Looking for the best car insurance rates in Florida? You’re not alone.

Finding affordable coverage that fits your needs can feel overwhelming with so many options out there. But what if you could cut through the noise and discover the smartest way to save money on your policy? This guide will help you understand exactly what affects your rates and how to find the best deals tailored just for you.

Keep reading to take control of your insurance costs and drive with confidence knowing you’ve got the right coverage at the right price.

Florida Car Insurance Landscape

Florida’s car insurance market is unique and often costly. High traffic density and weather risks impact rates. The state also has specific rules that drivers must follow. Understanding these rules helps drivers find the best insurance deals. It also helps to know what coverage options are common in Florida.

Insurance companies compete to offer plans suited to Florida drivers. Prices vary based on many factors like location and driving history. Knowing the basics of Florida’s insurance landscape is the first step to saving money on car insurance.

State Insurance Requirements

Florida requires drivers to have minimum car insurance. Every driver must carry Personal Injury Protection (PIP) and Property Damage Liability (PDL). PIP covers medical costs after an accident, regardless of fault. PDL covers damage you cause to other people’s property.

Minimum coverage limits are $10,000 for PIP and $10,000 for PDL. Drivers can choose to buy extra coverage to protect themselves better. Florida’s no-fault system means claims go through your own insurer first. This affects how insurance companies price their policies.

Common Coverage Options

Besides the required coverage, many drivers add other types. Collision coverage pays for damage to your car from crashes. Comprehensive coverage protects against theft, vandalism, and natural disasters. Uninsured motorist coverage is important in Florida due to many uninsured drivers.

Some drivers also choose medical payments coverage. It helps with medical bills not covered by PIP. Choosing the right coverage depends on your budget and risk level. Many insurers offer bundle discounts for multiple coverages.

