Finding the best small business bank account in Florida can feel overwhelming. You want an account that fits your unique needs, helps you manage money easily, and supports your growth.

Whether you’re just starting or looking to switch banks, the right choice can save you time and money. In this guide, you’ll discover top banking options designed specifically for Florida’s small businesses. By the end, you’ll know exactly which bank offers the features and benefits that match your goals.

Ready to find the perfect banking partner for your business? Let’s dive in.

Credit: fintechlabs.com

Top Banks For Small Business In Florida

Finding the right bank for your small business in Florida is important. Each bank offers different benefits. Some focus on cash handling, others on loans or online services. Choosing a bank that fits your needs helps your business grow smoothly.

This guide highlights top banks in Florida for small businesses. It covers banks that excel in key areas. These include cash deposits, sign-on bonuses, customer service, online banking, SBA loans, and international payments.

Best For Cash Deposits

Nbkc Bank stands out for handling cash deposits. It offers free cash deposits with no limits. This is helpful for businesses that receive a lot of cash payments. The bank also provides low fees and easy access to branches in Florida.

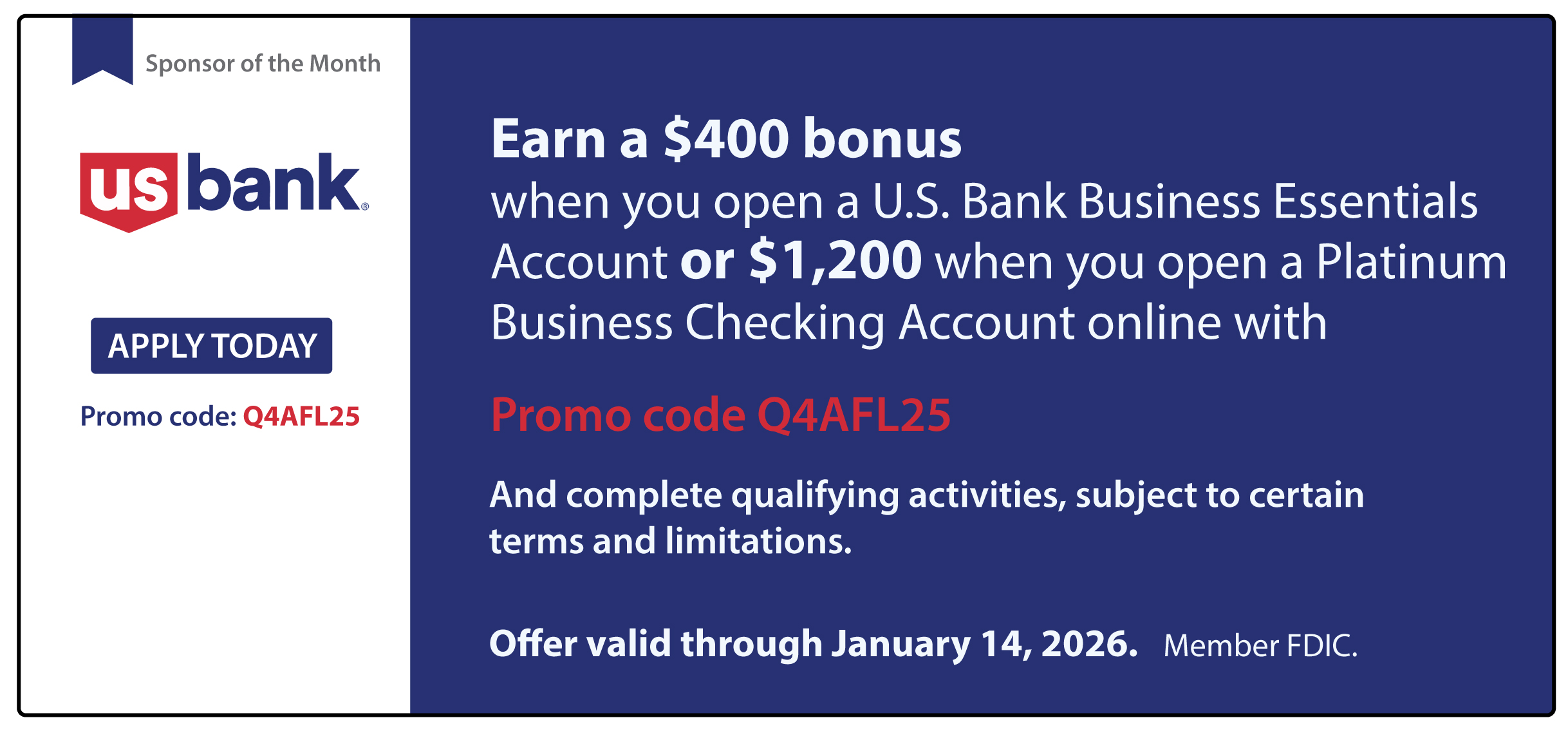

Best For Sign-on Bonuses

Chase Business Banking offers attractive sign-on bonuses. New business account holders can earn cash rewards after meeting simple requirements. This makes Chase a good choice for startups wanting extra funds to start with.

Best Customer Service

Found Bank is known for excellent customer support. Their team helps small business owners with clear and quick answers. They offer personalized help through phone and online chat. This makes managing your business finances easier.

Best Online Banking

Mercury provides a top online banking experience. The platform is user-friendly and designed for small businesses. It offers tools for tracking expenses, sending payments, and managing accounts remotely. No need to visit a branch.

Best Sba Loan Options

Live Oak Bank specializes in SBA loans. It has strong support for small businesses seeking government-backed loans. They offer competitive rates and guidance through the loan process. This helps businesses get funding faster and safer.

Best For International Payments

Wise Business is ideal for businesses with global transactions. It offers low-cost international transfers and multi-currency accounts. This reduces fees and speeds up payments to suppliers or clients abroad. Perfect for Florida businesses working worldwide.

Credit: management.org

Types Of Business Bank Accounts

