Owning an older home in Florida comes with a unique set of challenges—especially when it’s time to find the right homeowners insurance. You want to protect your investment without breaking the bank, but many insurers hesitate to cover older houses due to outdated wiring, plumbing, or roofing.

How can you make sure your home is properly covered? You’ll discover the best homeowners insurance options tailored specifically for older Florida homes. You’ll also learn key tips to navigate high premiums and tricky policy requirements. Keep reading to find out how to secure the coverage your home deserves and gain peace of mind in the Sunshine State.

Top Insurers For Older Florida Homes

Choosing the right insurance for older homes in Florida is vital. Older houses face unique risks like outdated wiring or roof damage. Insurers that know these challenges offer better coverage and peace of mind. Some companies specialize in protecting older homes with tailored policies. Others are large insurers with strong experience in Florida’s market. Here are top insurers trusted by owners of older Florida homes.

American Integrity Insurance Group

American Integrity Insurance Group focuses on older Florida homes. Their “Integrity Select” policy covers homes with age-related risks. It offers protection for roofs, plumbing, and electrical systems. This insurer understands the needs of older houses. They provide flexible options for owner-occupied properties. Many homeowners find their rates competitive. Claims service is responsive and local to Florida.

Security First Insurance

Security First Insurance is a Florida-based company. They offer policies designed for older homes. Their coverage includes windstorm and hurricane protection. The company uses inspections to assess home condition. This helps tailor the policy to the home’s needs. Security First often approves homes others reject. Their customer service is known for being helpful and clear.

Major Insurers Serving Older Homes

Big-name insurers like Allstate, Liberty Mutual, and Chubb also insure older Florida homes. These companies provide broad coverage options. They have strong financial backing and large networks. Their policies can include coverage for older construction materials. Discounts may be available for home upgrades. These insurers usually require thorough home inspections. They offer reliable claims handling and support.

Credit: floridaallrisk.com

Challenges Of Insuring Older Homes In Florida

Insuring older homes in Florida presents unique challenges for homeowners and insurers. These properties often face risks linked to their age and the state’s climate. Many insurance companies hesitate to provide coverage without higher premiums or specific conditions. Understanding these challenges helps homeowners prepare better and seek suitable insurance policies.

Outdated Plumbing And Electrical Risks

Older homes often have plumbing and electrical systems that do not meet modern standards. Pipes may be corroded or made from materials prone to leaks. Old wiring can cause fire hazards or electrical failures. These issues increase the chances of costly damages. Insurance companies see these risks and may limit coverage or raise rates.

Building Code Upgrade Costs

Florida updates its building codes to improve safety and durability. Older homes usually do not comply with current codes. After a claim, insurers may require costly upgrades to meet new standards. These upgrade costs can be expensive. Homeowners must consider these expenses when choosing a policy.