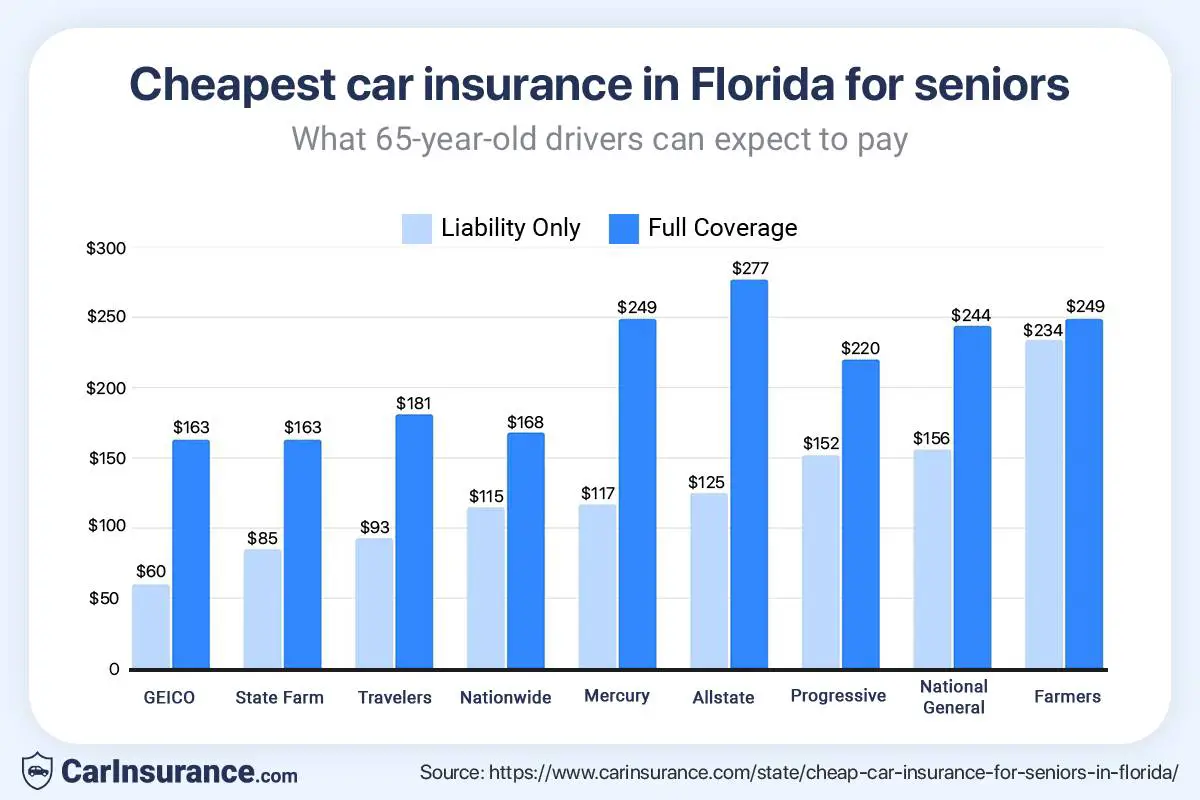

Credit: www.carinsurance.com

Top Providers In Florida

Florida offers a wide range of car insurance providers. Each company has unique benefits and pricing. Choosing the right provider helps save money and ensures good coverage. Here are some top car insurance companies popular in Florida.

Geico

GEICO is known for affordable rates and easy online services. It offers discounts for good drivers and military members. Many Florida drivers choose GEICO for its reliable coverage and quick claims process.

Progressive

Progressive provides competitive rates with flexible coverage options. It uses technology to offer personalized pricing. Drivers with past incidents may find good deals with Progressive. The company also has a user-friendly app for managing policies.

State Farm

State Farm is a large insurer with many local agents in Florida. It is praised for excellent customer service and claim support. State Farm offers various discounts, including for safe driving and multiple policies.

Travelers

Travelers offers strong coverage options tailored to Florida drivers. It provides discounts for bundling home and auto insurance. Many customers appreciate Travelers’ fast claim handling and clear policy terms.

Usaa

USAA serves military members, veterans, and their families. It offers some of the lowest rates available for eligible customers. USAA is known for outstanding customer care and comprehensive coverage options.

Factors Impacting Rates

Car insurance rates in Florida vary widely. Several factors influence these costs. Knowing these helps you find the best rates. Insurers use different criteria to set prices. Understanding these can guide your insurance choices.

Location And Zip Code

Where you live affects your insurance rates. Urban areas often have higher rates due to more accidents and thefts. Some zip codes face higher risks from weather or traffic. Insurers analyze local data to set prices. Rural areas may have lower rates but watch for unique risks.

