Finding the best car insurance in Florida can feel overwhelming. You want a policy that protects your car without breaking your budget.

But with so many options, how do you know which one is right for you? This guide will help you cut through the noise and discover the top choices tailored to your needs. Keep reading to learn how you can save money, get reliable coverage, and drive with peace of mind every day.

Your perfect car insurance is closer than you think.

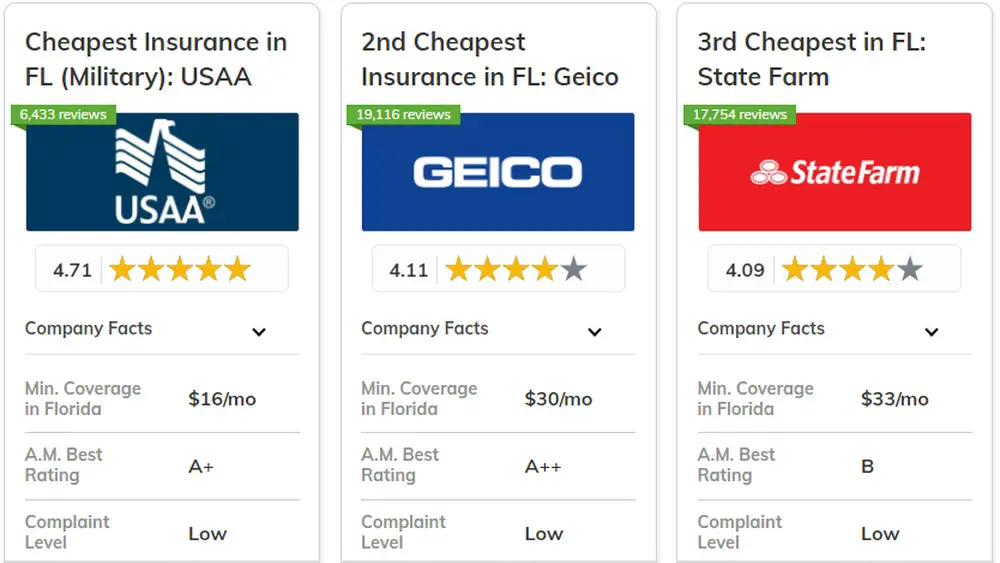

Top Florida Car Insurers

Florida drivers need reliable car insurance from trusted companies. Choosing the right insurer means better coverage and fair prices. This section highlights the top car insurers serving Florida residents. These companies have strong reputations for customer service and claims handling. They offer various plans to fit different needs and budgets.

State Farm

State Farm is one of the largest insurers in Florida. It offers a wide range of coverage options. Customers praise its fast claims process and helpful agents. Discounts are available for safe drivers and multiple policies.

Geico

GEICO is known for affordable rates and easy online service. It provides good coverage for Florida drivers. The company offers discounts for good students and military members. Many customers like its 24/7 claims support.

Progressive

Progressive offers customizable insurance plans. It uses a Name Your Price tool to fit budgets. Customers can bundle car and home insurance for savings. It also provides accident forgiveness in many cases.

Allstate

Allstate has a strong presence in Florida. It offers helpful tools to track driving habits. Discounts exist for defensive driving courses and safe vehicles. The company focuses on personalized service and support.

Usaa

USAA serves military members and their families. It provides competitive rates and excellent customer care. Members get benefits like roadside assistance and accident coverage. USAA is highly rated for claims satisfaction.

Coverage Options Explained

Understanding car insurance coverage helps you pick the best policy in Florida. Coverage options protect you in many ways. Each type covers different risks and costs.

Knowing what each coverage does saves money and trouble after an accident. Here is a clear guide to common coverage types.

Liability Coverage

Liability coverage pays for damage you cause to others. This includes injuries and property damage. Florida law requires minimum liability coverage for all drivers.

This coverage does not pay for your injuries or damage to your car.

