If you rely on vehicles to run your business in Florida, having the right commercial auto insurance is crucial. It’s not just about following the law—it’s about protecting your investment, your employees, and your reputation.

But with so many options out there, how do you find the best coverage that fits your needs and budget? You’ll discover the top commercial auto insurance choices in Florida, learn what makes a policy stand out, and get tips to save money without compromising protection.

Keep reading to make sure your business stays covered and confident on the road.

Credit: pandorainsurance.com

Top Commercial Auto Insurers In Florida

Finding the right commercial auto insurance in Florida matters for every business owner. Reliable coverage protects vehicles, drivers, and your company’s assets. Choosing a top insurer helps secure the best rates and service. The following companies offer strong commercial auto insurance options in Florida. They combine experience, coverage choices, and customer support to meet business needs.

Geico

GEICO provides flexible commercial auto insurance for many vehicle types. Their plans cover liability, physical damage, and more. GEICO is known for competitive rates and easy online management. Small and medium businesses often prefer GEICO for affordable, reliable coverage in Florida.

Progressive

Progressive offers tailored commercial auto policies to fit specific business needs. They cover trucks, vans, and specialty vehicles. Progressive includes features like accident forgiveness and multi-vehicle discounts. Their strong online tools make managing policies simple for Florida businesses.

The Hartford

The Hartford focuses on comprehensive commercial auto insurance with customizable options. Their coverage protects drivers and cargo against many risks. The Hartford also provides excellent customer service and claims support. Many Florida businesses trust them for dependable protection.

Travelers

Travelers offers broad commercial auto coverage with flexible limits. Their policies protect vehicles, drivers, and third parties. Travelers provides loss prevention resources to help reduce risks. Florida businesses appreciate their financial strength and claims handling.

State Farm

State Farm delivers customizable commercial auto insurance plans in Florida. They offer discounts for safe drivers and multiple policies. State Farm’s local agents provide personalized service and advice. Many businesses choose State Farm for trusted coverage and support.

Factors Affecting Premiums

Commercial auto insurance premiums in Florida vary due to several key factors. Understanding these elements helps businesses manage costs better. Each factor plays a role in determining how much you pay for coverage. Insurers evaluate risk based on vehicle, driver, coverage needs, and location. These details shape your premium and protect your business vehicles effectively.

Vehicle Type And Usage

The kind of vehicle influences insurance costs significantly. Larger trucks or specialized vehicles often cost more to insure. Frequent use or heavy-duty work raises the risk for insurers. Vehicles carrying valuable cargo or hazardous materials also increase premiums. How the vehicle is used daily impacts the insurer’s risk assessment.

Driver Experience

Experienced drivers usually lower insurance premiums. Insurers prefer drivers with clean records and years of driving. New or inexperienced drivers pose a higher risk and increase costs. Companies with strict driver screening often pay less. Safe driving history reduces the chance of accidents, lowering premiums.

Coverage Limits

Higher coverage limits lead to higher premiums. Choosing more protection means the insurer might pay more in claims. Businesses must balance adequate coverage with affordable costs. Additional coverage options, like comprehensive or collision, also raise premiums. The level of risk covered affects the final price.

Location And Driving Conditions

Location matters in commercial auto insurance pricing. Busy cities with heavy traffic often have higher rates. Areas with high accident or theft rates increase risk for insurers. Weather conditions like hurricanes in Florida also impact premiums. Roads and traffic patterns shape the likelihood of claims and costs.

Coverage Options For Businesses

Choosing the right coverage options is essential for protecting your business vehicles in Florida. Commercial auto insurance offers various protections tailored to business needs. Understanding each coverage type helps you make smart decisions. Below are key coverage options businesses should consider.

Liability Coverage

Liability coverage protects your business if your driver causes injury or property damage. It covers medical bills and repair costs for others. This coverage is required by Florida law for all commercial vehicles. It helps avoid costly lawsuits and claims against your company.

Physical Damage Coverage

Physical damage coverage pays for repairs to your business vehicles. It includes collision and comprehensive insurance. Collision covers damage from accidents with other vehicles or objects. Comprehensive covers damage from theft, fire, or natural disasters. This coverage keeps your vehicles in good condition.

