Are you tired of paying too much for auto insurance in Florida? Finding the best rates can feel overwhelming, especially with so many options out there.

But what if you could quickly discover which companies offer the best deals tailored just for you? You’ll learn exactly who has the best auto insurance rates in Florida—and how you can save money without sacrificing coverage. Keep reading to take control of your insurance costs and protect your wallet.

Florida Auto Insurance Market

Florida’s auto insurance market is unique and quite complex. The state has some of the highest car insurance rates in the country. This is due to various factors like weather, traffic, and legal rules.

Many drivers find it hard to choose the best insurance provider. Understanding the market helps make better decisions. Knowing how rates are set is key to finding affordable coverage.

State Regulations Impacting Rates

Florida requires drivers to carry Personal Injury Protection (PIP) insurance. This no-fault insurance pays for medical costs after accidents. It raises the base cost of insurance for all drivers.

The state also has minimum coverage limits. Insurers must follow these rules when offering policies. These regulations affect how companies price their plans.

Litigation rates in Florida are high. Many claims end up in court, raising insurance costs. Insurers include this risk in their premiums.

Factors Affecting Premiums

Age influences auto insurance rates. Younger and older drivers usually pay more. This is due to higher accident risk.

Driving history plays a big role. Accidents or tickets increase premiums. Clean records help lower them.

Where you live matters. Urban areas tend to have higher rates than rural ones. This is because of more traffic and theft.

The type of car also impacts costs. Expensive or sporty cars cost more to insure. Safety features can reduce premiums.

Credit history can affect rates in Florida. Insurers may use credit scores to predict risk. Better credit often means lower premiums.

Credit: www.thezebra.com

Top Auto Insurers In Florida

Florida has many auto insurance companies. Choosing the right one can save you money and stress. Knowing which insurers are top in Florida helps you make a smart choice. This section shows the leading companies by market share and their customer satisfaction scores.

Leading Companies By Market Share

Some companies dominate Florida’s auto insurance market. State Farm holds a large portion of the market. Geico follows closely, known for affordable rates. Progressive also has a strong presence. These companies have many customers in Florida. Their size often means more coverage options and discounts.

Customer Satisfaction Scores

Customer opinions matter. They reveal how well companies handle claims and service. J.D. Power surveys show high satisfaction for Amica Mutual. USAA scores well but serves military families only. Erie Insurance also receives good ratings in Florida. Checking these scores helps pick a reliable insurer.

