Looking for the best cheap Florida car insurance can feel overwhelming. You want to protect your vehicle without breaking the bank, but rates can vary a lot depending on your age, driving history, and coverage needs.

What if you could find a policy that fits your budget and gives you peace of mind on the road? You’ll discover which companies consistently offer low rates in Florida, how to compare quotes effectively, and tips to tailor your coverage for the best price.

Keep reading to find the smart, affordable car insurance option that’s just right for you.

Top Affordable Florida Insurers

Finding affordable car insurance in Florida is possible with the right insurer. Each company offers unique benefits for different groups of drivers. Rates vary based on age, driving record, and coverage needs.

This section highlights some top insurers known for low rates and good service in Florida. Learn which companies fit your profile and budget.

Travelers For Seniors

Travelers is popular among senior drivers in Florida. They offer discounts that lower premiums for older adults. Their policies include options tailored to senior needs. This makes coverage affordable and easy to understand.

State Farm For Young Drivers

State Farm works well for young drivers. They provide competitive rates and rewards for good driving habits. The company offers tools to help new drivers improve safely. State Farm’s coverage plans suit students and first-time drivers.

Geico’s Liability Options

GEICO offers some of the cheapest liability-only insurance in Florida. Their plans cover legal costs if you cause an accident. GEICO’s online tools help customers get quick quotes. This makes it simple to find a budget-friendly policy.

Usaa Membership Benefits

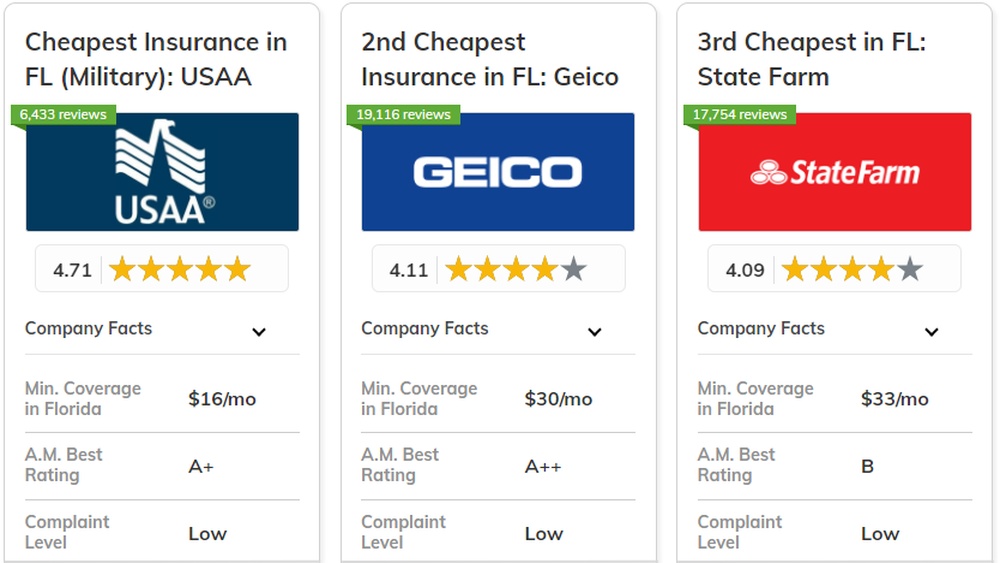

USAA serves military members and their families. They provide low rates on liability coverage and more. USAA’s customer service is highly rated. Membership gives access to discounts and special offers.

American National For Young Drivers

American National offers affordable full coverage for young drivers. Their policies often come with discounts for good grades and safe driving. This insurer is known for flexible payment options. Young drivers can find value and protection here.

Credit: www.nasdaq.com

Factors Affecting Florida Rates

Car insurance rates in Florida change based on many factors. Understanding these can help drivers find affordable coverage. Insurers assess risk by looking at personal and regional details. Each factor plays a role in the final price. Here are key elements that affect Florida car insurance rates.

Age And Driving History

Age strongly influences car insurance costs. Young drivers pay more due to higher risk. Older, experienced drivers often get lower rates. Driving history matters too. Tickets, accidents, or claims increase premiums. Clean records lead to cheaper insurance offers.

Coverage Types And Costs

Choosing coverage types impacts the price. Liability-only policies cost less than full coverage. Adding collision or comprehensive coverage raises rates. Higher coverage limits increase premiums as well. Deductible amounts also affect costs—higher deductibles mean lower rates.

Location And Vehicle Impact

Where you live in Florida affects your insurance rates. Urban areas with more traffic usually have higher premiums. Rural areas often have lower rates due to less risk. The type of vehicle matters too. Expensive or sports cars cost more to insure. Safety features and repair costs influence prices as well.

Demographic Influence On Pricing

Demographics such as gender and marital status can affect rates. Statistically, some groups show different risk levels. Married drivers often receive discounts. Gender may impact rates depending on age group. Insurers use these statistics to set fair prices.

Tips To Find Cheap Policies

Finding cheap car insurance in Florida requires smart strategies. You must understand how to lower your premiums effectively. This section shares useful tips to find affordable policies. These tips help you save money without losing essential coverage.

Comparing Multiple Quotes

Get quotes from several insurance companies. Prices vary a lot between providers. Comparing helps you spot the best deal fast. Use online tools or call agents for quotes. Check the coverage details with each price. Don’t settle for the first price you see.