Cargo Insurance

Cargo insurance protects the goods your business transports. It covers loss or damage to products while in transit. This coverage is important for delivery or freight businesses. It ensures your cargo is safe and your business does not lose money.

Uninsured Motorist Protection

Uninsured motorist protection helps if your vehicle is hit by an uninsured or underinsured driver. It covers medical expenses and vehicle repairs. This coverage gives your business peace of mind on Florida roads. It reduces financial risks from others’ lack of insurance.

Affordable Plans And Discounts

Finding affordable commercial auto insurance in Florida helps businesses save money. Many insurance providers offer plans with discounts tailored to reduce costs. These discounts reward safe driving, combine policies, or cover multiple vehicles. Choosing the right plan lowers your insurance expenses without losing coverage quality.

Safe Driver Discounts

Insurance companies value drivers with clean records. A history without accidents or tickets often earns discounts. Safe driver discounts can cut premiums significantly. This reward encourages careful and responsible driving habits. Maintaining a good record helps you pay less for coverage.

Multi-policy Savings

Bundling different types of insurance with one company saves money. Combining commercial auto with general liability or property insurance reduces costs. Multi-policy discounts simplify management by keeping all coverage under one roof. This option benefits businesses needing various insurance types. Savings increase as you add more policies.

Fleet Coverage Deals

Businesses with multiple vehicles can benefit from fleet coverage deals. Insurance providers offer reduced rates for insuring several vehicles together. These deals lower the average cost per vehicle. Fleet coverage also streamlines billing and claims processes. It suits companies managing a group of commercial vehicles.

How To Choose The Right Policy

Choosing the right commercial auto insurance policy is key for protecting your business vehicles. A smart choice saves money and avoids coverage gaps. Focus on what fits your business needs best. This section helps you pick the right policy with clear steps.

Assessing Business Needs

Start by listing your business vehicles and their uses. Consider the types of goods or passengers transported. Check the number of drivers and their experience. Identify any special risks or high-value items in transit. These details guide you to the proper coverage limits and types. Tailored coverage avoids paying for unneeded extras.

Comparing Quotes

Get multiple quotes from trusted insurers in Florida. Compare coverage options, limits, and deductibles closely. Watch for hidden fees or exclusions. Look beyond price; the cheapest quote may lack key protections. Use online tools or local agents to get clear, simple estimates. Accurate comparison helps find the best value policy.

Evaluating Customer Service

Good customer service matters during claims and questions. Read reviews about insurers’ responsiveness and support quality. Check if the company offers 24/7 claims reporting. A helpful, reachable agent reduces stress in emergencies. Choose insurers with clear communication and fast claim handling.

Credit: www.capstoneinsurancegroup.com

Common Claims And How To Avoid Them

Commercial auto insurance claims in Florida often arise from common incidents. Understanding these claims helps businesses reduce risks and lower costs. Identifying frequent accident types is the first step. Following this, adopting preventive measures can protect drivers and vehicles. Knowing how to file claims properly ensures faster processing and fewer complications.

Accident Types

Rear-end collisions happen most often in busy city traffic. Side-impact crashes occur at intersections with poor visibility. Single-vehicle accidents include rollovers and hitting objects. Weather-related crashes increase during Florida’s rainy season. Theft and vandalism claims also affect commercial vehicles. Understanding these types helps drivers stay alert.

Preventive Measures

Train drivers regularly on safe driving practices. Maintain vehicles to avoid breakdowns and malfunctions. Use GPS to track routes and avoid risky areas. Install dash cams to monitor driving behavior. Encourage breaks to prevent driver fatigue. Secure vehicles to reduce theft and vandalism risks. Clear communication of safety policies improves compliance.

Claim Filing Tips

Report accidents to your insurer immediately. Gather all details: photos, witness contacts, and police reports. Fill out claim forms carefully and honestly. Keep copies of all documents for reference. Follow up with the insurance company regularly. Provide accurate information to avoid delays. Understanding policy coverage helps manage expectations.

Legal Requirements For Florida Businesses

Florida businesses must follow legal rules for commercial auto insurance. These rules protect drivers, businesses, and the public. Knowing the legal requirements helps avoid fines and legal problems. It also ensures your business stays safe on the road.