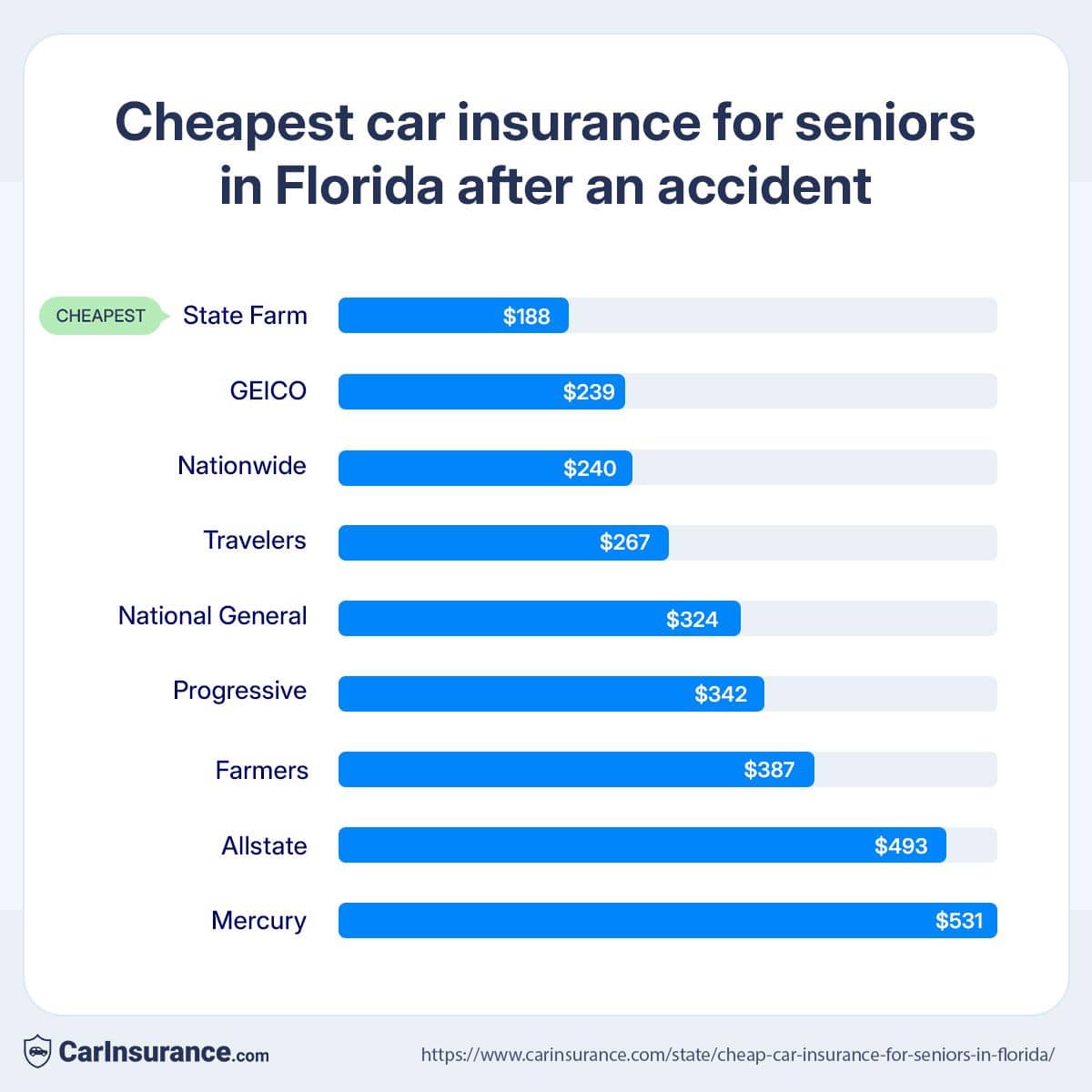

Driving History And Record

Your driving record impacts your premium heavily. Clean records with no accidents get lower rates. Tickets and claims raise your costs. Insurers see past behavior as a risk measure. Safe drivers pay less. Risky drivers face higher premiums.

Age And Gender

Your age and gender influence your insurance costs. Young drivers usually pay more due to inexperience. Older drivers often get discounts for safe driving. Men under 25 may pay higher rates than women. Insurers use statistics to predict risk by age and gender.

