Looking for the best insurance rates in Florida? You’re not alone.

Whether it’s for your car, home, or other valuable assets, finding affordable insurance can feel overwhelming. But what if you could unlock the secrets to saving big without sacrificing coverage? Imagine paying less each month while still protecting what matters most to you.

In this guide, you’ll discover proven tips and trusted providers that offer some of the lowest rates in Florida. Ready to take control of your insurance costs and keep more money in your pocket? Keep reading to find out how you can get the best deals tailored just for you.

Credit: www.moneygeek.com

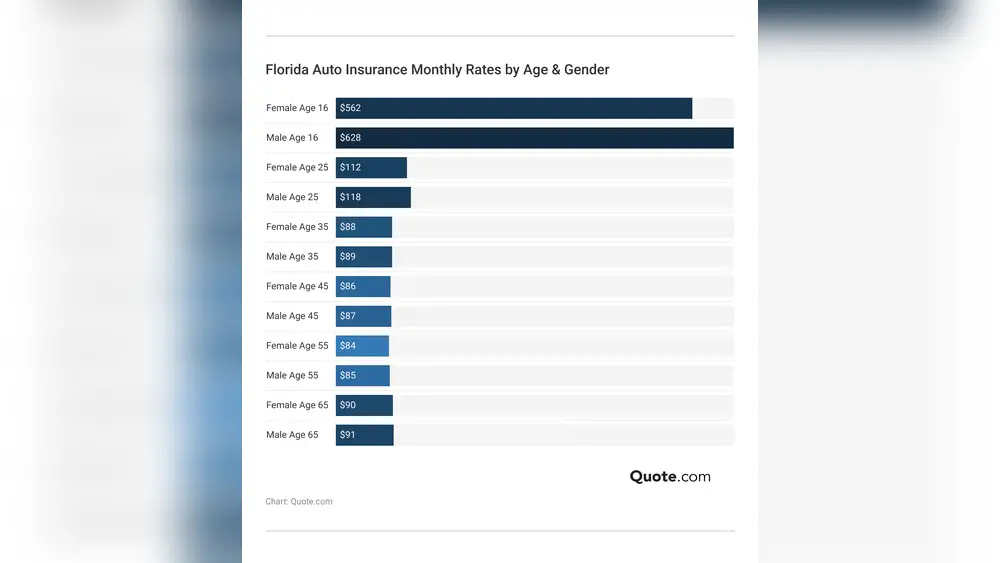

Florida Auto Insurance Rates

Florida auto insurance rates vary widely across the state. Several factors shape the cost. These include your driving record, location, and type of coverage chosen. Understanding these rates helps you find the best deal. Florida drivers can save money by comparing providers and coverage options.

Top Providers In Florida

Geico often offers the most affordable rates for full and minimum coverage. Travelers provides competitive prices with many discounts. USAA is popular for military families with low rates. Auto-Owners is a good choice for drivers with tickets or accidents. Travelers also offers low rates for drivers with a DUI. Wawanesa stands out for teen drivers seeking coverage.

Rates For Full Vs. Minimum Coverage

Full coverage includes collision and comprehensive protection. It costs more than minimum coverage. Minimum coverage meets Florida’s legal requirements only. Full coverage protects against more risks but costs roughly twice as much. Choosing depends on your car’s value and financial situation. Many drivers opt for full coverage to avoid large repair bills.

Discounts And Savings Opportunities

Many insurers offer discounts to reduce premiums. Safe driver discounts reward accident-free records. Bundling auto with home insurance can save money. Some companies give discounts for low mileage or good grades for teen drivers. Installing safety devices may lower rates. Checking all available discounts helps find the best savings.

Homeowners Insurance In Florida

Homeowners insurance in Florida is essential due to the state’s unique weather and risk factors. Strong winds, hurricanes, and flooding increase the risk of property damage. Many homeowners seek reliable coverage to protect their homes and investments.

Choosing the right insurance helps manage these risks. Knowing the best companies, cost factors, and savings tips can guide smarter decisions. This section covers key points about homeowners insurance in Florida.