Choosing the right type of bank account shapes your business’s financial health. Each account serves a unique purpose and offers distinct benefits. Understanding these options helps you manage money better and plan for growth.

Small businesses often need multiple accounts to handle different financial tasks. This diversity ensures smooth daily operations and secures your funds for future needs.

Business Checking Accounts

Business checking accounts handle daily transactions like payments and deposits. They keep your business money separate from personal funds. Most offer online access, debit cards, and check-writing capabilities. These accounts usually have monthly fees and minimum balance requirements.

Business Savings Accounts

These accounts store extra cash and earn interest over time. They help build a reserve for emergencies or planned expenses. Withdrawals may be limited, so use savings accounts mainly for funds you won’t need immediately.

Business Money Market Accounts

Money market accounts provide higher interest rates than regular savings accounts. They often allow limited check writing and debit card use. These accounts usually require higher minimum balances to avoid fees.

Business Credit Cards

Credit cards help manage business expenses and build credit history. They offer rewards like cash back or travel points. Use credit cards carefully to avoid high interest charges and debt.

Merchant Services Accounts

Merchant accounts enable businesses to accept credit and debit card payments. They connect with payment processors and point-of-sale systems. These accounts charge fees per transaction but increase sales opportunities.

Key Features To Compare

Choosing the best small business bank account in Florida means comparing key features. These features affect how easily you manage money and grow your business. Understanding each feature helps find the right fit for your needs.

Start by checking fees, then look at digital tools. Branch access and interest rates also matter. Extra services can add real value.

Monthly Fees And Charges

Monthly fees reduce your business funds. Look for accounts with low or no fees. Check charges for transactions, deposits, and withdrawals. Some banks waive fees if you keep a minimum balance. Avoid surprise fees that hurt your cash flow.

Online And Mobile Banking

Good online banking saves time. Mobile apps let you manage accounts anywhere. Look for features like mobile check deposit and bill pay. Easy navigation and quick access improve your experience. Secure platforms protect your business information.

Branch And Atm Access

Physical branches help with deposits and advice. Choose banks with locations near your business. Free ATM access avoids extra charges. Some banks refund ATM fees nationwide. Convenience matters if you need cash or in-person help.