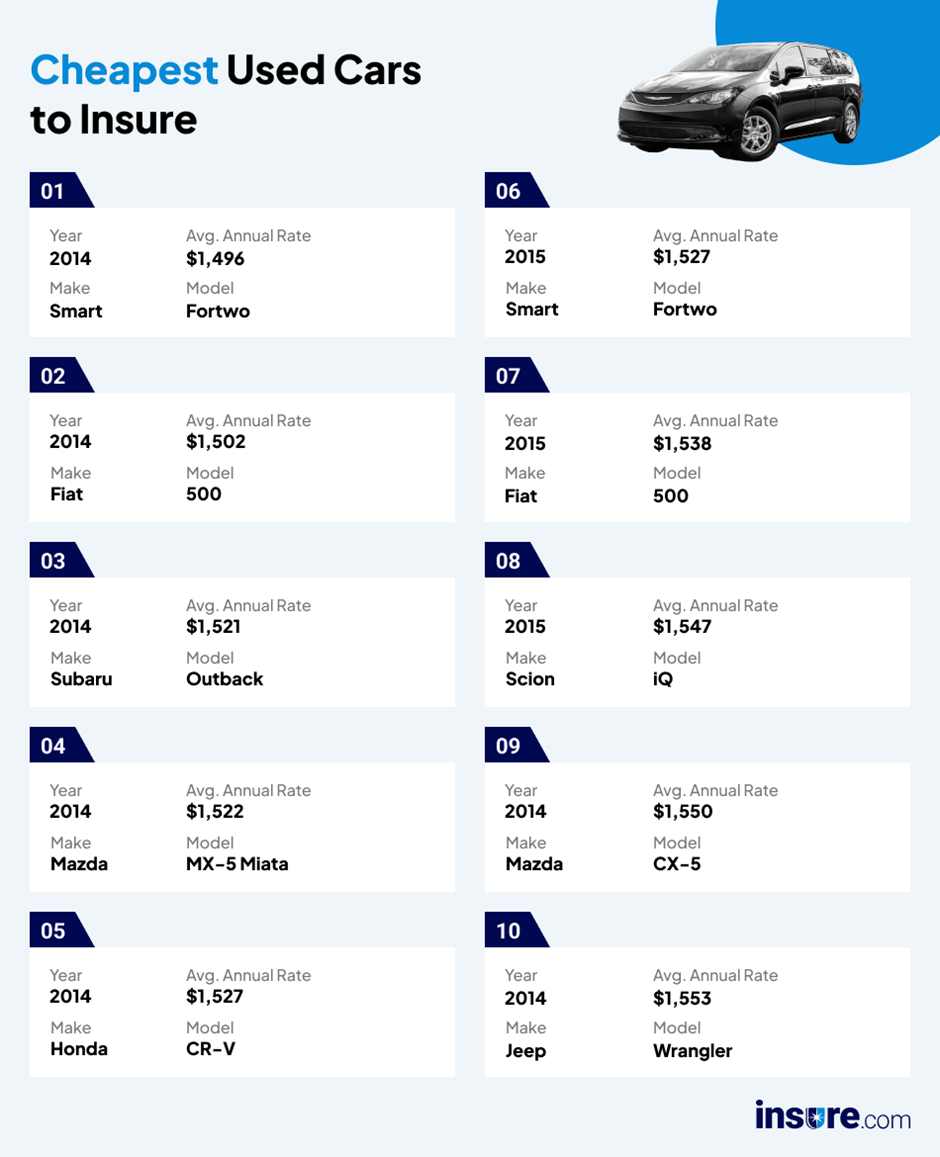

Vehicle Type And Usage

The car you drive matters. Expensive or sports cars cost more to insure. Older cars may have lower premiums but less coverage. How often and where you drive affects rates. High mileage or city driving increase risk and costs. Insurers consider repair costs and theft rates.

Coverage Levels

The amount of coverage you choose impacts your premium. Basic liability coverage is cheaper but offers less protection. Full coverage with collision and comprehensive costs more. Higher deductibles lower your premium but increase out-of-pocket costs. Choose coverage that fits your needs and budget.

Credit: www.insure.com

How To Secure Low Rates

Securing low car insurance rates in Florida requires smart planning and simple steps. Small efforts can lead to big savings on your premium. Understanding how insurers calculate rates helps you make better choices. Focus on what you can control to reduce costs. Follow these tips to find affordable coverage without sacrificing protection.

Getting Personalized Quotes

Start by requesting personalized quotes from different companies. Provide accurate details about your car and driving history. Personalized quotes reflect your unique risk profile. Avoid generic estimates that may not match your situation. Use online tools to get quick and tailored price offers. Personalized quotes help identify the best rate for your needs.

Comparing Multiple Insurers

Compare quotes from several insurance providers before deciding. Prices vary widely between companies for the same coverage. Look beyond the price; check company reputation and customer service. Comparing helps spot hidden fees or better benefits. Use comparison websites to save time and effort. This step ensures you pay the lowest possible rate.

Utilizing Discounts And Bundles

Ask about discounts you qualify for, such as safe driver or good student. Many insurers offer savings for bundling car and home insurance. Bundles often reduce overall costs and simplify payments. Check for discounts related to vehicle safety features or low mileage. Utilizing discounts can significantly cut down your premium. Always inquire to maximize your savings.

Choosing Appropriate Coverage

Select coverage that matches your actual needs and budget. Avoid paying for unnecessary add-ons or overly broad policies. Liability coverage costs less but may not cover all damages. Full coverage protects your car but costs more. Adjust your deductible to balance premium and out-of-pocket costs. Choosing the right coverage reduces your premium without risking protection.

Discounts And Savings Tips

Saving money on car insurance is possible with the right discounts. Many Florida insurers offer various discounts to help lower your premium. Knowing these options can make a big difference in your final rate.

Good Driver Discounts

Drivers with a clean record often qualify for good driver discounts. Insurance companies reward safe driving habits. Avoiding accidents and tickets can reduce your premium. Maintaining a good driving history pays off over time.

Multi-policy Discounts

Bundling your car insurance with other policies saves money. Combining home, renters, or life insurance with auto coverage may lower costs. This discount encourages customers to keep all insurance needs with one company. It simplifies payments and cuts expenses.