Personal Injury Protection (pip)

PIP covers medical expenses for you and your passengers. It also pays for lost wages and other related costs. Florida drivers must have PIP by law.

This coverage works no matter who caused the accident.

Collision Coverage

Collision coverage pays to fix your car after a crash. It covers accidents with other vehicles or objects. This coverage is optional but useful for newer cars.

You pay a deductible before the insurance pays the rest.

Comprehensive Coverage

Comprehensive coverage protects your car from non-crash damages. This includes theft, fire, vandalism, and natural disasters. Like collision, this coverage is optional and has a deductible.

Uninsured And Underinsured Motorist Coverage

This coverage protects you if the other driver has no or low insurance. It pays for your medical bills and car repairs. Florida drivers should consider this coverage for extra safety.

Factors Affecting Rates

Car insurance rates in Florida change based on several important factors. Understanding these factors helps you find the best insurance deal. Each factor affects how much you pay for coverage.

Insurance companies use these details to measure risk. Lower risk often means lower rates. Higher risk leads to higher costs.

Driver’s Age And Experience

Young drivers usually pay more for insurance. Less driving experience means higher risk. Older, experienced drivers get better rates. Safe driving records improve chances of low premiums.

Type Of Vehicle

Car make and model affect your insurance cost. Expensive or fast cars cost more to insure. Cars with strong safety features can lower rates. Repair costs also impact the price.

Location In Florida

Living in a busy city raises insurance costs. High theft or accident areas increase rates. Rural areas tend to have lower premiums. Insurance companies check crime and accident reports.

Driving History

Accidents or traffic tickets raise insurance rates. A clean record helps keep costs down. Insurance companies reward safe drivers with discounts. Past claims affect how much you pay.

Coverage And Deductibles

Choosing higher coverage limits raises your premium. Lower deductibles increase monthly payments. Balancing coverage and deductibles can save money. Different plans offer various protection levels.

Credit: www.cigflorida.com

Discounts To Lower Premiums

Car insurance costs can add up fast in Florida. Discounts help lower premiums and save money. Many insurers offer different ways to reduce your payments. These discounts reward safe driving, good habits, and special situations.

Knowing which discounts apply can help you pick the best policy. Some discounts are automatic. Others need you to ask or provide proof. Taking advantage of these can make insurance more affordable.

Safe Driver Discounts

Insurance companies reward drivers with no accidents or tickets. Staying accident-free for several years lowers your premium. Defensive driving courses may also qualify you for extra savings.

Multi-policy Discounts

Bundling car insurance with home or renters insurance cuts costs. Many insurers offer a discount when you combine policies. This saves money and simplifies payments.

Good Student Discounts

Young drivers with good grades can get reduced rates. Schools usually require a certain GPA. This discount encourages responsible behavior and safe driving.

Low Mileage Discounts

Driving less means less risk. Insurance companies offer lower rates for drivers with low yearly mileage. Tracking your miles can qualify you for this discount.

Vehicle Safety Features Discounts

Cars with airbags, anti-lock brakes, or alarms get discounted rates. These features reduce accident risk or theft chances. Providing vehicle details helps insurers apply these savings.

Customer Service And Claims

Customer service and claims handling are vital parts of car insurance. Good service means quick answers and clear help. Fast claims make a big difference after an accident. Drivers feel safer knowing support is ready. The best insurers in Florida focus on these areas to keep customers happy.

Responsive Support Teams

Top insurers provide support 24/7. Agents answer calls and chats quickly. They speak in simple terms. No confusing insurance jargon. Friendly help eases stress during tough times. Quick responses save time and frustration.

Easy Claims Process

Simple claims steps reduce hassle. Many companies offer online claims filing. Upload photos and documents in minutes. Some provide mobile apps for faster service. Clear instructions guide customers through each step. Less paperwork, more peace of mind.

Fast Claim Settlements

Speedy claim payments help drivers repair cars fast. Insurers with fast settlements build trust. Many pay within days of claim approval. Quick funds prevent prolonged inconvenience. This shows commitment to customer care.

