Finding the best car insurance in Florida as a young adult can feel overwhelming. You want coverage that protects you without draining your budget.

But with so many options out there, how do you choose the right one? This guide breaks down the top insurance companies that offer affordable rates, great coverage, and perks tailored just for you. By the end, you’ll know exactly where to look to save money and get peace of mind on the road.

Keep reading to discover how to get the best deal and protect your ride without the stress.

Top Insurers For Young Adults

Choosing the right car insurance is crucial for young adults in Florida. The best insurers balance cost, coverage, and service. Several companies stand out for their strong offerings tailored to younger drivers. These insurers provide affordable rates, useful discounts, and customer-friendly policies. Here are some of the top choices for young adults in Florida.

Geico’s Affordability And Discounts

GEICO is popular for low rates and many discounts. Young drivers can save with good student discounts. GEICO also offers discounts for safe driving. Their policies fit well with young adults’ budgets. The online tools make managing insurance simple and quick.

Travelers’ Coverage Options

Travelers provides flexible coverage that suits different needs. They offer options like accident forgiveness and rideshare coverage. This helps young drivers protect themselves better. Travelers lets you customize your policy to fit your lifestyle. Their customer service is responsive and helpful.

State Farm’s Customer Satisfaction

State Farm is known for high customer satisfaction. Young drivers benefit from personalized service and guidance. Their agents help explain coverage and claims clearly. State Farm’s strong local presence means support is nearby. They also offer discounts for good grades and safe driving.

Progressive’s Tech Features

Progressive uses technology to improve user experience. Their app tracks driving habits to offer better rates. Young drivers can use the Snapshot program to earn discounts. Progressive makes quotes and claims easy with digital tools. This tech focus appeals to younger, tech-savvy customers.

Usaa For Military Families

USAA specializes in serving military families and veterans. They offer competitive rates and excellent customer service. Young adults in military families find tailored coverage options. USAA provides added benefits like roadside assistance and financial advice. Their reputation for care and reliability is strong.

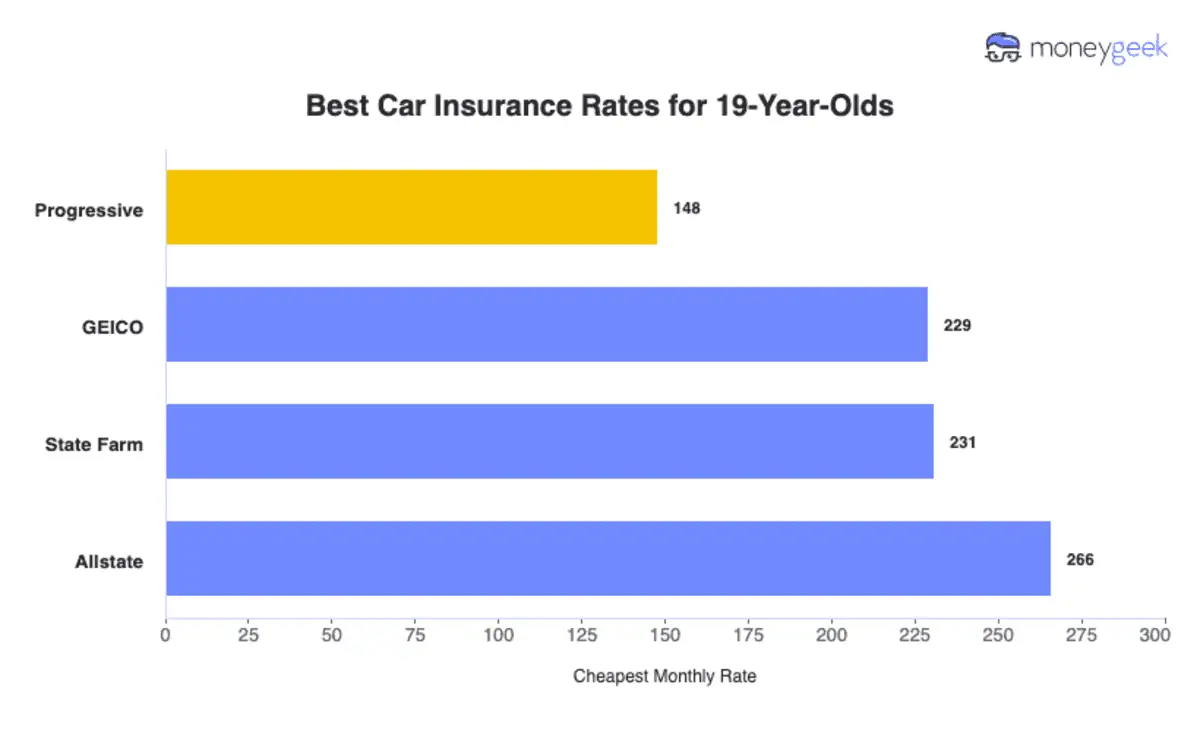

Credit: www.moneygeek.com

Factors Affecting Premiums

Car insurance premiums vary widely for young adults in Florida. Insurers calculate rates using several key factors. Understanding these factors helps find affordable coverage. Each factor reflects the risk the insurer takes by offering a policy. Knowing what affects your premium can guide better decisions.

Age And Driving Experience

Young drivers usually pay higher premiums. Insurance companies see them as higher risk. Lack of driving experience increases accident chances. Rates tend to drop as drivers gain experience. Even a few years of safe driving lowers costs.