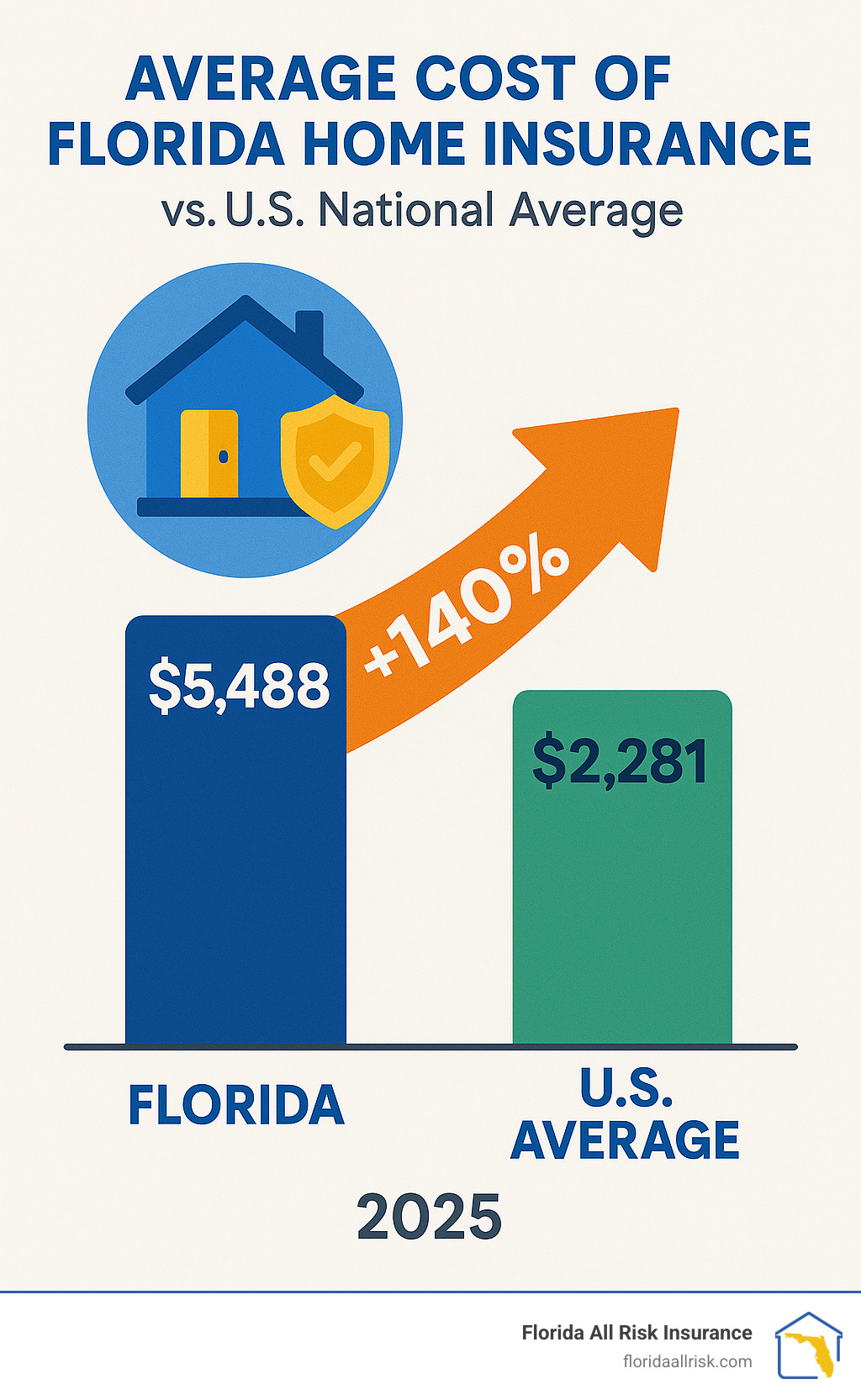

Higher Premiums Due To Age And Location

Insurance premiums for older homes in Florida tend to be higher than for newer homes. Age increases the likelihood of damage from storms, wear, and system failures. Florida’s weather, including hurricanes, raises risk levels further. Insurers charge more to cover these potential losses. Location also matters; coastal or flood-prone areas have even higher premiums.

Ways To Secure Better Insurance Rates

Securing better insurance rates for older homes in Florida requires smart strategies. Insurance providers consider the age and condition of your home. Certain actions can lower your premiums and improve coverage options. Understanding these ways helps you save money without sacrificing protection.

Using Independent Insurance Agents

Independent agents work with many insurance companies. They find the best rates for older homes. These agents understand Florida’s market and risks. They compare multiple quotes quickly. This process ensures competitive pricing and suitable coverage. Independent agents also explain policy details clearly. They help avoid costly coverage gaps.

Making Strategic Home Upgrades

Upgrading your home can reduce insurance costs. Focus on electrical, plumbing, and roofing improvements. Installing modern wiring and pipes lowers risk of damage. A new roof helps protect from storms. These upgrades signal better home maintenance to insurers. They often lead to lower premiums. Keep receipts and records of all improvements.

Obtaining Wind Mitigation And Four-point Inspections

Wind mitigation inspections assess your home’s storm resistance. Four-point inspections review roof, electrical, plumbing, and HVAC systems. These reports show your home’s condition to insurers. Positive inspection results can qualify you for discounts. They also identify issues needing repair. Addressing problems before renewing insurance saves money and stress.