Helpful Resources And Tools

Insurers offer tools like claim tracking and FAQs. These help customers stay informed. Updates via email or text keep drivers aware. Educational content teaches about coverage and claims. These resources empower policyholders.

Credit: ccicins.wordpress.com

Comparing Policy Benefits

Comparing policy benefits helps find the best car insurance in Florida. Not all policies cover the same things. Some cover more risks, while others have extra features. Knowing these details saves money and trouble later.

Reviewing what each policy offers helps choose the right plan. Focus on coverage, limits, and additional perks. These details impact your protection and costs.

Coverage Types

Different policies include varied coverage types. Liability covers damage to others. Collision pays for your car after accidents. Comprehensive protects against theft and natural damage. Check which coverages each policy offers.

Deductibles And Limits

Deductibles are the amount paid before insurance kicks in. Higher deductibles lower premiums but increase your out-of-pocket cost. Limits are the maximum payout for claims. Pick a balance that fits your budget.

Additional Benefits

Some policies add extras like roadside assistance or rental cars. These benefits help during emergencies or repairs. See what extras come with each plan and their value.

Discounts And Savings

Insurance companies offer discounts for safe driving and multiple policies. Good student or low mileage discounts reduce costs. Compare available discounts to lower your premium.

Tips For Choosing Insurance

Choosing the right car insurance in Florida can save money and stress. Many options exist, but not all offer the same benefits. Understanding key points helps pick a plan that fits personal needs and budget.

Focus on coverage details and customer service. Check discounts and claim processes. These tips guide smart choices for reliable protection on Florida roads.

Compare Coverage Options

Review each insurance policy’s coverage carefully. Some cover only basic damages, while others offer full protection. Choose coverage that meets your needs. Consider liability, collision, and comprehensive insurance types.

Check Company Reputation

Research insurance companies for reliability and service quality. Read customer reviews and ratings. A strong reputation often means better support during claims and emergencies.

Understand Deductibles And Premiums

Deductibles affect how much you pay after an accident. Premiums are your regular payment. Balance these costs. A lower premium might mean a higher deductible and vice versa.

Look For Discounts

Many insurers offer discounts. These may include safe driver, multi-policy, or good student savings. Ask about all available discounts to reduce your insurance cost.

Evaluate Customer Service

Good customer service helps with questions and claims. Test the company’s support by calling or emailing before buying. Quick and clear responses are a good sign.

Credit: www.nasdaq.com

Frequently Asked Questions

What Factors Affect Car Insurance Rates In Florida?

Car insurance rates in Florida depend on driving history, age, vehicle type, coverage level, and location. Florida’s high accident and theft rates also influence premiums. Insurers assess these factors to set competitive prices that reflect individual risk profiles.

Which Companies Offer The Best Car Insurance In Florida?

Top Florida car insurance companies include GEICO, State Farm, Progressive, and Allstate. These insurers provide reliable coverage, competitive rates, and excellent customer service. Comparing quotes from multiple companies helps find the best policy for your needs and budget.

Is Florida Car Insurance Mandatory For All Drivers?

Yes, Florida law requires all drivers to have minimum car insurance coverage. This includes Personal Injury Protection (PIP) and Property Damage Liability (PDL). Driving without insurance can lead to fines, license suspension, and legal penalties.

How Can I Lower My Florida Car Insurance Premiums?

To reduce premiums, maintain a clean driving record, choose higher deductibles, and bundle policies. Taking defensive driving courses and installing safety devices also helps. Regularly comparing quotes ensures you get the best possible rate.

Conclusion

Choosing the right car insurance in Florida protects your car and your wallet. Compare prices and coverage carefully. Find a policy that fits your needs and budget. Don’t rush; take time to read the terms. Good insurance gives peace of mind on the road.

Drive safely and stay protected with smart choices. Your car deserves the best care you can give. Keep these tips in mind for a safer drive.