Minimum Coverage Limits

Florida law requires businesses to carry specific minimum coverage. Liability insurance must cover at least $10,000 for property damage. It also requires $10,000 for personal injury protection (PIP). Bodily injury liability coverage must be at least $20,000 per person. The total per accident must reach $40,000.

These limits protect others if your commercial vehicle causes damage or injury. Businesses should check these limits regularly and update their policies as needed.

State Regulations

The Florida Department of Highway Safety and Motor Vehicles sets state rules. Businesses must register all commercial vehicles used for work. Insurance proof must be shown at vehicle registration. Insurance companies must meet Florida’s financial stability standards.

Some businesses need extra coverage if they transport hazardous materials. Others with large fleets may face stricter rules. Staying informed about these regulations avoids penalties and keeps operations smooth.

Compliance Tips

Keep your insurance documents up to date and easy to access. Train drivers on insurance requirements and safe driving practices. Review your policy yearly to ensure it meets state laws. Consider consulting with an insurance expert to stay compliant.

Regular checks prevent gaps in coverage and reduce risks. Compliance builds trust with clients and protects your business assets.

Credit: www.oyerinsurance.com

Frequently Asked Questions

What Is The Best Insurance Company For Commercial Vehicles?

Progressive, GEICO, Erie Insurance, and State Farm rank as top commercial vehicle insurers. They offer customizable, affordable, and reliable coverage. Choose based on your business needs and budget for the best protection.

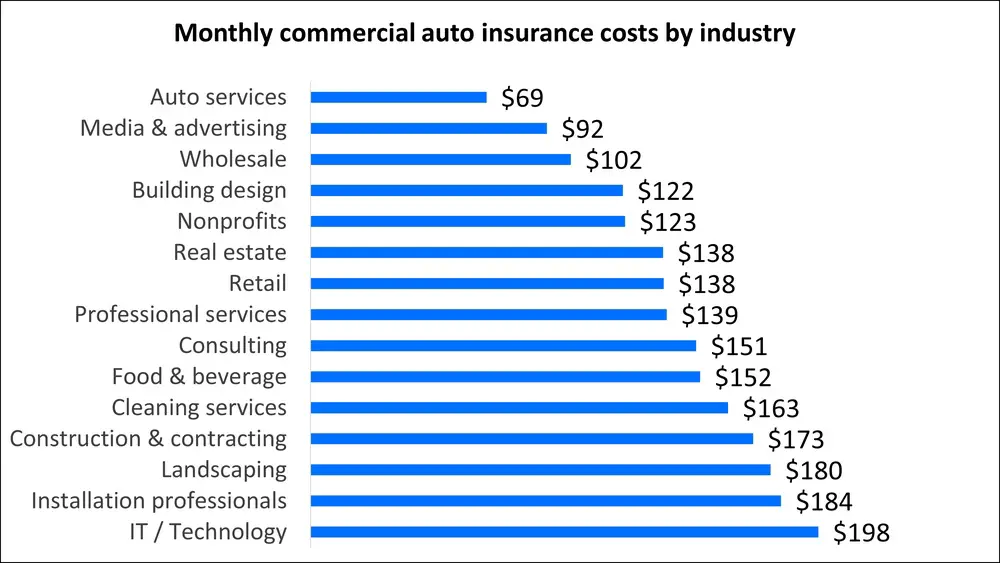

How Much Is Commercial Auto Insurance In Florida?

Commercial auto insurance in Florida typically costs between $1,200 and $2,500 annually. Rates vary by vehicle type, coverage, and driving history.

What Insurance Company Has The Best Commercials?

GEICO has the best commercials, featuring the memorable GEICO Gecko. Allstate, State Farm, and Liberty Mutual also create popular ads.

Which Insurance Company Has The Highest Customer Satisfaction In Florida?

Progressive and Erie Insurance rank highest in customer satisfaction for Florida. State Farm also scores well for customer experience.

Conclusion

Choosing the right commercial auto insurance protects your business and vehicles. Florida offers many options tailored to different needs. Compare coverage, prices, and customer service carefully. A good policy helps avoid costly risks and legal problems. Keep your business moving safely on Florida roads.

Take time to find insurance that fits your budget and requirements well. Your business deserves reliable protection every mile of the way.