Military And Veteran Discounts

Florida insurers offer special discounts for military members and veterans. Many companies recognize service by lowering premiums. These savings apply to active-duty personnel and veterans alike. Verifying eligibility is easy and worth the effort.

Safety Features And Low Mileage

Cars with safety devices qualify for discounts. Features like airbags, anti-lock brakes, and alarms help reduce premiums. Driving fewer miles each year also lowers your rate. Insurers see less driving as less risk. Tracking mileage can lead to ongoing savings.

Credit: www.moneygeek.com

Common Mistakes To Avoid

Finding the best car insurance rates in Florida is important. Avoiding common mistakes can save money and stress. Many drivers make errors that increase costs or reduce coverage. Learn which mistakes to avoid for a better insurance experience.

Settling For First Quote

Many accept the first insurance quote they get. This can lead to paying too much. Quotes vary by company and coverage. Always compare multiple offers before deciding. Comparing helps find better deals and coverage options.

Ignoring Coverage Needs

Choosing too little coverage risks big expenses after accidents. Some drivers pick the cheapest plan without checking what it covers. Make sure your policy fits your car, driving habits, and risks. Proper coverage protects you and your finances.

Overlooking Discounts

Insurance companies offer discounts but many miss them. Discounts lower your premium but require asking or qualifying. Common discounts include safe driving, good grades, and multiple policies. Check which discounts apply to you and claim them.

Neglecting Policy Reviews

Car and life changes affect insurance needs. Many keep the same policy for years without review. Review your policy annually or after major changes. Updating your policy keeps coverage relevant and can reduce costs.

Tools And Resources

Finding the best car insurance rates in Florida requires using the right tools and resources. These help you compare prices and coverage easily. Access to reliable information makes your decision simpler and faster.

Below are some key tools and resources to guide you toward affordable insurance options in Florida.

Online Comparison Platforms

Online comparison sites show quotes from many insurers at once. They save time and effort by listing options side by side. You can filter results by price, coverage, and company ratings. These platforms update rates often to reflect current market conditions.

Using comparison tools lets you spot the best deals quickly. Many sites also offer customer reviews and expert advice. This helps you understand what each policy covers before buying.

Insurance Company Websites

Visiting insurer websites provides detailed information on policies and discounts. Many companies offer online quote tools that give personalized rates. You can customize coverage levels and add-ons based on your needs.

Some insurers have special offers or bundling discounts only available on their sites. Direct contact through their websites also helps clarify any questions. This ensures you get accurate and updated pricing.

State Insurance Department Resources

The Florida Department of Financial Services offers official information on car insurance rules. Their website provides guides, complaint records, and safety tips. It also lists licensed insurance companies in Florida.

These resources help verify company reputations and legal compliance. You can learn about Florida’s minimum coverage requirements and how to file claims or disputes. This protects you from fraud and unfair practices.

Frequently Asked Questions

Who Has The Lowest Auto Insurance Rates In Florida?

GEICO and Progressive often offer the lowest auto insurance rates in Florida. USAA provides the cheapest rates for eligible military members. Rates vary by location, driving history, and coverage needs. Always compare multiple quotes to find the best rate for your profile.

Which Car Insurance Company Is Best In Florida?

GEICO offers the best overall rates in Florida. Progressive suits tech-savvy drivers. State Farm excels in customer service. Travelers provides broad coverage options. Compare quotes from these top insurers to find the best fit for your needs.

Who Has The Best Auto Insurance Rates Right Now?

GEICO and Progressive often offer some of the lowest auto insurance rates nationwide. USAA provides competitive rates for military members. Rates vary by location, driving history, and coverage needs. Compare personalized quotes from multiple insurers to find the best rate for you.

How Much Should Car Insurance Cost Per Month In Florida?

Car insurance in Florida typically costs between $100 and $200 per month. Rates vary by location, driver history, coverage, and vehicle type. Comparing quotes from providers like GEICO, Progressive, and USAA helps find the best rate for your needs.

Conclusion

Finding the best car insurance rates in Florida takes some effort. Compare quotes from several companies to see your options. Consider your driving history, age, and coverage needs carefully. Discounts can help lower your costs significantly. Choosing the right policy protects you and saves money.

Keep checking rates yearly to find the best deal. Smart decisions lead to affordable and reliable coverage. Stay informed and drive safely to enjoy peace of mind.