Leading Companies For Home Coverage

Several insurers offer strong home insurance in Florida. USAA is popular among military families for affordable, comprehensive plans. Geico often provides low rates for both basic and full coverage nationwide.

Travelers stands out with many discounts and value-driven pricing. Auto-Owners is a good choice for those with tickets or accidents on record. Each company has strengths that suit different needs.

Factors Affecting Home Insurance Costs

Home location impacts insurance costs, especially in hurricane-prone areas. Property age and construction type also influence rates. Older homes may cost more to insure due to higher repair risks.

Coverage amount and deductible size affect premiums. Higher coverage or lower deductibles raise costs. Claim history and credit score also play a role in pricing.

Tips To Lower Homeowners Premiums

Raising your deductible reduces the premium amount. Installing storm-resistant features can lower risk and costs. Bundling home and auto insurance often earns discounts.

Maintain a good credit score to secure better rates. Shop around yearly to compare offers. Simple precautions can lead to significant savings on home insurance.

Insurance For Special Cases

Finding the best insurance rates in Florida can be tough for drivers with unique situations. Insurance for special cases offers tailored options for those who face challenges like tickets, accidents, or DUI convictions. These plans help drivers stay protected without paying too much.

Special insurance plans also support teen drivers. These plans focus on safety and affordability. Understanding these options helps drivers choose the right coverage for their needs.

Coverage For Drivers With Tickets Or Accidents

Drivers with tickets or accidents often pay higher premiums. Some insurers specialize in coverage for these drivers. They offer fair rates despite past driving issues. Auto-Owners is known for helping drivers in this category. They provide reliable coverage that fits budgets.

Options For Drivers With Dui Convictions

DUI convictions affect insurance costs significantly. Many companies avoid covering these drivers. Travelers stands out by offering affordable rates to drivers with DUIs. Their plans meet state requirements and help keep insurance affordable. This option gives second chances to drivers who need it.

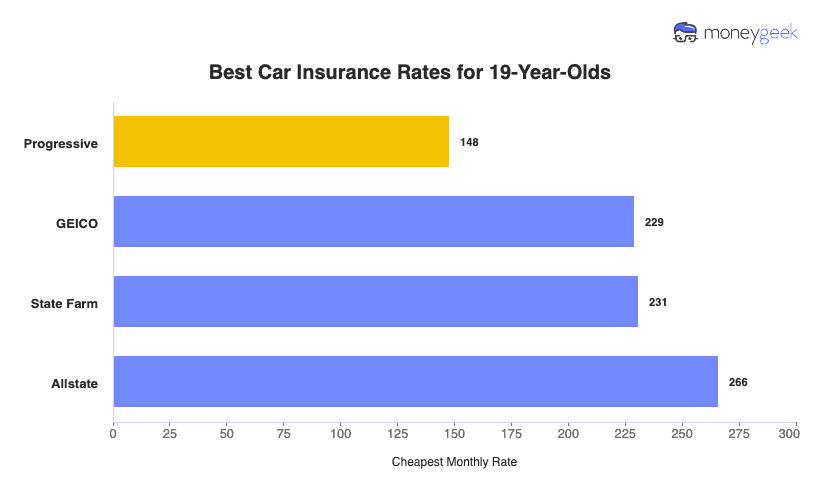

Affordable Plans For Teen Drivers

Teen drivers usually face high insurance costs. Insurers create special plans to lower these expenses. These plans reward safe driving and good grades. Some offer discounts for completing driver education courses. Affordable teen plans help families protect young drivers without stress.

Credit: www.ziprecruiter.com

How To Find The Best Rates

Finding the best insurance rates in Florida requires a clear plan. Start by understanding what coverage fits your needs. Compare prices from different sources. Ask insurers directly for quotes. This approach helps you save money and get proper protection.

Assessing Your Coverage Needs

Think about what kind of insurance you need. Consider your car, home, or health risks. Decide on the coverage limits that protect your finances. Avoid paying for extra coverage you do not need. This step ensures you get the right policy at a fair price.

