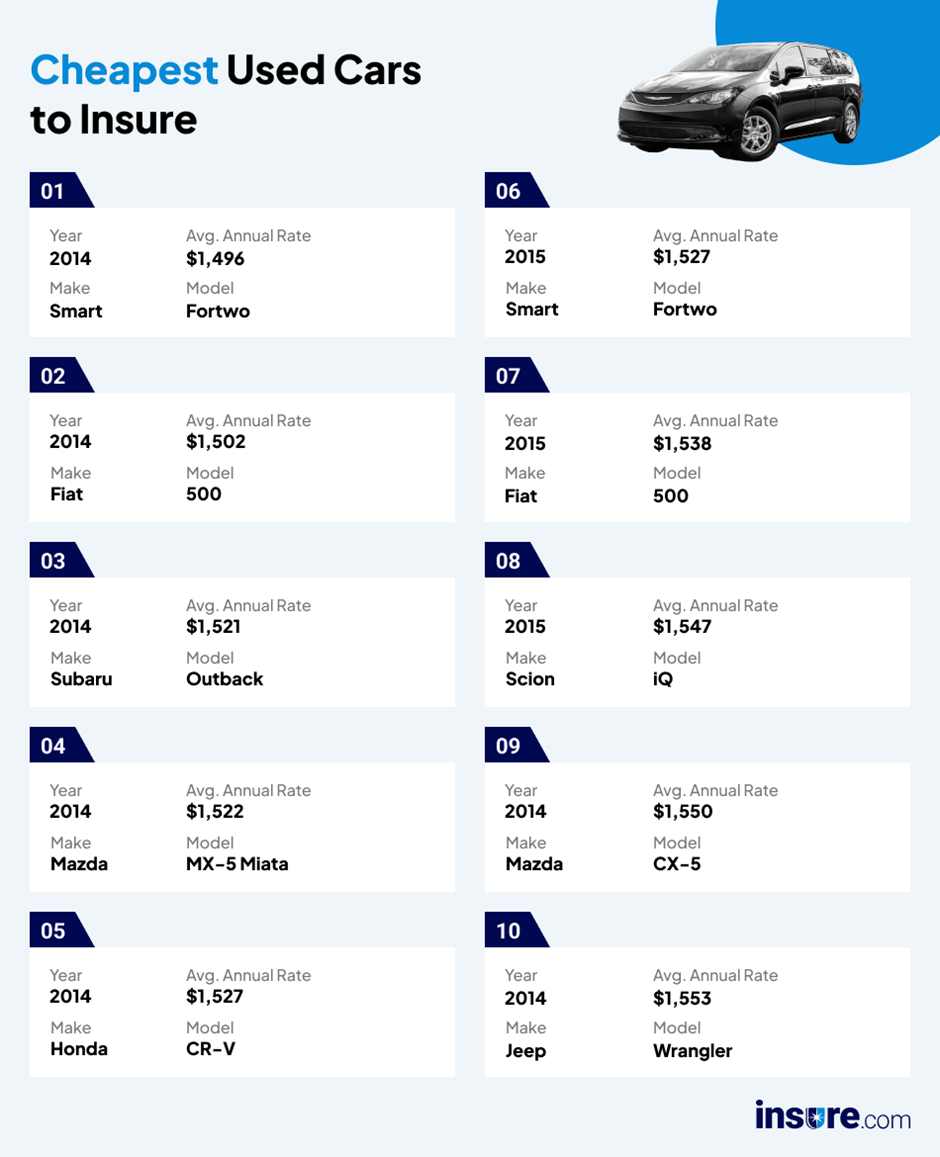

Vehicle Type Considerations

The kind of vehicle you drive impacts your insurance price. Sports cars and luxury vehicles cost more to insure. Older and less expensive cars often have lower premiums. Safety features and repair costs also influence rates.

Steps To Lower Your Rates

Lowering your auto insurance rates in Florida is possible with a smart approach. Small steps can add up to big savings. Understanding how to navigate insurance options helps you pay less without losing coverage. Follow these simple steps to reduce your premiums effectively.

Get Personalized Quotes

Start by getting personalized quotes from several insurers. Use online tools or call companies directly. Tailored quotes match your driving record, location, and vehicle. This ensures you see rates that fit your profile, not just averages. Personalized quotes help avoid overpaying for coverage you do not need.

Compare Multiple Insurers

Do not settle for the first quote you receive. Compare rates from multiple companies. Different insurers offer different prices for similar coverage. Comparing helps find the best deal and prevents missing out on cheaper options. Keep track of each quote to make a clear comparison.

Choose Right Coverage

Select coverage that matches your actual needs. Full coverage is not always necessary and costs more. Liability-only coverage costs less but offers less protection. Adjust your coverage limits and deductibles to balance cost and protection. Right coverage saves money without risking your financial security.

Ask About Discounts

Many insurers offer discounts that lower your premium. Ask about discounts for safe driving, bundling policies, or having security devices. Some discounts apply for good student status or military service. Always inquire about all possible discounts to reduce your rates further.

