Finding the best Florida car insurance rates can feel overwhelming, but it doesn’t have to be. You want to protect your vehicle without breaking the bank, and that’s exactly what this guide will help you do.

Whether you’re a new driver or have been on the road for years, discovering affordable coverage tailored to your needs is possible. You’ll learn simple yet powerful tips to save money, how to compare quotes effectively, and which discounts you might be missing out on.

Keep reading to unlock the secrets to lowering your Florida car insurance costs and get the coverage you deserve.

Compare Florida Insurance Quotes

Comparing Florida insurance quotes helps you find the best car insurance rates. It saves money and ensures proper coverage. Many options exist, so comparing quotes is essential. Use simple methods to get clear price comparisons and coverage details. Start by using online tools, consulting brokers, and checking various insurers.

Use Online Comparison Tools

Online tools provide quick access to multiple insurance quotes. Enter basic information once and get several price options. These tools show differences in coverage and prices side by side. They save time and help spot the cheapest rates fast. Always use trusted websites for accurate quotes.

Consult Insurance Brokers

Insurance brokers know the market well and offer personalized advice. They gather quotes from many insurers and explain coverage details. Brokers help find discounts and tailor policies to your needs. They make comparing easier by doing the research for you. Talking to a broker can reveal options online tools miss.

Check Multiple Insurers

Contact different insurance companies directly for quotes. Each insurer uses its own pricing model, so rates vary. Comparing many insurers helps find the best deal. Don’t rely on one company alone. Explore large firms and smaller local insurers. This broad search improves chances of low rates and good coverage.