Interest Rates And Apys

Interest rates grow your savings. Compare rates on checking and savings accounts. Higher APYs mean better returns on idle money. Even small differences add up over time. Check if rates change with balance levels.

Additional Business Services

Extra services support business growth. Look for merchant services and payment processing. Business credit cards and loans help manage cash flow. Payroll and invoicing tools save time. Choose banks offering services that suit your business type.

Bank Options For Different Needs

Choosing the right bank account depends on specific business needs. Different banks offer unique benefits. Some focus on technology and low fees. Others provide extensive branch networks or personalized service. Understanding bank types helps find the best fit for your Florida small business.

Neobanks And Online-only Banks

Neobanks operate entirely online. They usually charge low or no fees. Their digital platforms offer fast, easy access to accounts. Ideal for tech-savvy business owners. They lack physical branches but provide strong mobile apps. Services often include quick transfers and automated bookkeeping tools.

National Banks

National banks have many branches across the country. They offer a wide range of services. These include loans, credit cards, and merchant services. Strong security and advanced online banking are standard. Businesses with frequent cash deposits benefit from branch access. National banks suit companies planning growth beyond Florida.

Regional Banks

Regional banks serve specific areas like Florida and nearby states. They combine personal service with modern banking tools. These banks often understand local business challenges. Fees tend to be moderate compared to national banks. Regional banks are good for businesses wanting local support and fewer fees.

Credit Unions

Credit unions are member-owned financial cooperatives. They usually offer lower fees and better interest rates. Service feels more personalized and community-focused. Credit unions often support small businesses with tailored products. They may have fewer branches but strong local ties. Ideal for businesses valuing close relationships and cost savings.

Choosing The Right Account For Your Business

Choosing the right bank account is a key step for any small business in Florida. The right account supports daily transactions and long-term goals. It keeps business finances separate from personal funds. This separation simplifies accounting and tax filing. Selecting an account that fits your business needs saves time and money.

Matching Account Types To Business Needs

Different business types require different account features. Business checking accounts handle everyday payments and deposits. Savings accounts help store extra funds safely while earning interest. Money market accounts offer higher interest rates with limited check writing. Assess your daily transaction volume and cash flow. Choose an account that matches your business activities and budget.

Balancing Fees With Features

Many banks charge monthly fees, minimum balances, or transaction limits. Low or no-fee accounts reduce costs for small businesses. Features like free online banking, mobile deposits, and ATM access add value. Compare fee structures carefully. Pick an account that offers the most benefits without high costs. Avoid accounts with hidden fees that can add up over time.

Considering Growth And Credit Options

Choose a bank that supports your business growth. Look for credit options like lines of credit or business loans. Some banks offer rewards or perks for loyal customers. A bank with good credit products helps during expansion or cash flow challenges. Think about your future needs when selecting an account today.

Credit: www.finder.com

Frequently Asked Questions

What Is The Best Bank For Small Business In Florida?

The best bank for small businesses in Florida depends on needs. Chase offers sign-on bonuses, Live Oak excels in SBA loans, and Mercury provides top online banking. Choose based on fees, services, and branch access to fit your business goals.

Which Bank Is Best To Open A Small Business Account?

Chase offers comprehensive services and sign-on bonuses. Bluevine has no monthly fees. Live Oak excels in SBA loans. Choose based on fees, features, online access, and branch convenience.

Which Type Of Bank Account Is Best For Small Business?

A business checking account suits most small businesses for daily transactions and financial separation. Choose one with low fees, strong online banking, and convenient branch access. Consider business savings or money market accounts for extra funds and growth opportunities. Select based on your business needs and banking features.

What Bank Is The Best For Llc?

Chase offers great LLC banking with extensive services and branch access. Bluevine provides fee-free online accounts. Live Oak excels in SBA loans. Choose based on fees, features, and banking preferences.

Conclusion

Choosing the right small business bank account in Florida supports smooth daily operations. Consider fees, online access, and branch locations that fit your needs. Each bank offers unique features to help your business grow steadily. Keep your finances separate and organized for better management.

A good account saves time and reduces stress. Take your time to compare options carefully. The right choice makes banking simpler and keeps your business on track.