Common Discounts To Explore

Finding the best auto insurance rates in Florida often means exploring available discounts. Insurance companies offer many ways to lower your premium. Understanding common discounts helps you save money and get better coverage.

Many discounts depend on your lifestyle, driving habits, and vehicle type. Knowing these can make a big difference in your yearly cost. Here are some common discounts worth checking out.

Multi-policy Savings

Bundling your auto insurance with other policies often cuts costs. Many insurers offer discounts if you combine auto with home or renters insurance. This saves money by reducing overall risk for the company. It also simplifies bill payments and renewals.

Safe Driver Discounts

Drivers with clean records usually pay less. Insurance companies reward those who avoid accidents and traffic tickets. Some providers also offer discounts for completing defensive driving courses. Being a safe driver shows responsibility and lowers claims risk.

Good Student Offers

Students with good grades can get special discounts. Many insurers offer lower rates for young drivers who maintain a certain GPA. This encourages safe driving and academic achievement. Parents should ask about these savings for their children.

Vehicle Safety Features

Cars with safety devices often qualify for discounts. Features like anti-lock brakes, airbags, and alarms reduce accident risk. Insurers recognize these improvements and lower premiums accordingly. Upgrading your vehicle’s safety can lead to savings.

Tools For Rate Comparison

Finding the best auto insurance rates in Florida requires comparing offers from different providers. Several tools make this task easier and faster. These tools help you see many rates side by side. They save time and give a clear picture of your options. Use these tools to make a smart choice for your coverage and budget.

Online Quote Platforms

Online quote platforms let you compare rates from multiple insurers. Enter basic information once to get several quotes. These platforms often show detailed coverage options. They help identify the cheapest and most suitable plans quickly. Many sites update rates regularly to reflect market changes. This keeps your information current and reliable.

Insurance Agent Assistance

Insurance agents provide personalized help with rate comparison. They understand state rules and company policies well. Agents explain coverage details in simple terms. They can offer advice based on your driving habits and needs. Agents also know about discounts you may qualify for. Talking to an agent often uncovers better deals than online searches.

Mobile Apps For Insurance

Mobile apps make rate comparison easy on your phone. Use apps from trusted insurance companies or third-party services. Apps often include tools to save favorite quotes and update personal info. Push notifications alert you to new discounts and policy changes. You can compare rates anytime, anywhere, without a computer.

Credit: www.moneygeek.com

Understanding Florida Insurance Laws

Understanding Florida insurance laws helps drivers find the best auto insurance rates. These laws set rules that every driver must follow. They also affect the kind of coverage you need and how much you pay. Knowing these laws can save money and avoid legal problems.

Minimum Coverage Requirements

Florida requires drivers to have certain minimum auto insurance coverage. You must carry personal injury protection (PIP) and property damage liability (PDL). PIP covers your medical expenses and lost wages after an accident. PDL pays for damage you cause to others’ property. These are the least coverages allowed by law.

Many drivers choose to buy extra coverage beyond the minimum. This helps protect against bigger losses. Understanding the minimum helps you see what is required and what is optional.

No-fault Insurance System

Florida uses a no-fault insurance system. This means your insurance pays for your injuries no matter who caused the accident. It speeds up claims and reduces lawsuits. PIP coverage is key in this system.

Because of no-fault laws, drivers must file claims with their own insurer first. Laws limit the right to sue except for serious injuries. This system affects how insurance works in Florida.

Impact On Premium Costs

Florida’s insurance laws influence your premium costs. Minimum coverage keeps prices lower but may not cover everything. No-fault rules can increase premiums because PIP coverage must be included.

Insurance companies also consider risk factors like driving history and location. Knowing laws helps you choose the right coverage and find affordable rates. Smart choices lead to better savings on auto insurance.

Credit: www.moneygeek.com

Frequently Asked Questions

Who Has The Most Affordable Auto Insurance In Florida?

GEICO and Progressive often offer the most affordable auto insurance rates in Florida. USAA provides low rates for eligible military members. Rates vary by location, driving history, and coverage. Get personalized quotes from multiple insurers to find the best deal for you.

Who Has The Best Auto Insurance Rates Right Now?

GEICO and Progressive offer some of the lowest auto insurance rates nationally. USAA provides top rates for eligible military members. Rates vary by location, driving history, and coverage. Obtain personalized quotes from multiple insurers to find the best rate for your needs.

Why Is Florida Auto Insurance So High?

Florida auto insurance is high due to frequent accidents, fraud, expensive medical claims, and no-fault laws. Dense traffic and weather risks also raise premiums.

How To Get Lower Car Insurance In Fl?

Compare quotes from multiple Florida insurers like GEICO, Progressive, and USAA. Maintain a clean driving record and good credit. Choose appropriate coverage and ask about discounts for bundling or safe driving to lower car insurance costs.

Conclusion

Finding the best auto insurance rates in Florida takes time and research. Start by comparing quotes from multiple companies. Focus on your personal driving history and coverage needs. Remember, rates change based on location and vehicle type. Always ask about discounts you may qualify for.

Choosing wisely helps protect your car and wallet. Stay informed and shop around regularly to get the best deal.