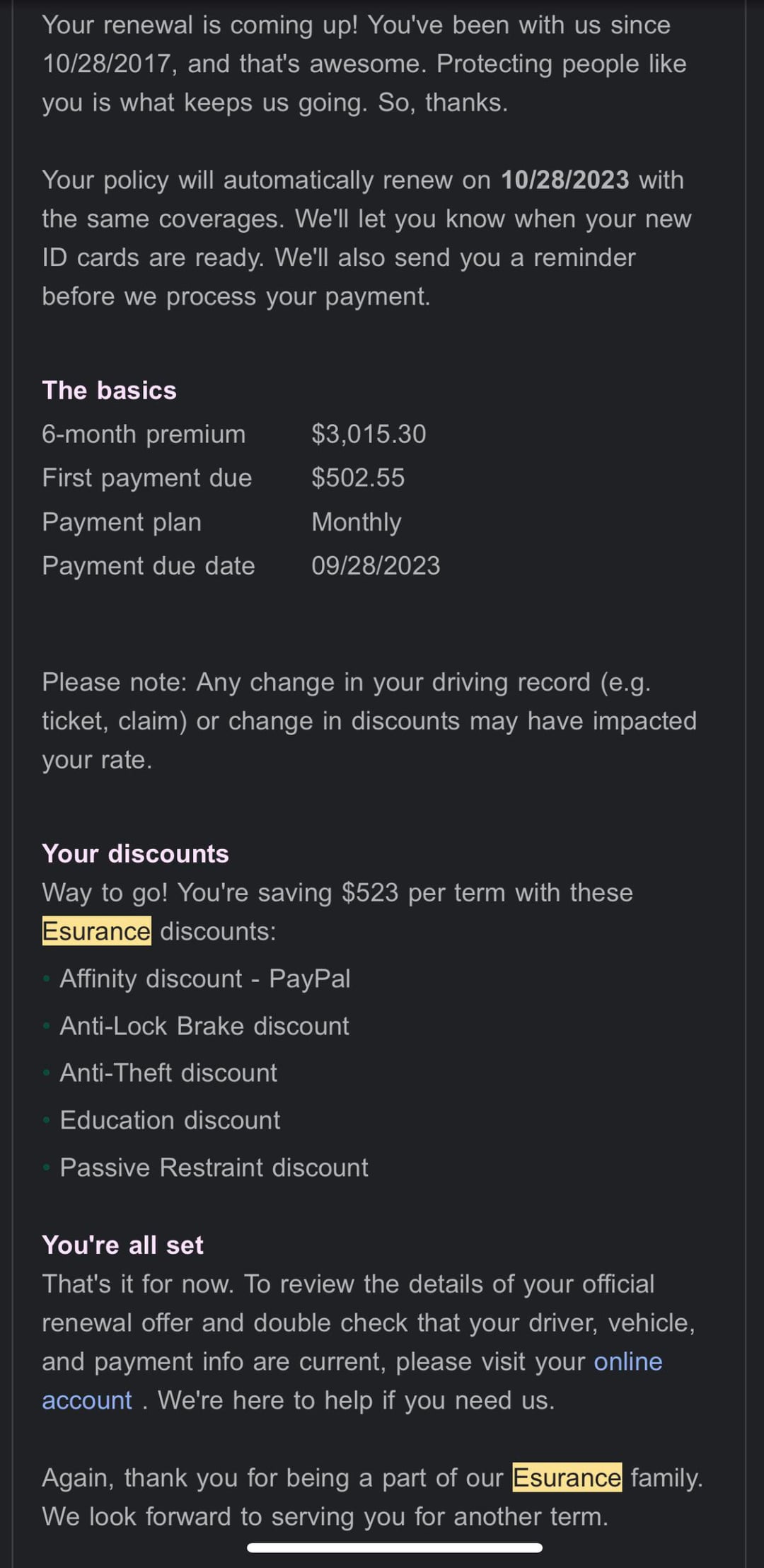

Credit: www.moneygeek.com

Adjust Your Coverage

Adjusting your car insurance coverage can help lower your premium and fit your current needs. Changes in your life or driving habits affect the right coverage for you. Small tweaks can make a big difference in your Florida car insurance rates. Review your policy regularly to ensure it matches your situation and budget.

Update Policy For Life Changes

Life changes like marriage, moving, or a new job affect insurance rates. Notify your insurer about these changes to update your policy. Removing a driver who no longer uses the car can lower costs. Adding safety features or a new vehicle may also change coverage needs.

Raise Your Deductible

Increasing your deductible reduces your premium amount. Choose a higher deductible if you can pay more after a claim. This option works well for drivers with fewer accidents. It helps save money on monthly or yearly payments.

Select Appropriate Coverage Levels

Choose coverage levels that fit your car’s value and your risk. Avoid paying for coverage you do not need. For older cars, consider dropping comprehensive or collision coverage. Make sure you meet Florida’s minimum insurance requirements to avoid fines.

Maximize Discounts

Finding the best Florida car insurance rates means taking full advantage of discounts. Insurance companies offer many ways to lower your premiums. Saving money is easier when you know which discounts apply. Simple actions can lead to big savings. Here are some key ways to maximize your discounts and pay less on car insurance.

Bundle Policies For Savings

Combine your car insurance with home or renters insurance. Bundling policies often earns you a discount. Insurers reward customers who keep multiple policies with them. This saves money and makes managing insurance easier. Ask your agent about bundling options and discounts available.

Maintain A Clean Driving Record

Safe driving is one of the best ways to get discounts. Avoid accidents and traffic tickets. Insurers lower rates for drivers with no claims or violations. A clean record shows you are a low-risk driver. This can reduce your insurance premiums over time.

Complete Defensive Driving Courses

Taking a defensive driving course can cut your insurance costs. These courses teach safe driving skills and accident prevention. Many insurers offer discounts after you complete approved courses. Check with your insurance provider for eligible programs near you.

Install Safety Features

Adding safety devices to your vehicle may lower your rates. Features like anti-theft alarms, automatic brakes, and airbags reduce risk. Insurers often provide discounts for cars with these upgrades. Installing these features protects you and your wallet.

Use Loyalty And Payment Discounts

Stay with the same insurer to earn loyalty discounts. Insurers value long-term customers and reward them. Also, pay your premium in full or set up automatic payments. Many companies offer discounts for these payment methods. Check what discounts your insurer offers for loyalty and payment.

Improve Financial Factors

Improving your financial factors can help you secure better car insurance rates in Florida. Insurers often check your financial habits to decide your premium. Small changes in your financial profile can lower your insurance cost.

Focus on key financial habits that show you are responsible. This can make a positive difference in your insurance rates.