Credit History Impact

Insurers often check credit history to predict risk. A poor credit score can raise premiums. Good credit shows responsible behavior, leading to lower rates. Maintaining a healthy credit score benefits insurance costs.

Location Within Florida

Where you live in Florida matters for premiums. Urban areas usually have higher rates than rural ones. More traffic means more accident and theft risk. Coastal regions may face additional risks like hurricanes. Insurers factor these local risks into pricing.

Vehicle Type And Usage

The kind of car affects insurance costs. Sports cars and luxury vehicles usually cost more to insure. Older or safer cars may get discounts. How often and why you drive also matters. High mileage or using a car for work raises premiums.

Ways To Save On Car Insurance

Saving money on car insurance is important for young adults in Florida. Insurance costs can be high for new drivers. Many insurance companies offer discounts and programs to lower rates. Knowing these options helps reduce expenses without losing coverage. Here are some effective ways young adults can save on car insurance.

Good Student Discounts

Many insurers reward students with good grades. A high GPA shows responsibility and focus. This can lead to lower insurance premiums. Typically, a 3.0 GPA or higher qualifies. Maintaining good grades helps keep the discount active.

Defensive Driving Courses

Taking a defensive driving course shows safe driving habits. Insurance companies often offer discounts after completing these courses. The classes teach skills to avoid accidents. This lowers the risk for insurers, resulting in cheaper rates.

Bundling Policies

Bundling means buying more than one insurance policy from the same company. For example, combining car and renters insurance. This often results in a discount on both policies. Bundling saves money and simplifies bill payments.

Telematics And Safe Driving Apps

Using telematics devices or apps tracks driving behavior. Good driving habits like smooth braking and slow speeds earn discounts. Insurers reward safe drivers with lower premiums. Many apps are easy to install and use.

Credit: www.quote.com

Policy Types For Young Drivers

Choosing the right policy type is key for young drivers in Florida. Insurance needs vary for new drivers starting on the road. Understanding available policy types helps find the best coverage. Young adults often decide between individual plans and family plans. Special features like accident forgiveness and usage-based plans add value and savings.

Individual Versus Family Plans

Individual plans cover just one driver and their car. These plans give young adults full control of their policy. Family plans cover multiple drivers under one policy. They often cost less per person than separate individual plans. Families can bundle cars and drivers to save money. Family plans may offer more flexible coverage options.

Accident Forgiveness Options

Accident forgiveness protects drivers from rate hikes after their first accident. Many insurers offer this feature for young drivers. It keeps insurance costs stable even after minor crashes. Accident forgiveness encourages safer driving habits. Not all companies provide this option, so check carefully.

Usage-based Insurance Plans

Usage-based plans charge premiums based on actual driving behavior. Insurers use devices or apps to track miles and driving style. Safe driving can lower monthly payments. These plans benefit young adults who drive less or carefully. Usage-based insurance promotes responsibility and can cut costs.

Comparing Quotes Effectively

Comparing car insurance quotes helps young adults in Florida find the best deal. This process goes beyond just looking at prices. Understanding coverage, service quality, and claims handling is essential. These factors ensure you get value and protection for your money. Taking time to compare quotes carefully leads to smarter decisions and better savings.

What Coverage To Prioritize

Focus on coverage that meets Florida’s legal requirements first. Liability insurance protects others if you cause an accident. Consider adding collision and comprehensive coverage to protect your car. Uninsured motorist coverage is important in Florida due to many uninsured drivers. Medical payments coverage helps with medical bills after an accident. Prioritize coverage that fits your needs and budget without gaps.

Evaluating Customer Service

Customer service affects your experience with the insurer. Check reviews and ratings to see how companies treat customers. Look for quick response times and helpful representatives. Friendly service makes handling questions or problems easier. Good communication builds trust and reduces stress during claims or changes.

Checking Claims Handling

Claims handling shows how well insurers support you after an accident. Fast and fair claims processing matters most. Research how long claims usually take to settle with each company. See if they offer easy online claim filing and tracking. Positive claims experiences mean less hassle and quicker repairs or payouts.

Credit: www.bankrate.com

Frequently Asked Questions

What Is The Cheapest Insurance For Young Drivers In Florida?

GEICO often offers the cheapest insurance for young drivers in Florida with competitive rates and discounts. Travelers and State Farm also provide affordable options. USAA is best for military families seeking low premiums. Comparing quotes ensures the best deal tailored to your needs.

Who Is The Best Auto Insurance Company In Florida?

GEICO ranks best overall for Florida drivers due to affordability and discounts. Travelers offers great coverage options. State Farm excels in customer service. Progressive suits tech-savvy drivers. USAA provides competitive rates for military families. Choose based on your needs and compare quotes for the best deal.

What Is The Best Auto Insurance For Young Adults?

The best auto insurance for young adults balances affordability, coverage, and customer service. Top providers include GEICO, Travelers, State Farm, Progressive, and USAA. GEICO offers competitive rates, Travelers provides flexible plans, State Farm excels in satisfaction, Progressive suits tech-savvy drivers, and USAA benefits military families.

Is Geico Or Progressive Cheaper For Young Drivers?

Geico usually offers cheaper rates for young drivers than Progressive. Rates vary by location and driving history. Compare quotes for the best deal.

Conclusion

Choosing the right car insurance in Florida can save young adults money and stress. Affordable rates and good coverage protect you on the road. Companies like GEICO, Travelers, and State Farm offer solid options. Compare plans carefully to find what fits your needs best.

Remember, good insurance means peace of mind while driving. Take time to review each policy before deciding. Your safety and budget both deserve careful attention.