Using Comparison Websites

Use comparison websites to check multiple insurance options quickly. These sites show prices from many companies in one place. Enter your details to see personalized rates. Check the coverage terms, not just the price. Comparison sites save time and reveal the best deals.

Getting Quotes Directly From Insurers

Contact insurance companies to get quotes directly. Some offer discounts only through direct contact. Ask about special offers or bundling policies. Talking to an agent can clarify policy details. Direct quotes help confirm what comparison sites show and may offer extra savings.

Impact Of Driving Records On Rates

Your driving record plays a key role in determining insurance rates in Florida. Insurance companies review your past driving behavior to assess risk. Safer drivers generally pay less for coverage. On the other hand, violations and accidents increase rates. Insurers see these as signs of higher risk. Understanding how different incidents affect your premium helps you manage costs.

Speeding Tickets And Insurance Costs

Speeding tickets raise your insurance rates in Florida. Each ticket shows risky driving to insurers. The faster you go, the higher the cost. Multiple tickets can lead to bigger rate hikes. Insurance companies may also add surcharges. Keeping a clean record helps keep premiums low.

Accidents And Premium Changes

Accidents impact insurance rates more than tickets. At-fault accidents especially cause rate increases. Insurers see these as signs of potential future claims. Minor accidents might cause small hikes. Major accidents often result in significant premium rises. Some companies offer accident forgiveness programs to help.

Dui Effects On Insurance Prices

A DUI conviction greatly increases insurance costs in Florida. It signals very high risk to insurers. Many companies charge steep premiums or refuse coverage. Rates can double or even triple after a DUI. Maintaining a clean record after a DUI is key to lowering rates later.

Credit: www.reddit.com

Tips For Saving On Florida Insurance

Saving money on insurance in Florida requires smart choices. Use simple strategies to lower your premiums without losing coverage. This section covers three effective tips to help you save on Florida insurance costs.

Bundling Auto And Home Policies

Combine your car and home insurance with the same company. Bundling often leads to discounted rates. It simplifies payments and can increase your overall savings. Many insurers offer special deals for bundled policies.

Taking Advantage Of Discounts

Ask your insurer about available discounts. Common options include safe driver, good student, and loyalty discounts. Some companies also offer discounts for security systems or low mileage. Applying these can reduce your insurance bills significantly.

Improving Your Driving Record

Maintain a clean driving record to get better rates. Avoid accidents and traffic tickets to keep your premiums low. Some insurers reward drivers with no claims or violations over time. Taking defensive driving courses may also help lower costs.

Frequently Asked Questions

Who Has The Best Rates For Homeowners Insurance In Florida?

Geico often offers the most affordable homeowners insurance rates in Florida. Travelers provides good value with many discounts. USAA serves military families with competitive pricing. Compare quotes from these insurers to find the best rate for your specific needs.

Which Insurance Company Has The Best Rates Right Now?

Geico often offers the lowest rates for full and minimum coverage nationwide. Travelers provides great value with discounts. USAA is best for military families. Auto-Owners suits drivers with incidents, while Travelers offers cheap rates after a DUI. Compare quotes online for personalized best rates.

What Part Of Florida Has The Lowest Insurance Rates?

Northern and central Florida often have the lowest insurance rates due to fewer storms and lower crime. Areas like Orlando and Gainesville offer more affordable coverage. Coastal regions typically face higher premiums because of increased hurricane risks and property damage claims.

What County In Florida Has The Highest Insurance Rates?

Miami-Dade County has the highest insurance rates in Florida. High population density and frequent storms increase risks and premiums.

Conclusion

Finding the best insurance rates in Florida takes time and care. Compare quotes from top providers like Geico, Travelers, and USAA. Think about your unique needs, such as coverage type and discounts. Use trusted comparison sites to save money and effort.

Keep your driving record clean to unlock better rates. Review your policy regularly to ensure it still fits your needs. Affordable insurance is possible with the right research and choices. Stay informed, shop smart, and protect your future in Florida.