Boost Your Credit Score

Your credit score impacts your insurance rates. A higher score shows insurers you manage money well. Pay bills on time and reduce debt to improve your score. Avoid opening too many new credit accounts quickly. A steady and good credit score may lower your insurance premiums.

Pay Premiums In Full

Paying your insurance premium in full can reduce your cost. Many insurers offer discounts for full payments. Avoid monthly payment plans if possible, as they may add fees. Paying upfront shows financial stability and lowers your overall expense.

Modify Driving Habits

Changing the way you drive can lower your Florida car insurance rates. Insurance companies reward safe and smart driving habits. Small changes in your daily routine can lead to big savings on your premium. Focus on reducing risk and improving your driving style.

Drive Less To Save

Insurance costs often depend on how much you drive. The fewer miles you put on your car, the lower your risk of accidents. Try to combine errands or carpool to reduce driving time. Consider walking or biking for short trips. Less driving means less chance of claims, which can reduce your rates.

Avoid Accidents And Violations

Clean driving records lead to better insurance rates. Avoid speeding tickets, reckless driving, and other traffic violations. These violations increase your insurance costs quickly. Drive carefully and follow traffic laws to stay accident-free. Defensive driving courses can also help lower your premiums. Safe driving habits protect your wallet and your safety.

Credit: www.moneygeek.com

Special Rates For Veterans

Veterans often qualify for special car insurance rates in Florida. Insurers recognize their service and offer discounts. These savings can significantly reduce your premium costs. Understanding these options helps veterans get the best possible rates. Below are ways to find and use these special offers.

Explore Military Discounts

Many insurance companies provide military discounts for veterans. These discounts lower your monthly payments. They reward your service with lower rates and extra benefits. Some discounts apply to active duty members, reservists, and retired veterans. Always ask insurers about available military savings. These offers can make insurance more affordable for veterans.

Use Veteran-focused Insurers

Some insurers specialize in serving veterans. They understand unique needs and risks. Companies like USAA focus on military members and their families. These insurers often offer better rates and tailored coverage. Signing up with a veteran-focused insurer can simplify your search. It also ensures you get discounts designed for your service background.

Top Florida Insurers To Consider

Finding the best car insurance rates in Florida depends on choosing the right insurer. Many companies offer different plans and discounts to fit various needs. This section highlights top Florida insurers known for competitive rates and reliable coverage.

These insurers have strong reputations and tailored options for Florida drivers. Understanding what each company offers can help you make a smart choice for your car insurance.

Progressive

Progressive is popular for its flexible pricing and discounts. It offers a unique “Name Your Price” tool. This tool helps drivers find coverage that fits their budget. Progressive also provides discounts for safe driving and bundling policies.

The company uses snapshot programs to reward careful drivers. Its customer service is available online and by phone. Progressive’s wide coverage options make it suitable for many Florida drivers.

Usaa

USAA serves military members, veterans, and their families. It offers some of the lowest rates in Florida for eligible customers. USAA focuses on excellent customer support and fast claims processing.

Discounts include safe driver rewards and multi-policy savings. The company also provides coverage tailored to military life. USAA’s strong financial stability makes it a trusted choice.

Other Leading Companies

Several other insurers offer competitive rates in Florida. State Farm is known for local agents and personalized service. GEICO offers affordable rates and many online tools.

Allstate provides various discounts and accident forgiveness programs. Each company has unique features and coverage plans. Comparing quotes from these insurers can help find the best deal for you.