Coverage Options For Older Homes

Older homes in Florida require specific insurance coverage tailored to their unique needs. Standard policies may not fully protect aging structures. Coverage options for older homes focus on safeguarding the home’s value and addressing risks linked to its age. These options help owners manage repair costs and meet local building rules. Understanding these coverages ensures better protection for older Florida homes.

Specialized Policies For Aging Structures

Specialized policies target homes built decades ago. They cover issues like outdated wiring and plumbing. These policies often include higher limits for repairs using original materials. Insurers assess the home’s condition before offering coverage. This approach helps protect the home’s historic charm and structure. Some companies even offer replacement cost coverage tailored to older homes.

Ordinance Or Law Coverage

Older homes must follow current building codes during repairs. Ordinance or law coverage helps pay extra costs to meet these codes. Without this coverage, owners pay out of pocket for upgrades. This coverage is vital after damage from fire or storms. It ensures repairs comply with Florida’s strict building regulations. This protects homeowners from unexpected expenses due to code changes.

Protection Against Hurricane Damage

Florida faces frequent hurricanes, a big threat to older homes. Specialized hurricane damage protection covers wind and storm-related losses. Policies may include higher deductibles but offer strong financial support. Some insurers provide additional coverage for roof repairs and debris removal. This protection helps homeowners recover faster after hurricanes. It is essential for older homes with less storm-resistant features.

Cost Factors Affecting Premiums

Homeowners insurance premiums for older homes in Florida vary widely. Many elements influence the cost. Understanding these factors helps homeowners choose the best coverage without overspending.

Impact Of Home Age And Condition

Older homes often have outdated structures and systems. Roofs, wiring, and plumbing may need repairs or replacement. Insurers see these as higher risks. The older and less maintained the home, the higher the premium.

Homes with recent upgrades usually get better rates. Updated electrical and plumbing reduce chances of claims. Insurers reward well-kept homes with lower costs.

Effect Of Coverage Types And Limits

The type of coverage greatly affects premium size. Basic policies cover standard risks but may exclude certain damages. More comprehensive plans cost more but offer greater protection.

Higher coverage limits mean higher premiums. Choosing limits too low can leave gaps in protection. Balancing coverage with budget is key for older home owners.

Discounts Available For Seniors In Florida

Florida insurers often provide discounts for senior homeowners. Age-based discounts can reduce premiums by 5% to 15%. Some companies offer savings for retired policyholders.

Safety features like smoke detectors and security systems also qualify for discounts. Seniors should ask insurers about available savings to lower costs.

Credit: floridaallrisk.com

Credit: floridaallrisk.com

Frequently Asked Questions

Which Homeowners Policy Is Designed To Cover An Older Dwelling?

The HO-8 homeowners policy is designed for older dwellings. It covers older homes with unique risks and replacement costs. HO-8 policies address outdated systems and provide specialized protection for aging properties. This policy fits homes that standard insurance may not fully cover due to their age or condition.

What Makes An Old House Uninsurable?

An old house becomes uninsurable due to outdated plumbing, wiring, leaky roofs, and poor maintenance. Insurers avoid high-risk, deteriorated structures.

Is Homeowners Insurance More Expensive For Older Homes?

Homeowners insurance often costs more for older homes due to higher risks like outdated wiring and plumbing. Premiums vary based on coverage and home condition. Insurers consider repair costs and code upgrades, increasing rates. Proper maintenance and specialized policies can help lower expenses for older properties.

Do Seniors Get A Discount On Homeowners Insurance In Florida?

Yes, some Florida insurers offer seniors discounts on homeowners insurance. Discounts vary by company and eligibility criteria. Seniors should compare quotes to find the best savings.

Conclusion

Choosing the right homeowners insurance protects your older Florida home well. Older homes need special coverage to handle unique risks. Many insurers offer policies tailored for aging properties. Compare options carefully to find the best fit for you. Protect your investment with reliable, affordable coverage today.

Keep your home safe through storms and wear over time. A good policy gives peace of mind for years ahead.