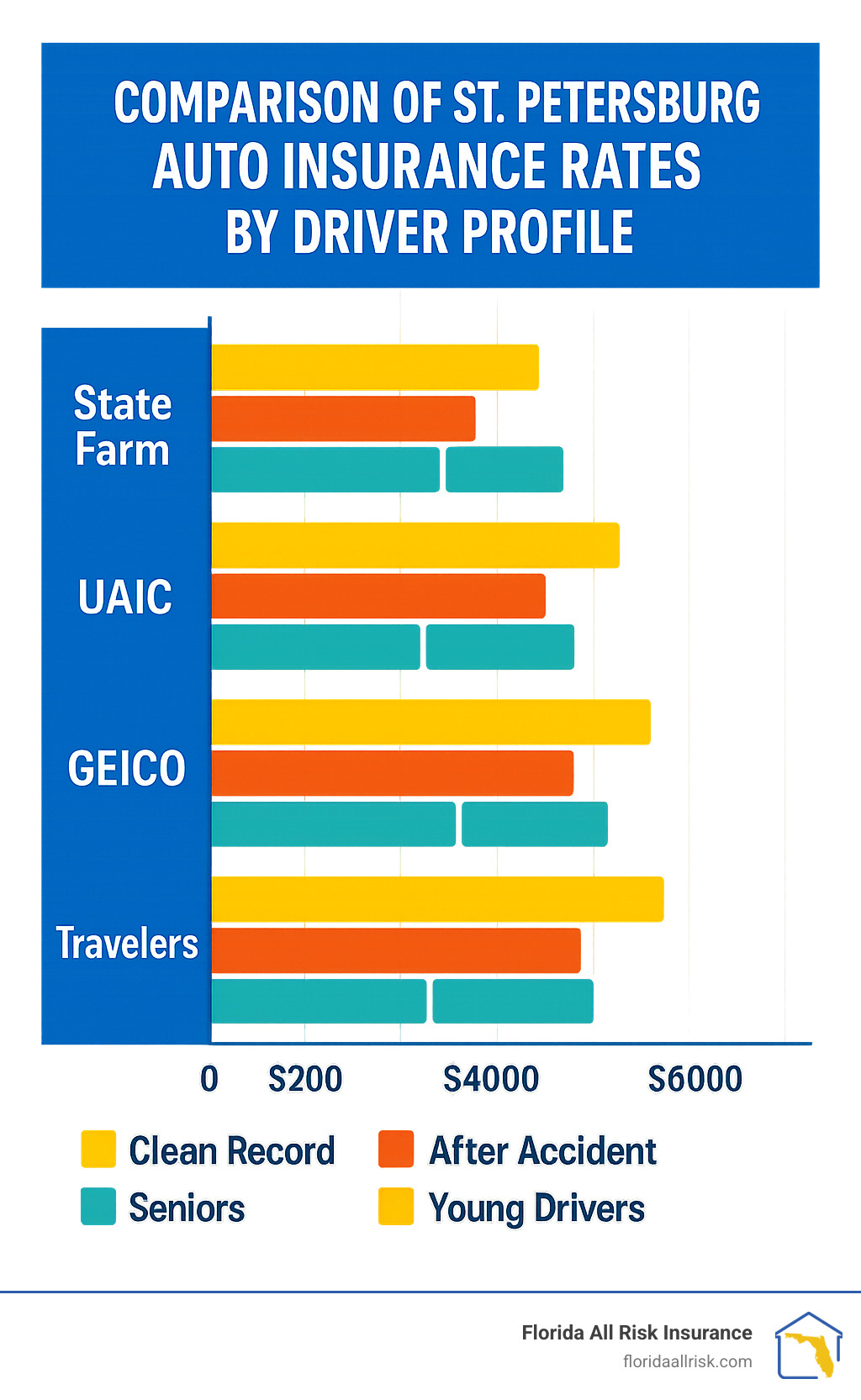

Rate Comparisons

Comparing auto insurance rates in Florida helps drivers find the best deal. Rates vary by provider and coverage types. Knowing these differences can save money and ensure proper protection. This section breaks down key points about rate comparisons.

Average Premiums By Provider

Florida drivers pay different premiums depending on the insurer. Some companies offer lower base rates, while others charge more. On average, providers like State Farm and GEICO tend to have competitive prices. Others, such as Allstate, might be higher but offer extra benefits. Premium costs depend on driver profile, car type, and location too.

Coverage Options And Costs

Coverage choices influence the final insurance cost. Basic liability coverage is cheaper but offers limited protection. Full coverage includes collision and comprehensive options, raising the price. Some insurers bundle extra features like roadside assistance or rental car coverage. These add-ons increase premiums but provide more security. Understanding coverage details helps balance cost and protection.

Discounts And Savings

Auto insurance in Florida can be expensive. Discounts and savings help lower your costs. Many insurers offer various discounts for different reasons. Learning about these discounts can help you pay less. Saving money means you get good coverage without overspending.

Common Discounts Available

Many insurance companies give discounts for safe driving. A clean driving record often lowers your rate. Discounts also apply for bundling car and home insurance. Some insurers offer savings for low mileage drivers. Good student discounts are common for young drivers. Military personnel often get special discounts. Defensive driving courses can reduce premiums too.

How To Maximize Savings

Compare quotes from several insurers to find the best rates. Ask about all discounts you may qualify for. Keep your driving record clean to maintain low rates. Consider increasing your deductibles to lower premiums. Bundle your car insurance with other policies. Update your policy if your car’s value drops. Review your coverage yearly to find new savings.

Choosing The Right Policy

Choosing the right auto insurance policy in Florida requires careful thought. The cheapest option may not cover all your needs. The best policy balances cost and protection. Understanding what matters most helps you make a smart choice.

Balancing Cost And Coverage

Price matters, but coverage is key. A low premium might mean less protection. Check what the policy covers. Look for essentials like liability, collision, and comprehensive insurance. Consider your car’s value and how much risk you can take. Sometimes paying a bit more means better peace of mind.

Evaluating Customer Service

Good customer service makes claims easier. Quick responses save time and stress. Read reviews to see how companies treat customers. Friendly and helpful support can be a big advantage. Choose an insurer that listens and solves problems fast.

Credit: www.oyerinsurance.com

Credit: floridaallrisk.com

Frequently Asked Questions

Who Offers The Cheapest Auto Insurance In Florida?

Geico, State Farm, and Progressive often provide the lowest rates. Rates depend on your driving history and location within Florida.

How Can I Get The Best Florida Auto Insurance Rates?

Compare quotes from multiple insurers. Maintain a clean driving record and consider bundling policies for discounts.

Does Florida Require Specific Auto Insurance Coverage?

Yes, Florida mandates personal injury protection (PIP) and property damage liability coverage for all drivers.

Are There Discounts For Florida Auto Insurance?

Yes, insurers offer discounts for safe driving, multiple vehicles, good students, and bundling home and auto insurance.

Conclusion

Finding the best auto insurance rates in Florida takes some effort. Compare quotes from different companies. Look for coverage that fits your needs. Check customer reviews to see how companies treat clients. Remember, the cheapest option is not always the best.

Balance price with good service and coverage. Take your time to choose wisely. Your car and wallet will thank you.