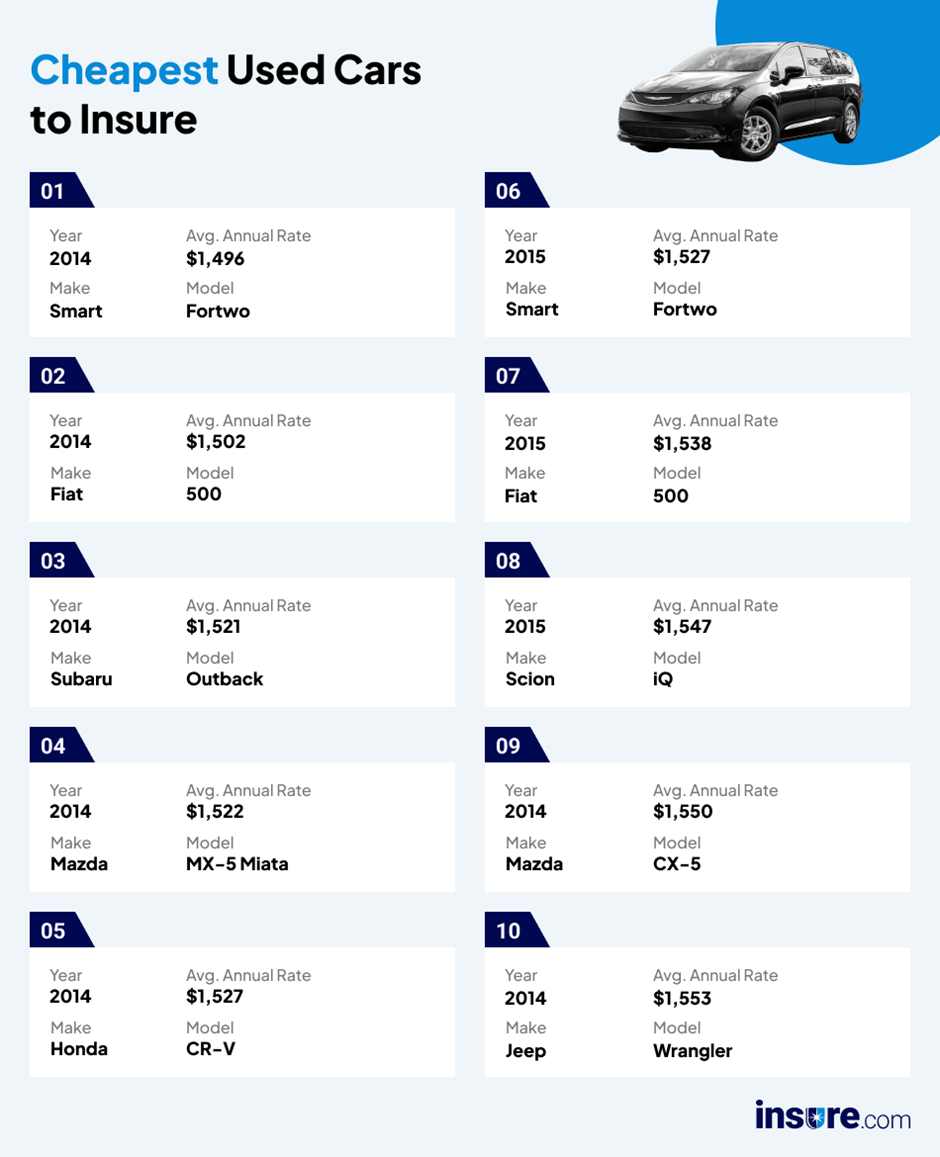

Credit: www.insure.com

Frequently Asked Questions

Who Has The Cheapest Car Insurance In Florida?

USAA and Progressive often offer the cheapest car insurance in Florida. Compare quotes to find the best rates for your profile.

How To Get Lower Car Insurance In Fl?

Compare quotes from multiple insurers and raise your deductible. Maintain a clean driving record and complete defensive driving courses. Bundle policies and install safety features. Improve your credit score and update your policy to match current driving habits for lower Florida car insurance rates.

Who Has The Best Auto Insurance Rates Right Now?

USAA and Progressive often offer the best auto insurance rates, especially in Florida. Compare quotes and use discounts to save more.

Why Is Florida Auto Insurance So High?

Florida auto insurance rates are high due to frequent accidents, expensive medical claims, high fraud rates, and mandatory coverage laws. Dense population and heavy traffic also increase risk, raising premiums for all drivers in the state.

Conclusion

Finding the best Florida car insurance rates takes time and effort. Compare multiple quotes to spot the cheapest option. Keep a clean driving record to earn lower premiums. Use discounts wisely, like bundling or good driver rewards. Review your policy regularly to match your current needs.

Small changes can lead to big savings on car insurance. Stay informed and shop smart to protect your budget. Safe driving and smart choices help you pay less. Affordable car insurance in Florida is within your reach.