Adjusting Coverage Levels

Change your coverage to match your needs and budget. Lower coverage limits can reduce premiums. Raise your deductible to cut costs. Avoid paying for coverage you do not need. Balance between affordable price and enough protection. Review your policy every year to adjust as needed.

Considering Personal Factors

Your age, driving record, and car type affect rates. Good drivers pay less than those with accidents. Newer or safer cars often get discounts. Living in low-risk areas can lower premiums. Ask about discounts for good grades, safety features, or memberships. Personalize your policy to fit your profile.

Cheapest Insurance By Driver Type

Finding the cheapest car insurance in Florida depends on the driver type. Insurance companies set rates based on age, driving record, and coverage needs. Different drivers qualify for different discounts and pricing. Understanding which insurer offers the best rates for your driver category saves money. Below are the cheapest insurance options for teens, good drivers, and seniors in Florida.

Best For Teens

Teen drivers usually pay higher rates due to inexperience. Some insurers offer discounts for good grades and driver education courses. American National Insurance often provides affordable full coverage for young drivers. State Farm also ranks well for teens with competitive pricing and rewards. Choosing insurers with teen-specific discounts reduces costs significantly.

Best For Good Drivers

Good drivers with clean records benefit from lower premiums. State Farm commonly offers the cheapest rates for safe drivers in Florida. Travelers also provides competitive full coverage rates for those with excellent driving history. GEICO is a strong choice for liability-only insurance among good drivers. Comparing quotes helps find the best deal.

Best For Seniors

Seniors often need affordable full coverage with reliable service. Travelers frequently ranks as the cheapest insurer for senior drivers in Florida. Some companies offer discounts for low mileage and defensive driving courses. USAA provides low liability-only rates, but it requires military affiliation. Seniors should check multiple insurers for the best price.

Budget-friendly Coverage Options

Finding affordable car insurance in Florida is possible with several budget-friendly options. These plans balance cost and protection. Choosing the right coverage helps save money and stay protected on the road.

Understanding the different types of coverage can guide you to the best deal. Options range from basic liability to full coverage. Discounts make policies more affordable for many drivers.

Liability-only Plans

Liability-only plans cover damages you cause to others. They do not cover your own vehicle. These plans cost less and meet Florida’s minimum insurance requirements. They suit drivers with older cars or low budgets. Choosing this option lowers monthly premiums significantly.

Full Coverage Deals

Full coverage includes liability, collision, and comprehensive insurance. It protects your vehicle from many risks, such as accidents and theft. Full coverage costs more but offers peace of mind. Some insurers provide affordable full coverage deals. These deals often include accident forgiveness or roadside assistance.

Discounts And Savings

Insurance companies offer many discounts to lower costs. Common discounts include safe driver, multi-policy, and good student savings. Paying your premium in full can also reduce costs. Asking about all available discounts can cut your bill. Combining discounts with the right plan saves you more money.

Credit: www.nasdaq.com

How Insurers Calculate Rates

Car insurance rates in Florida vary widely. Insurers use specific methods to set prices. They study many details about the driver and the vehicle. Understanding how rates are calculated helps you find the best cheap Florida car insurance. This section explains key factors insurers consider.

Risk Assessment Criteria

Insurers first assess risk. They estimate how likely you are to make a claim. Age, location, and credit score influence risk levels. Younger drivers often pay more due to higher risk. Living in busy cities may increase rates. Credit score shows financial responsibility and affects pricing.

Role Of Driving Record

Your driving record is crucial. Clean records usually get lower rates. Tickets, accidents, or claims raise your risk profile. Multiple violations can lead to higher premiums. Some insurers offer discounts for safe driving. Maintaining a good record lowers your insurance cost.

Impact Of Vehicle Type

The car you drive matters. Expensive or rare cars cost more to insure. Sports cars and luxury vehicles often have higher premiums. Safety features and repair costs affect rates too. Older cars may have lower rates but less coverage. Choose a vehicle wisely to keep insurance affordable.

Credit: ccicins.wordpress.com

Frequently Asked Questions

Who Has The Cheapest Auto Insurance In Florida?

Travelers, State Farm, and GEICO often offer the cheapest auto insurance in Florida. Rates vary by age, driving history, and coverage type. Travelers suits seniors, State Farm favors young drivers, and GEICO provides low liability rates. Compare multiple quotes to find your best deal.

What Is The 1 Cheapest Car Insurance?

The 1 cheapest car insurance varies by driver and coverage. Travelers, State Farm, and GEICO often offer the lowest rates. Compare quotes to find the best deal for your situation.

What Companies Offer The Cheapest Florida Car Insurance?

Travelers, State Farm, and GEICO frequently offer the lowest rates in Florida. Travelers is often cheapest for seniors, State Farm for young drivers, and GEICO for liability-only coverage.

How Can I Find The Cheapest Car Insurance Policy?

Get multiple quotes from different insurers, adjust coverage levels, and consider your personal factors like age and driving history. Comparing these helps you find the best price.

Conclusion

Finding cheap car insurance in Florida takes patience and smart choices. Compare multiple quotes from top companies like Travelers, State Farm, and GEICO. Think about what coverage you really need to keep costs low. Remember, your age and driving record affect your rates.

Take time to review options carefully before deciding. Affordable insurance is possible with the right approach. Stay safe and save money on your Florida car insurance.